|

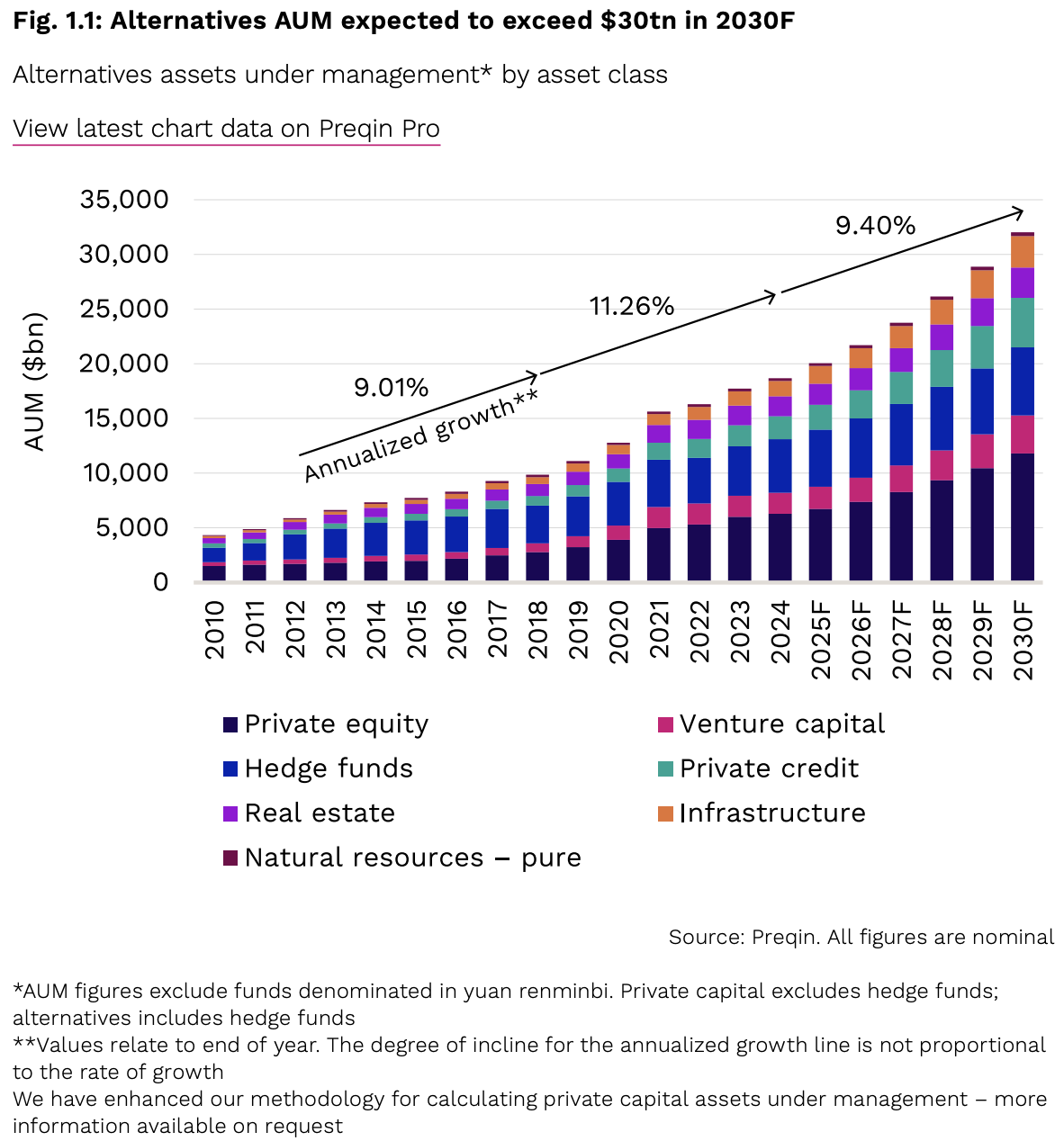

Opalesque Industry Update - Preqin, a part of BlackRock, has released its flagship annual private markets publication, this year titled the Preqin Private Markets in 2030 Report. As the definitive resource for institutional investors, fund managers, and industry stakeholders, this report offers one of the most thorough analyses of the trends shaping private markets through the end of the decade. This year's report zeroes in on a key milestone: The global alternatives market AUM is expected to reach $32 trillion by 2030. This figure includes private equity, private credit, infrastructure, real estate, hedge funds, and natural resources. This is Preqin's most anticipated report of the year, setting the benchmark for data-driven analysis and forward-looking perspectives on private capital, covering forecasts for fundraising, performance, and assets under management (AUM) growth across each asset class. Key themes in the report:

• Private Credit Enters Maturity: New, more-liquid fund structures in private credit will support fundraising and continue to provide alternative sources of capital alongside traditional lenders. Bank disintermediation and new borrower supply are expected to drive demand for direct lending and other strategies which are projected to reach $4.5 trillion by 2030. • A New Cycle Should Emerge: After a marked slowdown in exit activity since 2022, Preqin expects a recovery in exit volumes by 2030 and will help kickstart a new cycle in private equity and private markets. Key triggers include lower policy interest rates, improved valuation convergence, and a structural shift from public to private allocations. • Infrastructure Moves Center Stage: Infrastructure is set to accelerate as an asset class, with AUM approaching $3 trillion by 2030. European infrastructure AUM growth rate is expected to outpace that of North America, driven by investments in energy security, digital infrastructure, and defense. • Wealth Channel to Underpin Fundraising: The traditional 60/40 portfolio is giving way to a 50/30/20 split, with private markets now a core part of institutional portfolios. The private wealth channel is expected to mirror this growth in allocations to private markets, with the secondaries market growing its share of total deal flow, as the focus has shifted to managing existing holdings. Cameron Joyce, Director, Head of Research Insights at Preqin says "As we look toward 2030, private markets are entering a new era of growth-one defined by innovation, resilience, and strategic reallocation. With alternative assets forecast to reach $32 trillion in AUM by the end of the decade, this transformation is not only cyclical but structural. The convergence of public and private markets is reshaping investor expectations, driving demand for transparency, standardized data, and whole portfolio solutions. Investors who embrace this evolution-powered by AI-driven efficiencies, infrastructure-led expansion, and a more unified investment data ecosystem-will be best positioned to capture long-term value."

|

Industry Updates

Preqin releases private markets in 2030 report

Tuesday, October 21, 2025

|

|

RSS

RSS