|

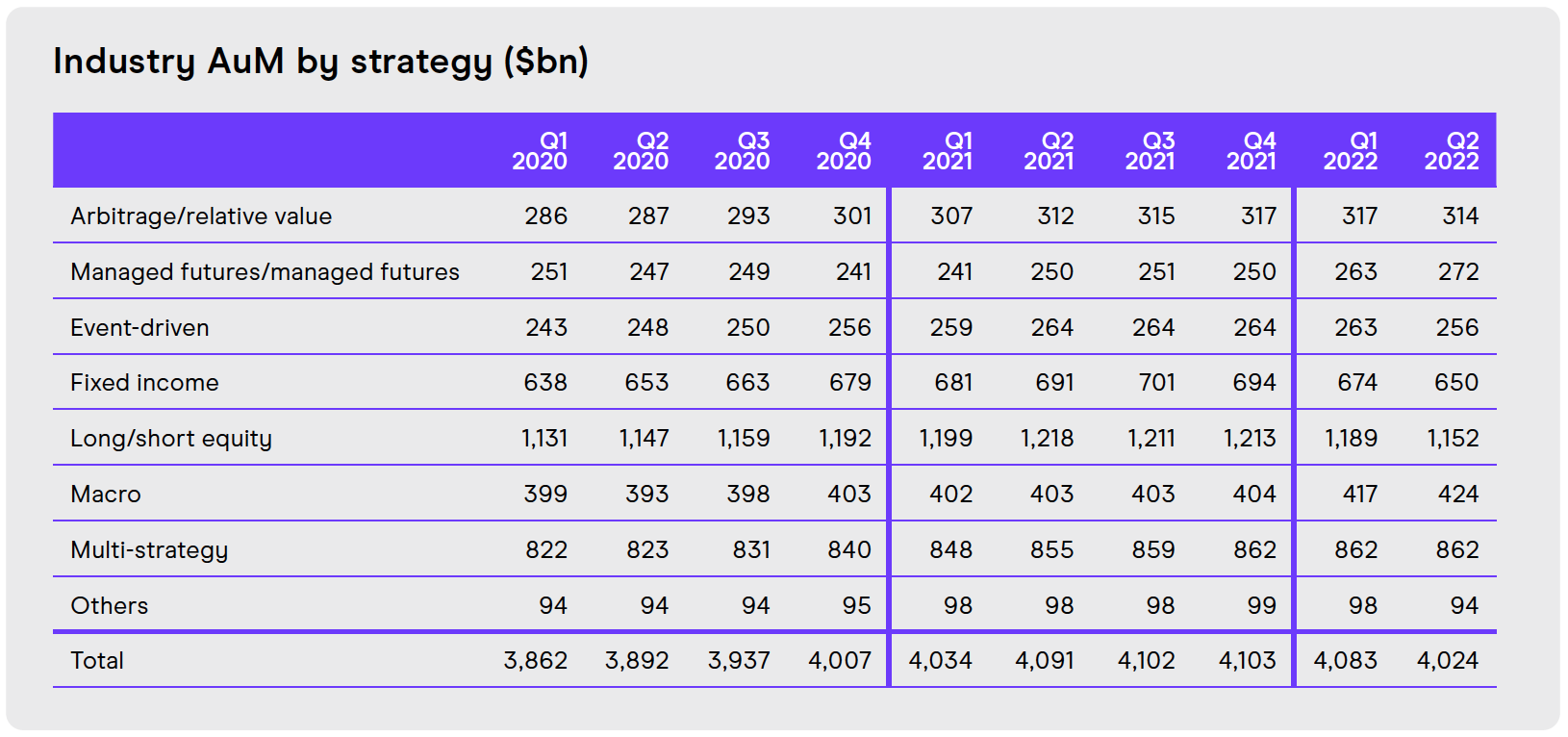

Opalesque Industry Update - Hedge funds faced a challenging half-year during H1 2022 as geopolitical and macro-economic events sparked market chaos and a rare, concerted sell-off in stocks and bonds, according to the With Intelligence Spotlight Report "Hedge Funds in H1 2022". However, this is not the sudden shock of Covid-hit H1 2020 but rather a steady, negative development during the past three quarters. Hedge funds have still fared better than US large-cap stocks, for example, and there is an opportunity to take advantage of the volatility and weak economic forecasts and outperform. Key Highlights of H1 2022 - The Eurekahedge Global Composite Index was down 5.4% for H1 2022. There was a contrast in performance between $1bn-plus funds and sub-$1bn funds as larger funds saw lower losses of 1.9% compared to losses of 5.5% for the sub-$1bn category. - AuM has declined by $78.8bn during the first six months of 2022, driven by $37.7bn of performance-based decline and $41.1bn of net outflows. The industry total stands at $4.02tn at the end of H1. - Europe posted the sharpest H1 net outflows of $36.0bn as investor sentiment in the region was most impacted by the ongoing Russia-Ukraine conflict and European dependence on Russian energy supplies. By contrast, North America and Asia recorded smaller AuM declines of $11.5bn and $14.5bn, respectively. - Fixed income (-$21.6bn) and long/short equities (-$21.2bn) posted the steepest outflows in H1 as the two strategies struggled amid the rising interest rate environment, resulting in performance-based declines of $23.4bn and $40.9bn, respectively. - Most major asset classes ended H1 2022 in negative territory with bond markets recording their worst six-month period since 1900, while the S&P 500 recorded its worst H1 since 1970. Despite this, hedge funds have outperformed the S&P 500 (-5.4% vs -20.6%) with CTAs performing best due to their downside protection strategies and adapted, shortened timeframes for hedging equity corrections. - Defensive strategies continued to outperform, with managed futures/CTA adding to Q1 gains to finish the half up 7.3%, delivering at a critical time for investors just as in 2008. - The industry experienced its third straight quarter of outflows in Q2 2022. After redemptions of $13.5bn in Q1 2022, there were further outflows of $26.6bn in Q2, as investors hunted for liquidity to give them flexibility at a time of crisis.

Press release Article source - Opalesque is not responsible for the content of external internet sites |

Industry Updates

Hedge fund industry AuM declined by $78.8bn in H1-2022

Thursday, August 11, 2022

|

|

RSS

RSS