|

Opalesque Industry Update - The hedge fund industry got back to monthly gains in March, eking out a 0.39% return for the month, according to the Barclay Hedge Fund Index compiled by BarclayHedge, a division of Backstop Solutions. By comparison, the S&P Total Return Index gained 3.71% in March 2022. For the year to date, the hedge fund industry was down -3.36% through March, losing slightly less ground than the S&P 500 Total Return Index, which was off -4.60% over the same period. "While volatility and macroeconomic uncertainty prevailed, equity markets recovered slightly in March, even as stocks ended their worst quarter in two years," reflected Ben Crawford, Head of Research at BarclayHedge. "Despite the fact that Hedge Funds mostly underperformed equity markets in March, the average Hedge Fund still looked like the better bet over the entirety of the first quarter. We find that this perspective holds on both an absolute return- and a risk-adjusted return- basis." Hedge fund subsectors were evenly divided between gainers and losers in March, with two subsectors flat month-over-month. The Distressed Securities Index had the strongest month of all subsectors, returning 4.51%. Other strong performers included the Healthcare & Biotechnology Index up 3.02%; the Pacific Rim Equities Index notching 2.77%; the Global Macro Index advancing 2.14%; and the Option Strategies Index booking 1.85%. Among the wounded in March, the majority of the suffering was borne by Emerging Markets. The Emerging Markets Asian Equities Index and the Emerging Markets Asia Index were on the vanguard of the retreat, losing -3.49% and -2.90% respectively. A second cluster of losses was led by the Emerging Markets Index down -1.95%. It was followed by the Emerging Markets Global Index - 1.86%; Emerging Markets Global Equities Index -1.79%; and the Technology Index -1.54%. The hedge fund industry as a whole as well as a significant majority of its subsectors remained in the red on a year-to-date basis. Despite the relatively broad trend toward losses, a handful of strategies have proved their mettle throughout Q1 2022. These included the Distressed Securities Index which was up 4.27%; the Global Macro Index banking 3.86%; and the Emerging Markets Latin America Index which pocketed 3.69%. Year-to-date losses have been headlined by managers in Eastern Europe as well as Technology-centric traders. The Emerging Markets Eastern Europe Index has shed -12.60% and the Emerging Markets Eastern Europe Equities Index is off -12.18%. The Technology Index has also struggled in 2022 and was down -12.45% at the end of the first quarter. Also struggling through Q1 were Emerging Markets across Asia. The Emerging Markets Asian Equities Index saw nearly a tenth of its value evaporate over this interval, showing a cumulative loss of -9.90%. The Emerging Markets Asia Index also suffered sharp losses totaling -8.57%. "All told, the month brought a profoundly mixed bag of indicators. In the U.S., February job growth exceeded the government's expectations, bringing unemployment claims to a new post-pandemic low. In the Eurozone, measurements of business growth surprised economists by topping consensus expectations. On the flipside, there's an ever-grimmer situation in Ukraine," remarked Crawford. "Hostilities steadily escalated in Ukraine as the Russian military ruthlessly ratcheted up its assault and willfully turned a blind eye to its commitments under the Geneva Convention. While the violence remained regionalized, the conflict spilled out into global diplomatic and economic channels. Aside from heightening the likelihood of a broader military conflict, this development exacerbated already-acute supply issues for critical inputs and all but guaranteed continued macroeconomic volatility."

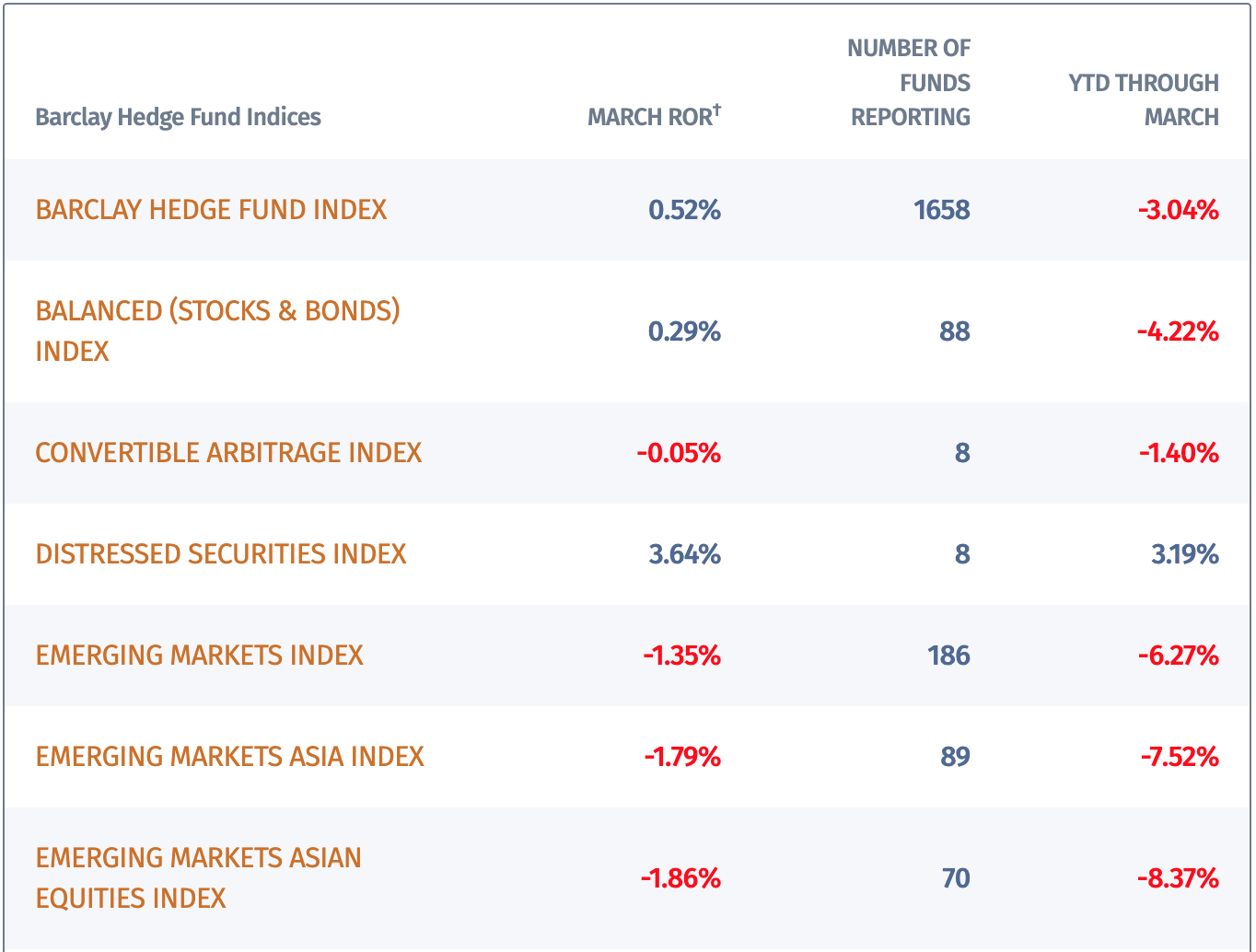

Full table: Article source - Opalesque is not responsible for the content of external internet sites |

Industry Updates

Hedge fund industry gains 0.39% in March, trims YTD loss to -3.3%

Monday, April 11, 2022

|

|

RSS

RSS