|

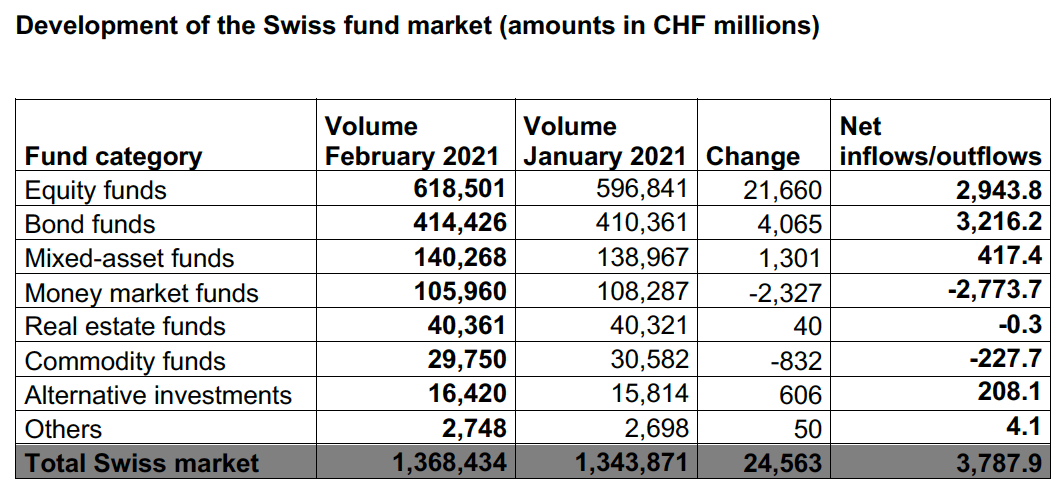

Opalesque Industry Update - In February 2021, the volume of assets placed in the investment

funds covered by the statistics compiled by Swiss Fund Data AG and Morningstar stood

at CHF 1,368.4 billion, an increase of CHF 24.6 billion or 1.8% month-on-month. Net

inflows totaled CHF 3.8 billion. The volume of assets entrusted by investors in Switzerland to the fund industry came to CHF 1,368,434 million in February 2021 (January 2021: CHF 1,343,871 million). "Following the setback experienced in January, many financial markets staged a recovery in February. With the exception of the SMI, which remained slightly in negative territory, the leading stock markets posted renewed gains. The trend in terms of net inflows continued in February, but it slowed down a little. Bond and equity funds attracted the most new money," explained Adrian Schatzmann, CEO of the Asset Management Association Switzerland. By way of comparison, the figures for selected indexes in February 2021 were as follows (January 2021 in brackets): Dow Jones 3.17% (-2.04%), S&P 500 2.61% (-1.11%), EURO STOXX 50 4.45% (-2.00%), SMI -0.65% (-1.05%), SBI -1.38% (-0.32%), and Bloomberg Barclays US Aggregate Bond Index -1.44% (-0.72%). The CHF lost 1.56% against the EUR and 2.01% against the USD. Net inflows in February 2021 totaled CHF 3.8 billion. Bond funds led the way with inflows of CHF 3.2 billion, followed by equity funds with CHF 2.9 billion. Outflows mainly affected money market funds (-CHF 2.8 billion). There were no changes in the ranking of the most popular asset classes: equity funds 45.20%, bond funds 30.28%, mixed-asset funds 10.25%, and money market funds 7.74%.

press release Article source - Opalesque is not responsible for the content of external internet sites |

Industry Updates

Swiss fund market growing again

Thursday, March 18, 2021

|

|

RSS

RSS