|

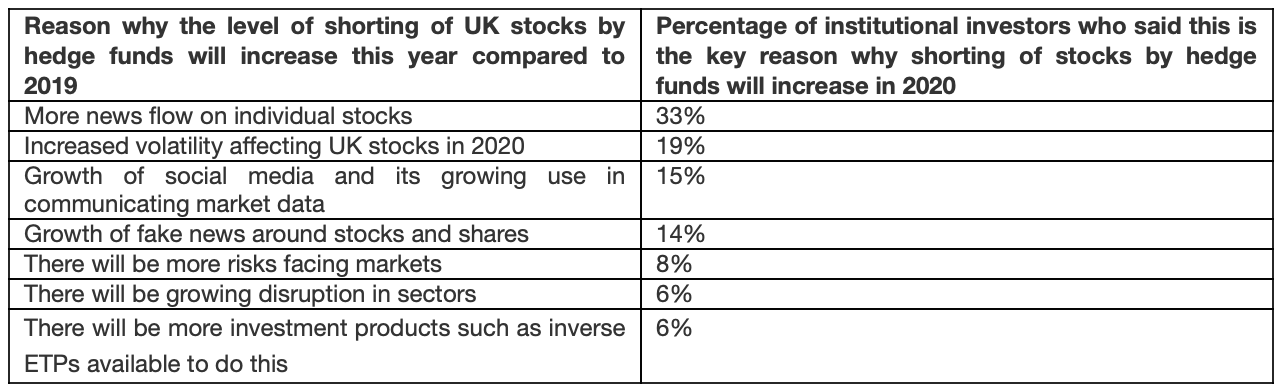

Opalesque Industry Update - New research from ETF provider GraniteShares reveals 81% of institutional investors expect the use of leveraged investment strategies to increase over the next five years. Similarly, 58% predict the level of shorting of UK stocks by hedge funds to become more prevalent this year when compared to 2019 - with one in four (25%) anticipating a dramatic rise. Only 12% expect the level of shorting of UK stocks by hedge funds to fall. This comes at a time when 71% of institutional investors interviewed by GraniteShares expect to increase their exposure to UK stocks, with the main reason given for being that they expect 2020 to be a good year for the economy. In November last year, GraniteShares launched a range of short and leveraged single stock daily Exchange Traded Products (ETPs) on the London Stock Exchange, enabling for the first-time sophisticated investors to take positions on both rising and falling share prices. In addition to this, they can also be used to hedge individual stock exposures, including those in index or fund holdings. By providing transparent access through an ETP, GraniteShares is removing the barriers that sophisticated investors face if they want to use leverage. Reason why level of shorting of stocks will increase in 2020 When asked what they think is the main reason why hedge funds will short UK stocks more this year, 33% of institutional investors interviewed said it was because there is increased news flow on individual stocks and markets in general, followed by 19% who said it's because there will be more volatility in UK stocks this year. However, 15.4% said the main reason was the growth of social media and the growing use of this to communicate market data. Some 13.5% said the main reason is the growth of 'fake' news around stocks and markets. Some 6% said it will be because there are more investment products and vehicles such as inverse ETPs available to do this.

"The UK is one of the most sophisticated and advanced investment markets in the world and our research shows that investors here increasingly want to use leveraged and inverse strategies. This is because they are gaining access to more information and data than ever before, and our products allow them to act on any strong views they have on key UK stocks. "The UK is ripe for the launch of more leveraged and inverse ETPs."

Article source - Opalesque is not responsible for the content of external internet sites |

Industry Updates

Hedge funds predicted to increase level of shorting of UK stocks in 2020

Wednesday, February 26, 2020

|

|

RSS

RSS