|

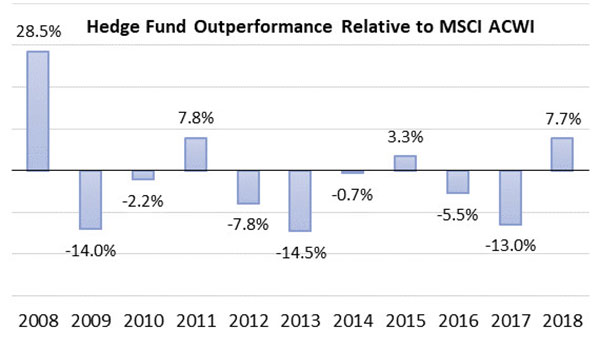

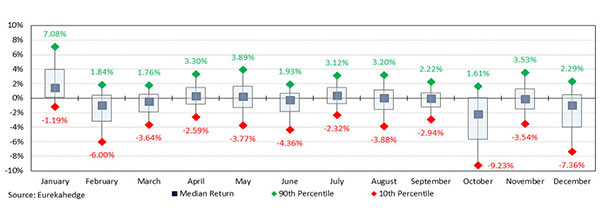

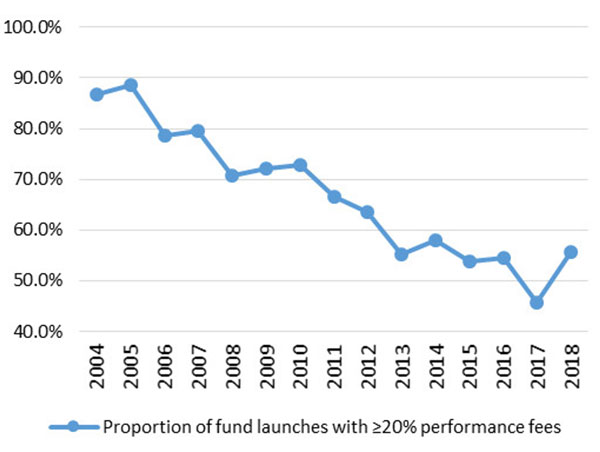

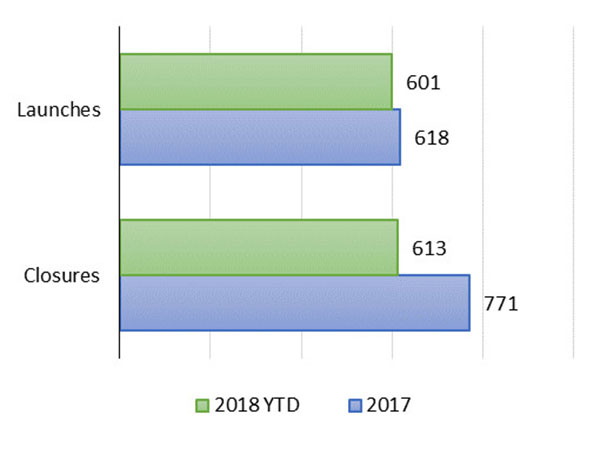

Opalesque Industry Update - The Mizuho-Eurekahedge Index (USD), an asset-weighted index representing the global hedge fund industry performance was down 0.39% in December, bringing its year-to-date loss to 4.09% amidst the global equity market sell-off. Despite ending the year in the red, hedge fund managers recorded their best outperformance over the global equity markets since 2011, as they returned 7.70% more than the MSCI ACWI IMI (USD) throughout 2018. The MSCI ACWI Investable Market Index (IMI) captures large, mid and small cap representation across 23 developed markets and 24 emerging markets countries. With 8,725 constituents, the index covers approximately 99% of the global equity investment opportunity set. It was down 9.6% in 2018. Historically, the Mizuho-Eurekahedge Index (USD) has outperformed underlying equity markets during periods of market distress, such as the years 2008 and 2011, during which the index outperformed global equity markets by 28.52% and 7.80% respectively. Launches and closures A total of 601 fund launches and 613 liquidations were recorded in 2018, marking a third consecutive year in which fund closure activities outpace launches. Among these newly launched funds, 55.7% charged no less than 20% performance fees, compared to 45.8% back in 2017. However, both figures are still significantly lower than what was observed prior to the financial crisis, during which an overwhelming majority of hedge funds charged 20% performance fees or higher.

|

Industry Updates

Mizuho-Eurekahedge Index records best outperformance over MSCI ACWI IMI since 2011

Wednesday, January 30, 2019

|

|

RSS

RSS