|

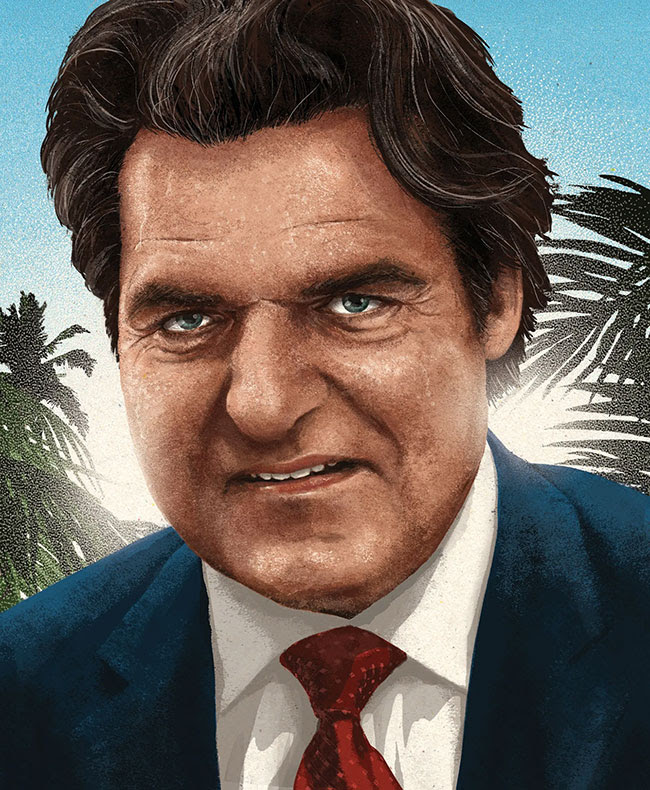

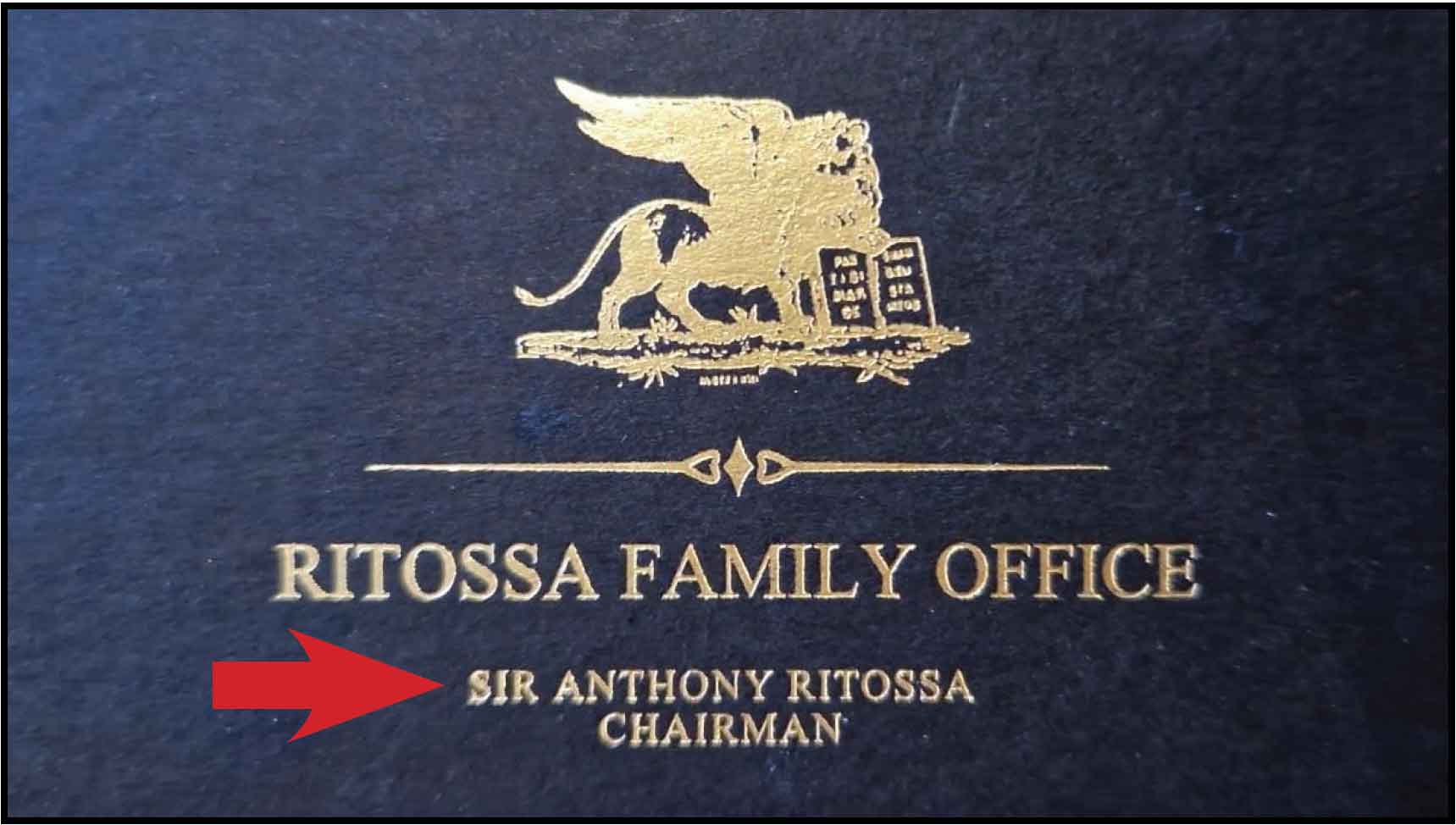

By Matthias Knab How Imposters, Con Artists, and Sophisticated Fraudsters Are Infiltrating the Ultra-Wealthy's Most Exclusive Networks At a prestigious financial conference in Switzerland, I watched a familiar figure work the room with practiced ease. His name tag identified him as representing yet another "family office," though this one was different from the one he'd claimed to manage in 2015. Back then, he had posed as the Chief Investment Officer of the "Ritossa Family Office" - a fiction that unraveled spectacularly in exposés by Opalesque and a devastating Vanity Fair investigation that revealed Anthony Ritossa as a serial fabricator who had built an empire of lies on the foundation of fake aristocratic titles, non-existent wealth and borrowed prestige. Yet here he was, ten years later, at another high-end financial event, wearing a different badge but playing the same dangerous game. He wasn't alone. Over three days at this gathering of legitimate wealth managers and ultra-high-net-worth individuals, I encountered more questionable characters - each claiming to represent substantial family fortunes. This is the paradox of modern wealth management: As family offices have proliferated globally - with Singapore alone hosting over 1,100 registered entities and worldwide numbers potentially exceeding 10,000 - they have become both more influential and more vulnerable. The very discretion that defines the family office model has created a perfect smokescreen for imposters, fraudsters, and opportunists who exploit the sector's culture of privacy to infiltrate and exploit its most exclusive circles. The Anatomy of Deception The modern fake family office operates through a sophisticated playbook that would be almost admirable if it weren't so destructive. Unlike crude financial scams that promise unrealistic returns to unsophisticated investors, these operations target the ultra-wealthy and the ecosystem that serves them - investment managers, financial advisors, and legitimate family offices seeking co-investment opportunities. In 2022, a fake family office in Singapore was uncovered after authorities found it had been facilitating illegal money transfers. It posed as a legitimate advisory service but was actually involved in laundering proceeds from organized crime. Or examine a Hong Kong scandal from 2021, where a supposed family office operated what was essentially a Ponzi scheme behind the facade of sophisticated investment strategies. The perpetrators didn't target retail investors; they focused on other wealthy families, leveraging the trust inherent in family-to-family dealings. When it collapsed, it had defrauded investors of millions while tarnishing Hong Kong's reputation as a trusted wealth management hub. These aren't isolated incidents. From Switzerland to New York, from Dubai to Singapore, the fake family office phenomenon has evolved from occasional embarrassment to systemic threat: Edoardo Collevecchio, managing director of Oppenheimer Generations Asia, tells a story that has become disturbingly common. At a Singapore conference, he was preparing to share a panel with another family office executive. During pre-panel small talk, Collevecchio mentioned knowing the principal of his co-panelist's firm. The response was telling: the supposed executive couldn't answer basic questions about his employer and didn't even recognize the owner's name. "The panelist was quietly removed before we went on stage," Collevecchio recalls. "But it makes you wonder how many others slip through." Singapore's transformation into a family office hub - accelerated by government incentives and favorable tax structures that attracted billionaires like Ray Dalio and James Dyson - has inadvertently created fertile ground for imposters. The city-state's rapid growth in this sector, combined with the inherent privacy of family offices, has made due diligence increasingly challenging. And, the private nature of founders' wealth makes due diligence challenging, providing ample opportunities for misrepresentation. The Many Faces of Fraud Through my investigation, I've identified several distinct categories of fake family offices, each with their own methodologies and motivations: The Unsophisticated Pretenders These are wealthy individuals who inflate their credentials, claiming to manage family offices when they're at best high-net-worth investors making direct investments. While not necessarily malicious, they muddy the waters, enjoying to mingle with the rich and powerful at some of the world's most delightful locations and luxury resorts. Some of them may not even invest at all - just pretending to be. And if, then mostly on a "spray and pray" approach, lacking the size, infrastructure, expertise, and fiduciary framework of genuine family offices. The Broker Masquerade More problematic are licensed broker-dealers who rebrand themselves as family offices to gain access to exclusive deal flow. They may hold legitimate licenses, but they fundamentally misrepresent their role in the ecosystem. They may pose as buy side at conferences, but their oly interest is filling their rolodex with prospects for their own deals. These operators waste time and resources, creating noise in a system that depends on trust and authentic relationships. Real family offices to the most part avoid these intermediaries, recognizing them as parasites on the investment ecosystem.  The GREAT PRETENDER The International Grifters Perhaps most dangerous are overseas entities that charge fees for "elite" conferences or gatherings, introductions or investment facilitation. The notorious Anthony Ritossa represents the apex predator of this category. As detailed in Vanity Fair's investigation, Ritossa built an entire business empire - including his "flagship events" - on fabricated titles, wealth and false pretenses. A well known industry insider confirmed to me that Ritossa was so broke in 2009 - being laid of by Deutsche Bank and going through a divorce from his first wife - that he had to lent him $10,000. Only to see Ritossa re-emerge later as the purported scion of the "600 year old Ritossa Family Office", adorned with a fake aristocratic title.  Fake title, fabricated "600 year family office" He convinced legitimate players to partner with him, leveraged these relationships to attract others, and created a self-reinforcing cycle of deception that took years to unravel, and which - thanks to a perfectly orchestrated, glittering social media engineering - seems still ongoing under a new brand, the "Global Family Office Investment Summit". The Technology-Enabled Fraudsters A new breed of impostor has emerged, powered by artificial intelligence and digital sophistication. The case of "Alex Morgan" - documented by blockchain entrepreneur Jean-Laurent Tari - reveals how scammers now use AI-generated profile photos, fabricated LinkedIn histories, and sophisticated social engineering to target founders and investment managers. Morgan's approach was methodical: a LinkedIn profile with professional keywords like "Family Office," "Investor," and "Convertible Debt"; an AI-generated photo that looked convincingly professional; a website for "CVL Holding" that appeared legitimate at first glance but was registered just weeks before contact; and a careful escalation from initial contact to requests for financial verification. The technical sophistication was remarkable. A "synthetic legitimacy" was created, using social media tools to construct an appearance of authenticity that doesn't exist. But the red flags were there for those who looked: seven spelling mistakes in a 50-word message; inability to answer basic questions about the investment thesis; a company website blacklisted by antivirus software; an email address from "myyahoo.com" rather than a corporate domain. The Hong Kong Embarrassment The extent of the problem was starkly illustrated at Hong Kong's own Wealth for Good summit, a government-backed initiative to establish the territory as a premier family office destination. Among the speakers was "Sheikh Ali Rashed Ali Saeed Al Maktoum", presented as a "member of Dubai's royal family" and a significant wealth manager. Except that he wasn't. The "Sheikh" had burst onto Hong Kong's financial scene in December 2023, signing a business partnership MoU with the Hong Kong Middle East Business Chamber. By March 2024, he was telling Bloomberg about his plans to open an office managing his family's USD 500 million portfolio, targeting investments in start-ups, construction, and energy in Hong Kong. The red carpet was rolled out with remarkable enthusiasm. InvestHK, the government department responsible for foreign direct investment, invited him to speak on a panel alongside the director of the Bill & Melinda Gates Foundation. Chief Executive John Lee received him personally at the summit's opening on March 26. That same day, the Hang Seng University of Hong Kong appointed the Sheikh as an honorary professor. Then things began to unravel. Hours before his scheduled office inauguration on March 28, the event was abruptly cancelled. The Sheikh's team claimed it would be postponed to May. Reporters from the South China Morning Post discovered that the address of the Prince's Office was shared with an investment firm linked to Macau's casino operators. Questions arose about whether he truly controlled the claimed $500 million. The explosive revelation came on April 2: the "Dubai Prince" had a double identity as Alira, an Emirati pop star with a significant following in the Philippines, where he sang in fluent Tagalog. In 2021, this same individual had told Filipino media he was merely "an internal auditor at a government agency." The investigation revealed that key staffers of the Sheikh's "family office" actually came from Here4U, an entertainment company associated with Alira. The plot thickened. The CEO of the Sheikh's family office, Eleanor Mak (also known as Mak Hoi Yan), appeared on director lists of multiple mainland Chinese companies associated with Zhongtang Air Railway Group, a company embroiled in legal disputes over incomplete sky train projects in Sichuan. She had been lobbying the Hong Kong government since 2023 to construct a sky train in east Kowloon - now suddenly reappearing as CEO of a Dubai royal's family office. The plot thickened. The CEO of the Sheikh's family office, Eleanor Mak (also known as Mak Hoi Yan), appeared on director lists of multiple mainland Chinese companies associated with Zhongtang Air Railway Group, a company embroiled in legal disputes over incomplete sky train projects in Sichuan. She had been lobbying the Hong Kong government since 2023 to construct a sky train in east Kowloon - now suddenly reappearing as CEO of a Dubai royal's family office. Aaron Shum Wan Lung, founding president of the Hong Kong-Middle East Business Chamber with strong ties to the city's pro-establishment sector, had introduced the Sheikh to Hong Kong. When questioned about the cancelled inauguration, he claimed government officials had pulled out of attending, potentially offending the prince. The Hong Kong government's response was telling in its inadequacy. Despite having invited this individual to speak at their flagship summit, officials deflected criticism about their failure to conduct due diligence. A spokesperson merely stressed that "the government has not made any investments in family offices established in Hong Kong, nor will it provide any additional policy benefits or financial support." The situation deteriorated further when the US Securities and Exchange Commission issued a warning on April 7 against the Dubai Prince's Hong Kong office, citing concerns of untrustworthiness regarding their involvement in cryptocurrencies. Government sources revealed the troubling philosophy behind this debacle: they told local media that background checks on investors like the Dubai Prince might "offend the investors and undermine Hong Kong's reputation as a financial hub." The incident exposed not just one fraudster's audacity, but the desperate measures Hong Kong was willing to take - or not take - to maintain its financial hub status. While citizens had "a good laugh at the bizarre drama," as one observer noted, the implications were serious. In a city competing fiercely with Singapore for family office business, the willingness to suspend basic due diligence in favor of headline investments had created a perfect environment for imposters to thrive. The Bait and Switch One particularly insidious scheme has become so common that genuine family offices now recognize its pattern immediately while the uninitiated capital seeker will still fall for it. It unfolds in four predictable acts, explains Gus Morison, founder of private members club AYU: Act One: Initial contact at a conference or through LinkedIn. The impostor expresses strong interest in an investment opportunity, claiming to represent a family office seeking exactly this type of deal. Act Two: Enthusiasm builds. The "family office" commits to a substantial investment - perhaps $10 million - and offers to introduce other family offices who might co-invest. Act Three: A complication arises. The initial commitment is reduced, but compensated with promises of even more introductions to other investors. Act Four: The reveal. To facilitate these valuable introductions, there are "costs" - fees ranging from $25,000 to $250,000 for events, due diligence, or "processing." The initial investment never materializes. The other investors don't exist. But by then, desperate fund managers may have already paid substantial fees for phantom opportunities. The New Detective Culture In response to this threat, legitimate family offices have developed an informal but effective intelligence network. WhatsApp groups that once shared investment opportunities now serve as verification services. What some call a "full CSI approach" has emerged, with family offices conducting extensive background checks on new contacts. "The messaging groups have completely changed," one Hong Kong-based family office principal tells me. "We used to share deal flow. Now we also share warnings about suspicious individuals and requests for verification." This defensive posture represents a fundamental shift in family office culture. The sector built on relationships and trust now operates with the skepticism of intelligence agencies. LinkedIn profiles are scrutinized for AI-generated photos. Company registrations are traced through multiple jurisdictions. Even casual conference conversations are followed by discrete background checks. The Regulatory Response Governments and regulators have begun to respond, though their efforts often lag behind the sophistication of the fraudsters. Singapore's Monetary Authority has implemented stricter due diligence requirements and enhanced monitoring for family offices. Switzerland has conducted nationwide audits of family office operations. Hong Kong is acting as well. In a recent Legislative Council session led by the Hon. Tang Fei in June this year, concerns were raised regarding the proliferation of "fake family offices" in Hong Kong's financial landscape. Efforts to prevent abuse of preferential tax regimes for family offices and funds are also underway. Anti-avoidance measures have been instituted to curb misuse of tax concessions, with strict guidelines in place to prevent tax avoidance tactics. Hong Kong has also increased collaboration with international regulators, and initiatives to enhance talent training and accreditation schemes for professionals catering to family offices are being implemented to meet industry demands effectively, according to an article of DimsumDaily. Yet regulatory responses face inherent limitations. Family offices, by design, operate in the space between institutional finance and personal wealth. Too much regulation risks destroying the very flexibility and privacy that makes the family office model attractive. Too little allows fraudsters to flourish. The solution emerging from within the industry itself may prove more effective. Organizations like AYU have launched formal verification programs. Their Approved Family Office (AFO) Programme requires extensive documentation: business references, banking relationships, investee confirmations, and verification of assets under management exceeding $50 million. "I have been in this industry for over 30 years, and I can normally smell a fake family quite easily," says Lex van Dam, founder of SFO Alliance, which hosts the annual SFO Week conference in London. "If someone is obviously evading basic questions or telling stories I can't verify, they are not coming in. Another important concern is reputation. Do other families want to be near this person? That's also very critical." The Questions That Matter Through conversations with dozens of legitimate family offices and wealth managers, I've compiled the critical questions that separate genuine family offices from imposters:

The Technology Arms Race As fraudsters become more sophisticated, so too must detection methods. The "Alex Morgan" case reveals both the power and limitations of AI-enabled fraud. While the scammer successfully created convincing visual elements - professional-looking websites, AI-generated profile photos, and polished marketing materials - the deception crumbled under systematic scrutiny.

Yet technology alone isn't sufficient. The human element - the ability to sense when "something is off" during a conversation, to notice inconsistencies in a narrative, to ask the unexpected question that reveals deception - remains irreplaceable. Continue reading Oriane Cohen's article in this HORIZONS issue: "The Blind Spot In Due Diligence: Why Family Offices Need Strategic Vetting". The Global Perspective The fake family office phenomenon isn't confined to Asia. In 2021, New York authorities shut down a fraudulent family office that had diverted millions in client funds. The perpetrators had operated for years, maintaining offices in Manhattan, employing staff, and actively participating in the investment community. Switzerland, despite its reputation for financial probity, dismantled a fake family office in 2020 that had been laundering money for criminal networks. The investigation revealed gaps in enforcement that prompted a comprehensive review of the sector. Also Dubai, with its ambitious plans to become a wealth management hub, has faced embarrassment. The Ritossa scandal, with its epicenter in the UAE - where, at least, the fake "Sir Ritossa Foundation" has now been suspended - demonstrated the vital need to look through facades and to avoid association with pretenders. The impact of fake family offices extends far beyond immediate financial losses. Each exposed fraud:

More insidiously, the presence of fake family offices corrupts the information ecosystem. Investment trends reported by fraudulent entities skew market intelligence. Fake participants at conferences dilute the value of networking. Spurious deal flow wastes time and resources. "Every fake family office that attends our events devalues the experience for genuine participants," one conference organizer tells me. "We've had to evolve from event planning to intelligence gathering, making sure we curate a safe environment for our legitimate guests." The Path Forward The family office sector stands at a crossroads. The explosive growth that made it attractive to fraudsters shows no signs of slowing. Deloitte projects the number of single-family offices will grow from approximately 8,000 today to over 10,700 by 2030. Each new entrant represents both an opportunity for the sector and a potential vector for fraud. The solution likely lies not in regulation but in adaptation. As the industry matures, networks of verified family offices are emerging. These trusted circles, whether formal associations or informal alliances, create barriers to entry that no fraudster can breach. Membership requires not just wealth but verification, not just claims but confirmation. Technology will play an increasing role. Blockchain-based identity systems, AI-powered verification tools, and sophisticated data analytics will make deception increasingly difficult. But technology must be balanced with human judgment, systematic processes with relationship-based trust. The Warning Signs For those navigating the family office ecosystem, whether as investors, service providers, or family offices themselves, vigilance is essential. The red flags are often subtle but consistent: Digital footprints that don't match claims: LinkedIn profiles with no history, websites registered days before contact, email addresses from free providers rather than corporate domains. Linguistic inconsistencies: Poor spelling and grammar from supposed financial professionals, vague responses to specific questions, inability to articulate investment philosophy. Behavioral anomalies: Reluctance to meet in person, insistence on unusual communication channels, pressure for quick decisions, requests for upfront payments. Verification failures: Offices in inappropriate locations, principals who can't be verified, references that don't check out, claimed relationships that don't exist. A Personal Note During my investigation, I encountered victims who had lost not just money but faith in the investment ecosystem. Entrepreneurs and fund managers can pay tens of thousands for conferences without real investors, for introductions that never materialized, ending up confessing: "It wasn't the money that hurt most. It was realizing that my desperation to raise capital had made me vulnerable to such obvious deception." In an ecosystem built on trust, betrayal of that trust has cascading consequences that extend far beyond immediate victims. We must train ourselves to stick to the updated version of the old adage: Trust, but verify - by triangulation and multi-dimensional checks. Conclusion: The Price of Privacy The family office sector faces a fundamental tension. Its appeal lies partly in discretion - the ability to manage substantial wealth without public scrutiny. Yet this same discretion creates opportunities for deception. The challenge for legitimate family offices is maintaining privacy while establishing authenticity. All this while the websites of suspicious "family offices" continue to proliferate. LinkedIn profiles with AI-generated photos continue to contact unsuspecting founders. The game of deception continues. But something has changed. The industry that once operated on assumption of good faith now operates on verification. The networks that once welcomed new members now scrutinize them. The conferences that once sought maximum attendance now prioritize quality over quantity. The fake family office phenomenon has forced a maturation upon the sector. Like a immune system responding to infection, the industry has developed antibodies to deception. The cost has been high - in money, time, and trust. But the result may be a stronger, more resilient ecosystem. For those entering the family office world, whether as principals, service providers, or partners, the message is clear: verify everything, trust gradually, and remember that in a world of phantom fortunes, skepticism is not cynicism - it's survival. The gentleman I observed at that Swiss conference, working the room with his new purported family office credentials, will still be operating. But increasingly, he's finding that the room is watching him back. In the world of family offices, the phantoms are being exposed, one verified question at a time. Even the Smartest Investors Fall for Scams. Here's Why-and How to Protect Yourself A Wake-Up Call for Family Offices When Rupert Murdoch, the Walton Family, and Larry Ellison collectively lost over $400 million to Theranos, it proved one thing: No one is immune to sophisticated fraud. In today's world of fake VCs, fraudulent summits, and elaborate social engineering schemes, family offices face unprecedented risks. The con artists have evolved-and so must your defences. Book Matthias Knab for Your Next Event Presentation: "Unmasking Modern Investment Fraud: Case Studies & Implications" An Essential Briefing for Your Family, Board, and Investment Committee This gripping 60-minute presentation - already delivered to acclaim at private family office gatherings - moves beyond theory to provide a practical toolkit for surviving in a low-trust world. Your team will uncover:

What Attendees Are Saying: "Matthias did a more than brilliant job to convey how investment fraudsters work their psychological tricks on anybody who will listen... wow! 🚀 Thank you so much dear Matthias, people were blown away and you left the room with many realizing they have come across the types of people you so well described." Prof. Dr Eelco Fiole, Chair Switzerland Tiger21 Protect Your Legacy. Arm Yourself with Clarity. This vital presentation is now available for private booking for your family office, investment team, or client event. Equip your principals, next-generation members, and key executives with the critical skills needed to identify and neutralize the sophisticated threats of today. Perfect For:

"Fraud today wears a tailored suit and speaks our language. The only real protection is clarity - and the courage to look closer."- Matthias Knab Don't Let Your Next Investment Be Your Worst Mistake Inquire for details: +49 170 1890077 Available for keynotes, workshops, and executive briefings worldwide. | ||||

|

Horizons: Family Office & Investor Magazine

The Phantom Fortunes: Inside the World of Fake Family Offices |

|

RSS

RSS