|

Richard Simmons B. G., Opalesque Geneva: Since 2013, Derby Street Managers, a London-based investment manager, has scoured UK and European markets for undervalued equities for its two funds and has outperformed their benchmarks in the process.

The portfolio manager, Richard Simmons, has extensive experience managing money in many different market cycles. He has been managing equities professionally since 2001, and privately since 1997, so he has witnessed the dotcom boom-bust-boom, as well as the Lehman crisis and Covid.

"It is important to keep your head", he tells Opalesque. "A good business will survive and perhaps even thrive in a bad business environment. As its competitors suffer, it will sustain and deepen its advantages leading to a more profitable outcome when the good times return - as they always do."

Simmons will present at the Manager Discovery Panel webinar on May 3rd, at 11 am ET.

Derby Street has two long-only funds investing in UK and European Equities, which have substantially outperformed their indices since launch. Simmons cites their investments in Robert Walters and Synergie, the international recruitment consultants, one held in each fund.

"These equities were purchased in 2020, during the first Covid lockdown, at bargain-basement prices. They combine the qualities we look for in a good investment - strong and growing demand, entrenched business model advantages (in this case from long-standing client relationships), and conservative financing; both companies have substantial net cash balances. The last and culminating factor is valuation. We paid around three to four times normal earnings power net of their cash for these good businesses and they have both nearly doubled to date."

The kicker is that these types of businesses should outperform in an inflationary environment. "Many of our investments are 'pass-throughs', that is they are able to pass on cost inflation through higher prices or by managing their own costs. Robert Walters and Synergie additionally can tax inflation. Because their revenues are commissions on wages, as salaries go up, so should their own revenues."

The Funds

Derby Street's Cayman-domiciled UK Equities and European Equities AIFs are managed by Richard Simmons. He relies heavily on internally-generated research and fundamental analysis. He runs high conviction portfolios with a low turnover and applies patient long-term investing. Furthermore, he invests in smaller and more niche themes than the average fund.

The Derby Street funds are long-only, fundamental value-oriented, and unconstrained. The European Equities fund, which manages €4m ($4.3m), was launched in February 2013. It has cumulated +204% to the end of 2021. The Euronext100 index, its benchmark, has cumulated 68% in the same period.

The UK Equities Fund invests primarily in the UK or other sterling-related securities including fixed income. Also launched in February 2013, the £17m ($22m) fund has cumulated +77% to the end of 2021. The FTSE100 has cumulated 16.5% in the same period.

European equities

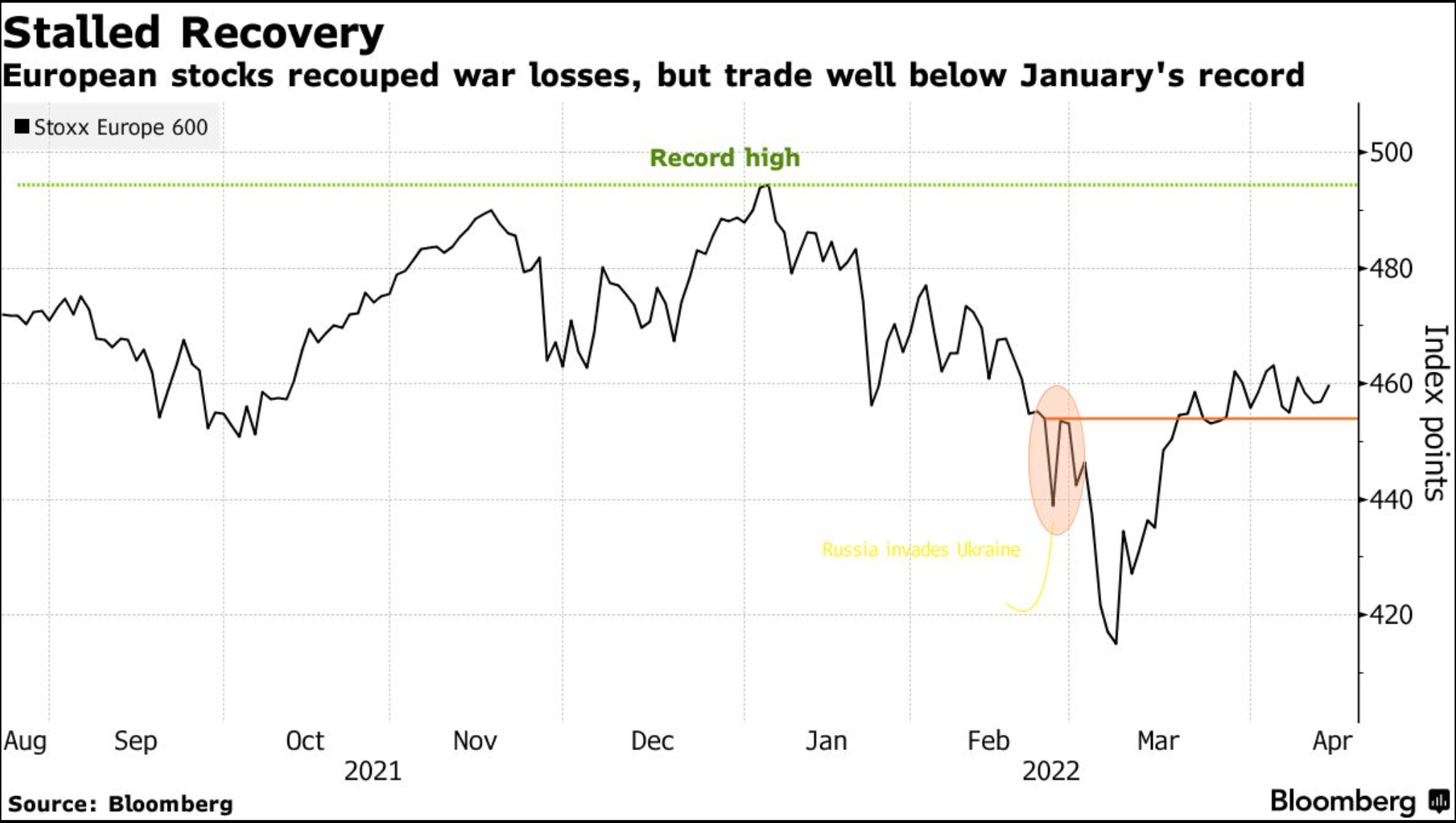

All European regional markets were in the red on April 18th as worries about the war in Ukraine, expectations of aggressive monetary policy tightening by the U.S. Federal Reserve, and mixed earnings kept investors on edge.

Source

The Euronext 100 index is down 7.6% YTD and the FTSE 100 index is up 1.4% YTD (as at April 19th).

The pandemic-induced recession could have marked a reset of an already-mature economic cycle, which has implications for the growth outlook and the types of companies most likely to thrive, writes Lazard, a large asset manager, in a recent outlook on Europe.

"While the cycle should remain supported by factors such as the European Union's unprecedented fiscal stimulus and the build-up in household savings during the pandemic, the tightening of the monetary environment could put any sustained recovery at risk. The complex and nuanced environment is likely to be positive for stock selection once the macro situation becomes less volatile. In some cases, valuations have become detached from company fundamentals, and we are identifying a wide dispersion of returns across sectors and companies. A focus on fundamentals and active management will be critical for identifying potential winners."

Next Opalesque webinar:

Manager Discovery Panel: London

Meet five brilliant fund managers and hear their presentations in this interactive webinar.

• Theron de Ris, Eschler Asset Management

• Richard Simons, Derby Street

• Mark Walker, Tollymore Investment Partners

• Christian Putz, ARR Investment Partners

• Mathias Wikberg, Agera Capital

When: Tuesday, May 3rd, 2022, at 11 am ET

Free registration: www.opalesque.com/webinar/

Related article:

03.May.2021 Opalesque Exclusive: The stock's future counts more than its value for this European equities manager

|