|

Alix Capital Q2 2013 reportKey findings:

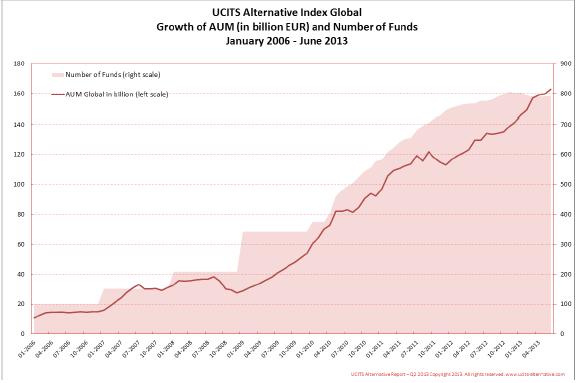

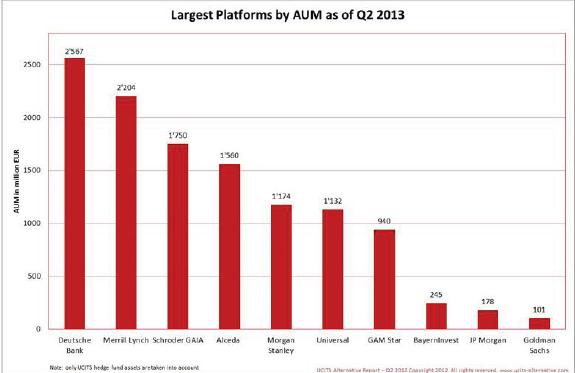

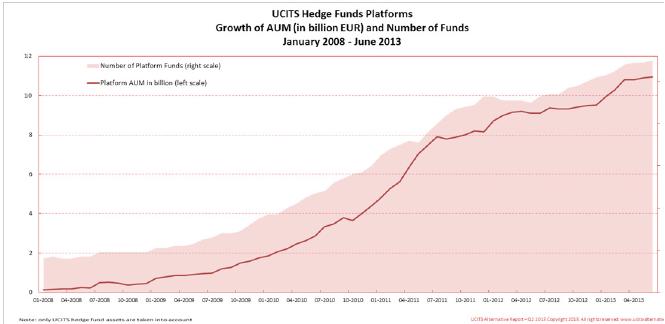

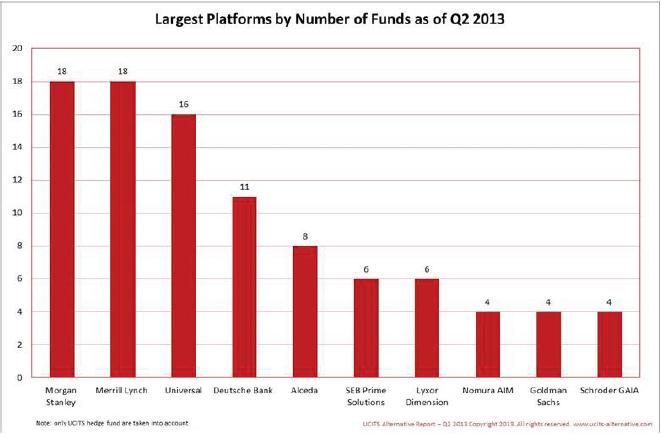

Louis Zanolin, CEO of Alix Capital, says: "UCITS absolute return fund assets continue to grow during the second quarter of 2013. This is explained by several factors. The continuous shift from long only to absolute return fixed funds is probably the most important reason currently. Given the size of the long only fixed income market, one can expect this trend to continue if not to accelerate during the next quarters. Other key important drivers are linked to more secular trends such as the continuously increasing need for highly regulated and liquid products able to deliver consistent absolute returns. Louis Zanolin further adds: We are seeing more and more US based investment managers launching UCITS funds.Fund platforms and their benefits in terms of easy market access are playing an essential role in this development. While they still only account for 5% of the total number of funds, US based managers represent 37% of all platform funds." In our view, the UAI Industry Report gives access to the most comprehensive information about the UCITS absolute return funds universe. Nara Capital has a long track record in the sector and is managing investors' portfolios. The report can be purchased on the UCITS Alternative Index website or by contacting Alix Capital.

|

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS