|

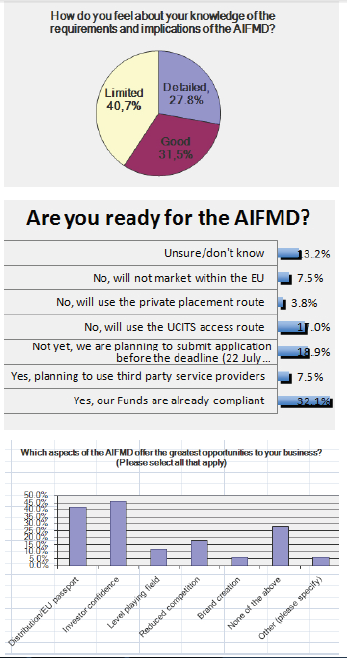

AIFMD : Are your ready? Latest research report published by KEPLER-ALCEDA ResearchAlceda Fund Management S.A. and Kepler Partners LLP conducted a survey in May/June 2014 among the global alternative fund manager community. The 56 correspondents collectively manage $300 billion under management representing firms in Europe, Asia-Pacific and the USA. The objective of the survey explains Georg Reutter at Kepler Partners, is to assess the key issues of investment fund managers and the potential opportunities AIFMD may bring. Key findings: Are you ready for the AIFMD? only 32% said they

were already compliant European managers responding were generally perceived as better prepared compared to other managers in other locations possibly more blindfolded 17% of managers surveyed said they preferred to keep the UCITS route, even for Institutional investors

Biggest issues on AIFMD raised:

Main benefits: Best routes for distributing across Europe: Alceda viewpoint Since July 22nd, managers have in hands either AIFs, or UCITS or still use the National Placement Regime, in place until 2018. As Alceda explains in its survey, using the remaining Placement Regimes seems a relatively easy option, but nevertheless requires significant paper work to document activities to local regulators. Passive marketing also called « Reverse solicitation » is possible but might be a painful exercise if not done properly. A manager has the option to obtain his own AIFM licence or assign an external party. The first option might prove to be costly and choosing an external distributor would sa good alternative for Europe. Therefore, as Michael Sanders, CEO and Chairmanof the Board of Alceda Fund Management S.A outlines: Foreign managers must ask themselves how they wish to enter the European market.

|

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS