|

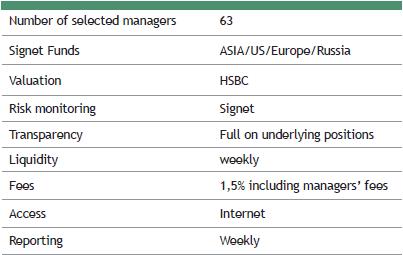

SIGNET SERIES : ACCESSING HIGH YIELD RETURNS Signet Asset Management is an investment boutique selecting hedge funds for 20 years. The firm has been growing in good and adverse cycles and has the reputation to be a long term small prudent but innovative dynamic player. In 2013, Signet manages 1 billion Sterling of assets for family offices and institutional clients. The firm has main offices in Switzerland, US, Hong Kong and London. Signet seeds emerging managers and has always been an early stage investors when they believe in the pedigree and the talent of the managers. Today, Signet is entering the space of UCIT platforms by launching Signet SERIES, its Long Only High Yield Specialised platform. Opalesque UCIT Intelligence has met Bob Marquardt, the CIO to understand Signet business model in this segment. SvS: Dear Bob, your new venture seems different, could you explain us how and why ? Today, investors are looking for the magic combination of attractive bond returns, in a secured regulated format with liquidity and transparency and possibly low fees. In that context, we decided to respond to the growing investments in high yield bonds by selecting the fund managers that could provide the best risk/return approach, in a regulated vehicle. Post crisis, the fund of fund model is not entirely responding to investment requirements and the platforms offer the flexibility to select directly fund managers. Despite recent good returns in Equities, most investors, private or institutional in Europe are still highly invested in bonds and they are all looking for yield. We are in a declining interest rates' environment, leverage is not possible anymore and investors are moving aggressively to high yield markets to improve their returns in Fixed Income. At the same time, Corporates are starting to increase access the financial market to finance their growth and they are issuing bonds at interesting levels of coupons. Therefore, the Signet Platform offers to our investors an access to 63 managers, all selected by Signet, investing in high yield bonds with a Long Only approach, in a transparent format. SvS: So why UCITS? Why Long Only? Why a platform? What are the benefits for investors? UCITS is the recognized investment solution for onshore regulated vehicles. It matches investors' requirement for transparency in a liquid format. We like the vehicle and have been early stage investors in Alternative UCITS. We know the universe well, its limits and where the pool of talent is. We have decided to open 4 investment segments by regions: US/Asia/ Europe and Russia. Long Only because we believe that shorting Bonds does not offer value; the cost of hedging and shorting is not rewarded by added performances. Each regional fund has 3 years average Bond maturity. The platform is one of the easiest format for investors. It allows them to choose the investment theme they want, the level of diversification required. It gives them the right level of investment flexibility. We provide weekly liquidity and they can exit at convenient time. They capitalise on Signet expertise to manage the risk of investment, to select talented managers, to identify new ones and they benefit from 20 years experience in due diligence and risk monitoring. They can find the requested level of capacity, each of our Signet funds by region have a capacity of 1 billion of assets. Each regional fund has been seeded by Signet. We believe in the alignment of interests with our investors. SvS: Why Russia? We believe that the market is opening up, the market is capitalizing on 300 new issues representing a market of almost 3 trillions of assets. There are interesting Corporates in Consumer Goods, in telephone systems and they are offering coupons of 8 to 9%. We think that it is a value proposal for investors. Russia offers now a wider range of managers, experienced and backed by banks. SvS: Bob, what do you think is the key edge of your platform? We believe that Signet Platform combines what investors are all searching for returns, in a secured environment, with a long term player who has faced different life cycles, who knows managers and has the capacity to grow. We also believe in independence. We target traditional hedge fund investors and long only investors that are looking for ETF plus type of returns in Fixed Income. More on: www.signetcapitalmanagement.com KEY FEATURES

|

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS