|

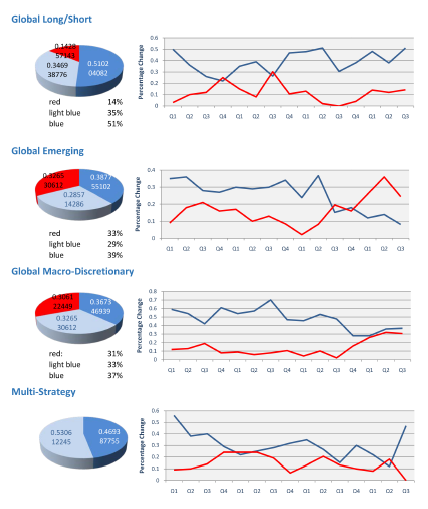

ML QUARTERLY INVESTOR SURVEY – June 2014ML Capital Asset Management, the investment manager and promoter of the MontLake UCITS Platform, is delighted to present the 15th edition of the quarterly ML Capital Alternative UCITS Barometer (Barometer). The Barometer is designed to help identify and anticipate key trends in the demand for the major strategies within the Alternative UCITS sector. The capital introductory team at ML Capital survey a diverse range of 60 investors who collectively manage almost $95 billion and today invest upwards of $35 billion into Alternative UCITS, reflecting the widening of the investor base for regulated alternative products in Europe. Respondents range from insurance and pension funds to private banking organisations, with a significant constituent of financial advisers that deal with the primary source of Alternative UCITS inflows, the mid-net-worth investor. Commenting on the highlights of the latest Barometer, John Lowry, Co - Founder & CIO of ML Capital; "With markets near all-time highs, investors are increasingly looking for Multi- Strategy funds which have the ability to deliver returns less dependent on market movements. Our latest Barometer shows a sustained high level of interest for Long Short funds focussed on the following areas, US equities, Global equities and those that concentrate on investing in the Emerging Markets. In the non-equity sector, for the family offices, wealth managers and other institutions that we interact with, there is also a strong demand for less correlated strategies such as Global Macro and Multi- Strategy funds. With asset levels at all-time highs in the overall hedge fund industry, a large number of well-respected US managers are now expanding their product ranges through launching a regulated UCITS product to support the widening of demand for investment products that are not fully dependent on the direction of the stockmarkets". To receive the Barometer, please contact james@mlcapital.com

|

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS