|

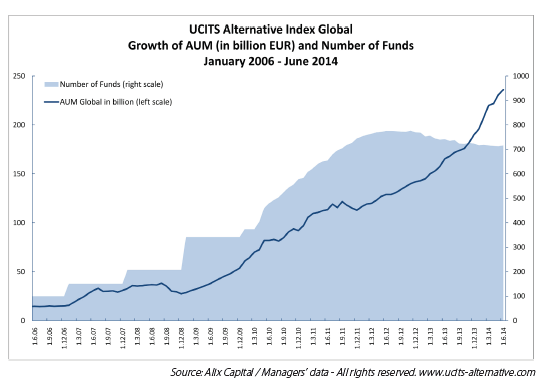

UCITS absolute return funds continue to progress during the second quarter. After a difficult start (-0.37% in April) the performance improved during the last two months of the quarter with respectively +0.75% in May and +0.22% in June. The performance of the UCITS Alternative Index (UAI) Global for the first half of the year is +0.94%. CTAs are the best performing funds during the second quarter with a progression of 3.93%. They are followed by emerging markets and multi-strategy funds respectively up 2.32% and 1.42%. With their strong results in the second quarter CTA are now the best performing funds since the beginning of the year with a progression of 1.70%. Coming next are multi-strategy and fixed Income funds respectively up 1.62% and 1.58%. UCITS funds of funds display a similar pattern as the global market in terms of performance evolution. They are up 0.27% during the second quarter and up 0.48% since the beginning of the year. Growth of assets and number of fundsAssets managed by UCITS alternative funds increase by EUR 15 billion (+7%) during the second quarter to reach EUR 235 billion at the end of June. 80% of the asset progression is due to fixed income, long/ short equity and equity market neutral funds. In terms of percentage the largest progression of assets is recorded by Event-Driven funds with +83%. On the negative side commodities, CTA, emerging markets and volatility funds all lost assets since the beginning of the year.

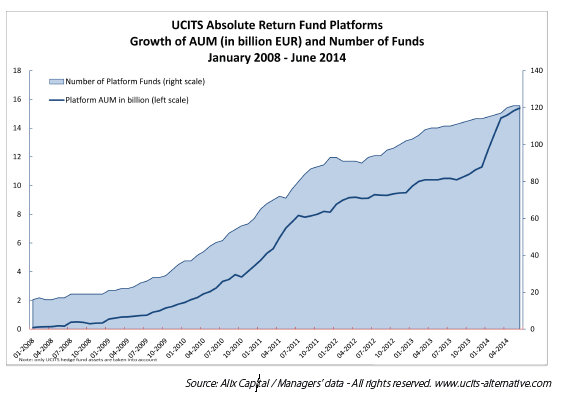

UCITS PlatformsPlatform of UCITS absolute return funds continue to progress during the second quarter both in terms of number of funds and assets under management. After the strong progression witnessed in Q1 (+33%) the total assets managed by platform funds continue to advance during the second quarter (+ 5%) to reach EUR 15.48 billion at the end of June. Several of the most successful funds in terms of asset progression are platform funds. As a result, a growing number of these funds are now closed to new investments.Louis Zanolin, Alix Capital zanolin@alixcapital.com

|

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS