|

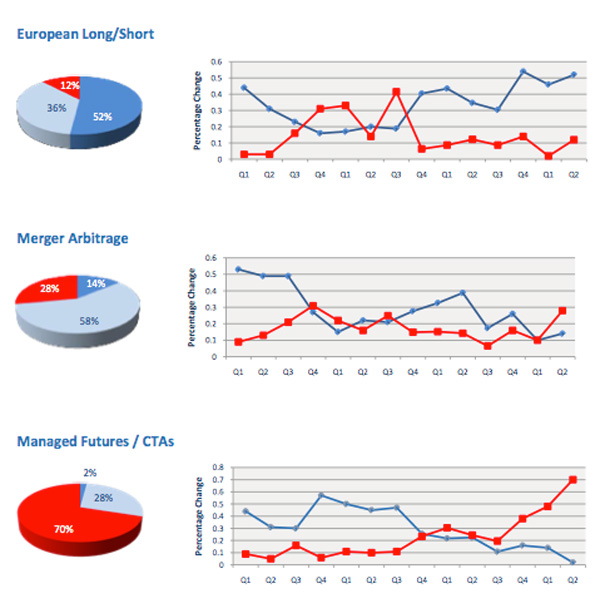

ML Capital Asset Management, the investment manager and promoter of the MontLake UCITS Platform, published its13th edition of the quarterly ML Capital Alternative UCITS Barometer (Barometer). The Barometer is designed to help identify and anticipate key trends in the demand for the major strategies within the Alternative UCITS sector. The capital introductory team at ML Capital survey a diverse range of 60 investors who collectively manage almost $95 billion and today invest upwards of $20 billion into Alternative UCITS reflecting the widening of the investor base for regulated alternative products in Europe. Respondents range from insurance and pension funds to private banking organisations, with a significant constituent of financial advisers that deal with the primary source of Alternative UCITS inflows, the mid-net-worth investor. Commenting on the highlights of the latest Barometer, John Lowry, Co -Founder & CIO of ML Capital; "Hedge funds managed to navigate very choppy waters over the first three months of 2014 and as a whole, posted solid gains for the first quarter. However, with continued volatility predicted, asset allocators are planning some significant moves in their investment portfolios. European funds are likely to be one major beneficiary, with some 52% of respondents planning to raise their European fund exposures. This compares with just 30% nine months ago and less than 20% through most of 2012. Other Equity strategies in high demand are dedicated US and UK funds, with Market Neutral strategies also experiencing a growth in following. While the desire to raise allocations to mature markets is natural given that they appear likely to deliver decent growth, with volatility expected, there is a strong demand for market neutral managers in order to moderate drawdowns, with 48% of investors looking to increase their allocations to the strategy".

To receive the Barometer, please contact: James@mlcapital.com |

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS