|

UCITS absolute return funds advanced by 0.34% during the first quarter of 2014. The good performance of Equity and Fixed Income strategies was partially offset by the negative performance of CTA and Emerging Markets funds. Since the beginning of the year the three best performing strategy indices are the UAI UCITS Long/Short Equity Index up 1.50% followed by the UAI Fixed Income up 0.80% and the UAI Equity Market Neutral Index up 0.77%. On the negative side the UAI CTA is down -2.15% and the UAI Emerging Markets down -1.44%. Benefiting from the good performance of equity related strategies UCITS funds of funds end the first quarter slightly positive with +0.21%.

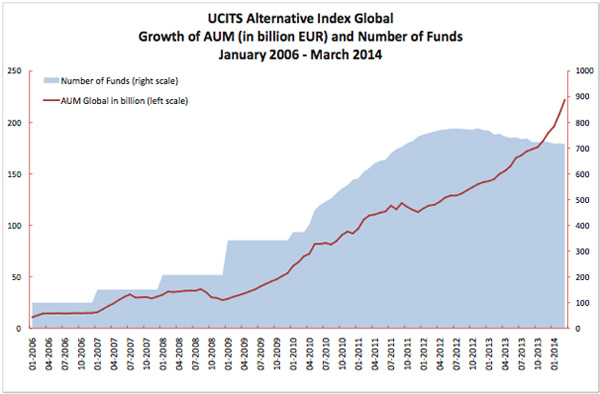

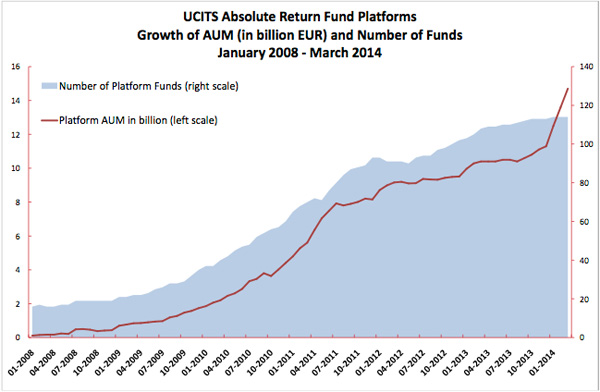

Growth of assets and number of Funds While the total number of funds remains stable the level of assets under management strongly advanced during the first quarter passing from EUR 190 billion to EUR 220 billion, a progression of 16%. The high progression rate – the largest quarterly increase since June 2010 - is explained by several factors. The first reason is the increasing preference from investors for absolute return fixed income rather than long only funds. The second one is the strong interest for absolute return equity strategies such as Long/Short Equity, Equity Market Neutral and Event-Driven following the good performance recorded in 2013. UCITS Platforms Jumping by around 30% - from EUR 11.3b to EUR 14.9 - the total assets managed by platforms of UCITS absolute return funds progressed twice as fast as the global market during the first quarter of 2014. A large part of the asset progression is explained by two funds: the Schroder GAIA Sirios US Equity and the MLIS Marshall Wace TOPS UCITS that collected respectively USD 1899 million and EUR 588 million in Q1 2014. In total 10 platform funds increased their assets under management by more than EUR 100 million during the period. Louis Zanolin, Alix Capital - zanolin@alixcapital.com

|

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS