|

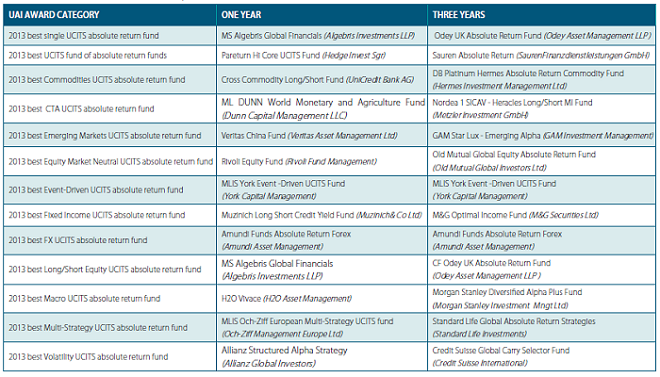

Alix Capital announces winners of the 2013 UCITS Alternative Index (UAI) AwardsThe UAI Awards cover 13 categories with two awards announced per category. The winners have been selected by a committee led by Louis Zanolin, CEO of Alix Capital, which oversees the award methodology. The 2013 UAI Awards winners are as follows:

Louis Zanolin, CEO of Alix Capital, says: "2013 marks another strong year for UCITS absolute return funds with total assets under management increasing by 34% to reach EUR 190 billion at the end of December. Investors are more and more appealed by the attractive risk return profile and strong regulatory oversight characterizing these funds. The strong performance of the 2013 UCITS Alternative Index (UAI) Award winners is an additional sign showing that the scale and quality of the funds in this universe is also improving." "I would like to congratulate all the winners of the 2013 UAI Awards. These distinctions reward not only the best performing funds over the last 12-month period but also the ones that succeed over the longer term which is really what investors are looking for. Since their launch the UAI Awards have become one of the most significant - and more importantly truly independent - distinctions in the UCITS absolute return funds industry." To qualify for the awards funds must be part of the UCITS Alternative Index Global or UCITS Alternative Index Fund of Funds, have at least 12 or 36 months of performance history and have at least EUR 10 million AUM. For further information about the UAI awards, please visit the website www.ucits-alternative.com. About Alix CapitalAlix Capital is a Geneva-based investment company specialising in alternative investments. Founded by a team of experienced alternative investment specialists, Alix Capital provides research and advisory services to the institutional investor community in the field of absolute return investing. The Company is responsible for the calculation, licensing, branding and marketing of the UCITS Alternative Indices. www.ucits-alternative.com.

DISCLAIMER |

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS