|

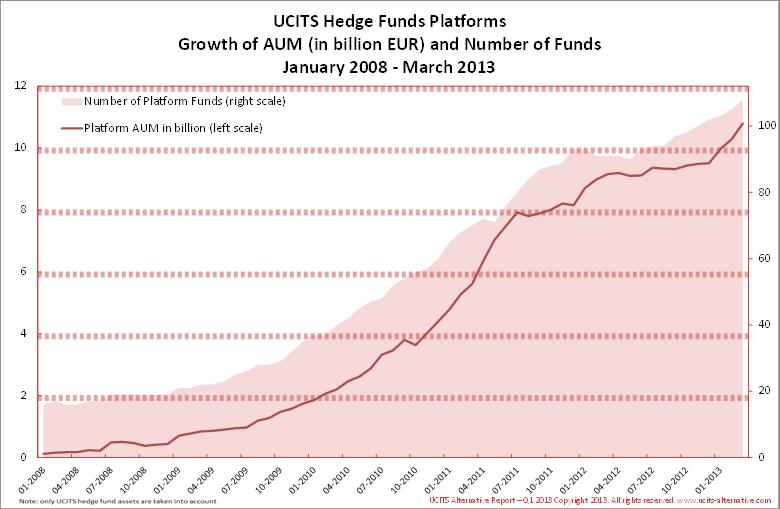

UCITS PLATFORMS UCITS platforms were first launched in 2007, and the model is dominated by banks. The liquidity crisis in 2008 questioned the funds of funds model and its ability to offer to investors transparency on underlying assets. The investors' requirements for regulated, transparent and liquid funds triggered a strong interest in the UCITS vehicle. Today, 15 platforms are available with different business models, type of funds and distribution reach. The latest key market entrant is Goldman Sachs with three funds launched at the end of 2012. Market Players: Bank of America Merrill Lynch and Deutsche Bank were among the first market players to see the benefit of offering to investors a secured platform where they could find selected prestigious managers registered under the regulated and liquid structure of a UCITS. Merrill Lynch Investment Solutions managed strong growth and also experienced the exit of Bluecrest. At that time, some people questioned the business model of the UCITS platforms and its ability to secure long term relationships with managers. Since then, all platforms have shown steady growth and have enlarged their offering. The business proposal aims to select funds that have decided to access the UCITS market with the support of a secured platform and its distribution network. The business models differ in the location of the funds registered, in the liquidity provided (Canyon UCITS fund on the Lyxor platform is weekly, not daily) and the way the funds are structured. The market has grown significantly in assets and players as showed in Alix's Capital chart.

Source Alix Capital Structure: Winton is listed on 3 platforms (Morgan Stanley, Deutsche Bank and Lyxor) with three UCITS funds that are registered and structured under different format.

The DB fund is structured as a financial index (embedded into a swap) as the only way to get exposure to commodities UCITS. As the new ESMA rules releases in 2012 prohibit the financial index solution going forward, Lyxor decided to go down the pure physical replication route (no swaps or other financial engineering solution), which excludes commodities as imposed by regulation but seems a robust solution going forward, without deteriorating the investment proposition as evidenced by the back test. Morgan Stanley uses a certificate-based approach whereby the UCITS sub Fund purchases certificates. These certificates are linked to interests in a trading company that references the Winton Diversified Program, which has commodities exposure. Universe: According to Alix Capital's quarterly reports, almost 42% of the assets of the platforms are with US managers. The platforms are judged by managers for their ability to raise assets and by investors for their capacity to attract talented managers. Not all strategies can fit the UCITS format and naturally those platforms will in the future extend their offering to the new AIFs funds. A similar trend is currently taking place in the U.S. where a growing number of hedge funds are starting to be offered in a "40-Act" format. The Top funds above $1 billion in 2012: Winton (DB Platform) Aquila (Alceda) York (Merrill Lynch Investment Solutions) We have decided to present in this edition six platforms: Merrill Lynch Investment Solutions, Deutsche Bank, Alceda, Morgan Stanley, Goldman Sachs and Lyxor. We take this opportunity to thank all of them for their reactivity in sending us relevant information. |

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS