|

This particular report (see reference link) has been published very recently (April of this year) and is a joint collaboration between the ISFB, IRTI and the IDB. We felt a desire to further scrutinize this study since it seems that not enough attention has been given to its findings. Even their own press release failed to include a link to the actual report and almost every media outlet (in particular those that claim to be internet savvy) could not - or would not - bother to include a simple hyperlink to the online document. In any case, the output can be easily described with one word: lucid. It provides a concise, refreshing and pragmatic overview of the Islamic financial industry today and provides poignant signals as to its future. The report itself is in fact the amalgamation of work performed by three different task forces that worked on the following areas:

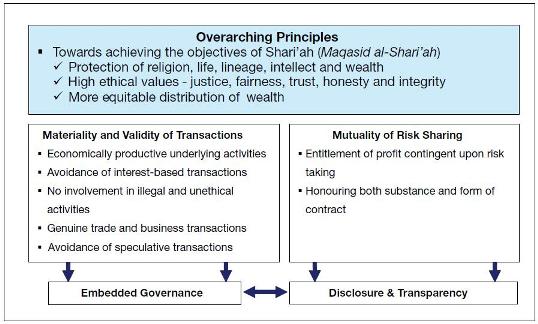

Essential Features of Islamic Finance

All three sections deserve attention, for instance the attached graph from the first area (Appreciating the Islamic Finance Model) provides a succinct overview of Islamic finance. Nevertheless, it is the third area (Challenges and Strategies for Strengthening Financial Stability in the Islamic Financial System) that provides very useful indicators in terms of governance. The report takes a predominantly forward looking perspective and it identifies three key areas of priority that warrant greater attention from policy makers and regulators, so as to strengthen and enhance the "Islamic finance ecosystem":

The overall recommendations are focused on macroeconomic issues, policy concerns, as well as crisis management. Nevertheless, it also suggests that increased attention will be given to "issues of coherence and convergence, and on opportunities to increase the efficiency, integrity and stability of Islamic financial markets". If these can be developed within an aggressive timeframe and if they have the implicit buy-in of IFSB members (regulatory bodies in particular) then we are looking at a governance initiative that could have far reaching consequences for the industry. Your feedback and comments are very important to us, please feel free to contact the author via email. |

Opalesque Islamic Finance Intelligence

Industry Snapshot: IFSB-IRTI-IDB Islamic Finance and Global Stability Report |

|

RSS

RSS