|

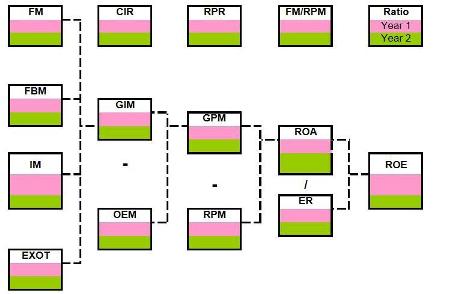

Ahmed is an Assistant Lecturer at the German University in Cairo (GUC), he graduated from the GUC with Double Majors of Finance and International Business and took his Masters in Economics with a thesis in Islamic Finance. He has been working as a teacher for several years and recently published his paper on "Measuring the Performance of Islamic Banks by Adapting Conventional Ratios" (see reference link). Before discussing the paper I would like to highlight that I have witnessed the huge potential of students in the Finance majors with special focus on Islamic Studies but at the same time almost all my students have highlighted these two significant barriers: The first is that they have a very hard time finding resources and information about Islamic Finance and cannot find any centers or companies that are able to help them. Secondly, they feel that their research and work in the Islamic Finance area is useless because there are no well known journals that can communicate their findings to the practical world, since most of the research around Islamic Finance is very practical and can be applied, but "there is no one to listen". A key driver for developing this paper was to gain a better understanding of the Islamic Banking sector, as I had already realized that the industry is still growing and is missing many aspects which have been covered in the conventional banking sector. Beginning with Performance Measurement, I decided that Islamic Banks need their very own custom-made performance measurement tools in order to have better insights and greater understanding of how these banks (and their balance sheets) are performing and how to compare them, which I believed would be very useful academically for more progress in studying the sector, identifying how they are performing and finally in comparing it to conventional banks. Similarly, it would be very useful for the actual mainstream users (whether bankers, government entities or even financial analysts) in order to have a more solid basis for making their decisions and investment calls. The abstract of the paper provides a brief but concise summary of the complete paper: "One consequence of the current financial crisis is that many countries began to reevaluate their financial systems and recognize its flaws and drawbacks. They also began the search for alternative systems for their economies; one of the proposed systems is the current Islamic financial model. This model is still in its infancy and many modifications and additions are required. It also lacks the necessary financial performance measurement tools similar to those used by conventional banks for managers and investors alike. This paper evaluates this lack of performance measures. It then adapts a currently applied ROE Analysis Tool used in conventional banks, to the currently established model of Islamic Banks and tests its applicability and evaluates its usefulness. The findings suggest that such an adapted model would be quite successful for use in Islamic banks and would offer much better analysis and basis of comparison within the Islamic financial system. It also suggests that much of the previously measured performance of Islamic Banks is unsound and should be revised for accuracy and reliability because of the flawed methods used for measurement in the first place". Furthermore, the attached graph provides an illustration of the process that is developed in the paper itself, outlining the tracing procedure used to adapt the Return on Equity of Islamic banks in order to make them comparable to conventional banks. When these changes are taken into consideration then "it becomes possible to use the Adapted ROE Scheme to measure performance of Islamic banks fairly and accurately without any loss of information, discrepancies in intended meaning or incorrect categorization of funds, deposits or income". Explaining the Tracing Procedure of the Adapted ROE Scheme

It must be said that there were several obstacles faced (and can be found in the limitations section of the paper) which mainly revolved around the diversity in accounting standards used by Islamic banks across the world, as well as the actual sub-items presented in the financial statements. These need to be more uniformly prepared in order to ensure a complete and transparent understanding of the financial positions of these banks. Another great obstacle was the availability of data on Islamic banks, most of the data collected has been downloaded directly from each and every bank’s annual report and website. Such a method is very time consuming (even if ensuring complete accuracy and liability of information falls on the banks themselves and not on some other database supplying the data), as well as limited in scope as not all banks have published their statements online, or might not have enough historical reports available for download. I believe a good step now for Islamic banks would be to first adopt the Islamic Accounting Standards in their preparation of financial statements, this can be followed by more accurate performance measurement which can in turn allow people to make more secure investment decisions which might show Islamic Banks to be much more superior to other investments and will definitely improve and prosper the sector and allow it to take its real and significant position among the global banking sectors. Your feedback and comments are very important to us, please feel free to contact the author via email. |

Opalesque Islamic Finance Intelligence

Kulliyyah Korner: Measuring the Performance of Islamic Banks by Adapting Conventional Ratios By Ahmed Mohamed Badr-Eldin |

|

RSS

RSS