|

Options have value - it is one of the core concepts of modern finance. This optionality can be manufactured as in a financial instrument such as a derivative option or it can be embedded in mundane day to day choices (companies can choose to default, individuals can pay their mortgage in advance, we can skip a day at work, etc). Thus options are everywhere, some might not be very wise choices and others might be totally unknown to us since they might expire without ever being exercised.

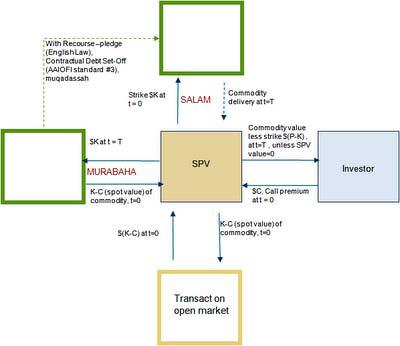

Specifically in finance, options have been monetized (i.e. a significant part of the industry is built on how to price them) and they are typically used to transfer risks from an issuer to a buyer/holder of that instrument. It is this risk transfer (as opposed to risk sharing) that precludes Islamic financial institutions from using these instruments. Much of the pricing/valuation of options centers around payoffs, so a financial transaction might not be a derivative in a puristic sense but its payoff might be identical. Arriving at a call option through debt set-off is a case in point. Also known as muqaddasah, a debt set-off will necessarily observe AAIOFI shariah standard number 3, which states that setoffs are possible as long as: 1) they involve the same counterparties (e.g., I owe you and you owe me) and 2) the notional is the same and 3) the maturity is the same. These can even be made contractual. There is also some leeway if notionals are different and maturities are different. Here we profile the basic set-off. In the diagram above we see the cashflows for a call-option. This structure has been used for Principal Protected Commodity Notes (just adding on a separate SPV with murabaha to synthesize the zero-coupon bond) by some large commercial Saudi banks and super-large continental European banks. The procedure is as follows:

Effectively, investor receives max(P-K,0) at time t=T, the payoff of a call option. Some see the combination of Salaam and Murabaha as a suspect means of preventing forward sales, since they clearly can synthesize a forward (although scholars rarely try to limit this). If we move beyond these possible objections, then combining Salaam, Murabaha and Debt Set-off, allows for a wide variety of payoffs. Certainly AAOIFI standards alone show that debt set-off is allowed and it can be contractual. Here, the salaam and the murabaha have the same maturity and same notional, so what is owed on one can be used to offset the other by contract with no further recourse or implications. The SPV and pledge allow it to take place from an English Legal perspective. Your feedback and comments are very important to us, please feel free to contact the author via email. |

Opalesque Islamic Finance Intelligence

Featured Structure: Call Option using Set-Off By Nikan Firoozye, PhD |

|

RSS

RSS