|

By Mark Melin

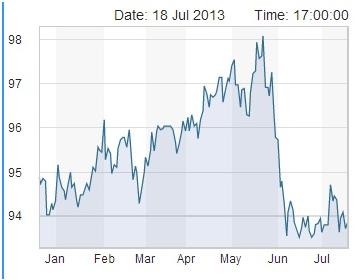

The iSTOXX Managed Futures index experienced a reasonably steady climb most of the year until late May and early June trend reversals in large financial markets hit trend following programs. Chart Copyright ‚© 2013 iSTOXX Source

June was another difficult month for managed futures, as the large cap Newedge CTA Index ended down -1.50% and was up only a slight 0.74% year to date, while the Altegris 40 slid 3.79% in June. As graphically evident in the chart below, the large cap iSTOXX Efficient Capital index, which includes the top 20 managed futures performers based on assets under management, showed a June decline on trend reversals in key financial markets. "Many trend following programs were short bonds and long dollar," noted Alexei Chekhlov, founding partner at the New York-based CTA Systematic Alpha Management. The firm utilizes counter-trend strategies in combination with market neutral methods, avoiding trend following, and year to date is up 5.46% in the A shares and up 12.58% in class B shares. "A slowing of economic growth in China combined with concerns of Fed tapering led to trend reversals in equities, commodities, and interest rates in June," said Sol Waksman, founder and president of BarclayHedge. Asset Inflows: Despite negative performance in a choppy market environment, asset inflows to managed futures reached at all time highs with reported inflows of $2.98 billion in May alone. Some notable CTAs receiving significant 1st quarter asset inflows exceeding 15% of their AUM include Crabel, JE Moody & Company, Campbell & Company, Fort (Global Diversified & Contrarian), Doherty (Relative Value Volatility), Eagle, 2100 Xenon (Managed Futures 2x), C-View Limited (Emerging), Kottke Associates (Commodity), Cardwell Investment Technology, T2 Associates, QBasis Fund Management. Markets strongly trending: While trend followers might have found trouble, some trending markets included the US and Canadian Ten Year Government Bond, US five Year note and soybean meal. Markets where relative value traders are eyeing price dislocation could include: US / Australian Dollar, Russell / Hang Seng, Oil and Soybean Meal / Oil. As another measure of trend strength, the Rho Trend Barometer is at 39% as of this writing, highlighting a murky environment for trend followers. End of the month equity market volatility spikes tested short vol options programs, but firms mentioned in this issue Global Sigma Plus and LJM Partners finished higher, capturing the volatility opportunity (and they are likely pleased that the market drop found a floor after a volatility selling opportunity presented itself.) Newedge Indicies Highlights Dispersion "After a solid start to the year, CTA performance broadly dipped in May and June. However, we continue to see a large dispersion of performance amongst the index constituents with some posting positive performance in June," said Ryan Duncan, global co-head of Newedge's Advisory Group for Alternative Solutions.

Some of the top performing hedge funds during June included: The Newedge CTA Index:

The Newedge Trend Index:

The Newedge STTI Index:

The Newedge CTA Index, which is equally weighted, calculates the daily rate of return for a pool of the largest 20 CTAs that are willing to provide daily returns and are open to new investment. Both indices are rebalanced and reconstituted annually. The Newedge Trend Index, which is equally weighted, calculates the daily rate of return for a pool of the largest 10 trend following-based CTAs that are willing to provide daily returns and are open to new investment. The Newedge Commodity Trading Index includes funds that utilize a variety of investment strategies to profit from price moves in commodity markets. Managers may typically use either (i) a trading orientated approach, typically involving the trading of physical commodity products and/or of commodity derivative instruments in either directional or relative value strategies; or (ii) Long short equity strategies focused on commodity related stocks. The Newedge Trend Indicator is a market based performance indicator designed to have a high correlation to the returns of trend following strategies. Newedge's Alternative Investment Solutions Group, part of Newedge's Prime Clearing Services, is an innovator in providing investors with benchmarking tools that accurately represent key hedge fund strategy styles. Newedge is the leading prime broker for the CTA market, servicing the largest share of the CTA fund market in the word. Currently, Newedge ranks No. 3 based on the CFTC's tracking of customer assets on deposit. *YTD Performances are as of 6/30/2013 |

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS