|

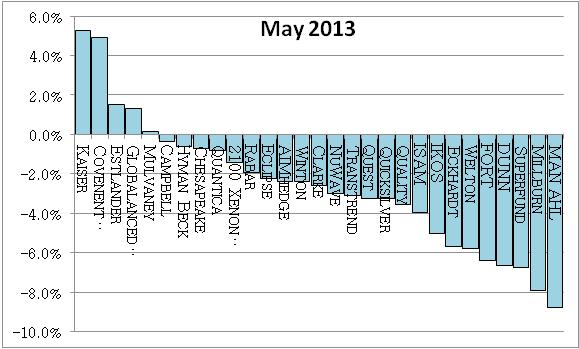

By Mark Melin May ended down broadly for managed futures, with the benchmark large cap Newedge CTA index ending down -1.72% with the broader and less discerning Barclay CTA Index -1.27%. What garnered media attention were the returns of some of the larger trend following CTAs, such as Graham Capital down -3.9%; Transtrend -3.1% and the financial heavy AHL down 10%. For the institutional allocator it is important to understand not just what happened, but why it happened. "Classic trend models are not build for a near zero yield environment," noted Andreas Clenow, author of Following the Trend and a principal at Zurich-based ACIES Asset Management. "The classic models will tell you to take larger and larger trades on the upside on every new peak. Those models are completely unaware of the asymmetric risk in that trade. A very limited upside and a massive downside."

Andreas Clenow, author of "Following The Trend," is also manager of the CTA Globalanced Systematic

Sources indicate that one of the larger trend following CTAs had recently changed risk management regimes where they no longer utilized intraday stop orders to scale out of positions, opting to exit all trades near the end of the trading day, which proved problematic when liquidating large positions in a volatile market. This CTA was adversely impacted by events in Japan and the sudden change in bond market trend dynamics. In their blog, managed futures brokerage Attain Capital noted that the sheer size of their positions makes exiting positions quickly difficult - particularly when the algorithms the largest CTAs all send a sell signal at the same time. Covenent Capital, with over $300 million under management, reported returns of +4.89% in May and is up 10.19% year to date in its original program. The CTA's programs, which have been audited by the National Futures Association, have a track record dating back to 1999 and a compounded annual return of 13.64% with annualized volatility of 17.04%. The aggressive program, with a track record dating back to 2004, has a compounded annual return of +21.72% and annualized volatility of 20.60%. Other well known trend following CTAs ended positive in May, including Estlander, which was up near +1.75%, while the majority ended lower. Major Trend Followers

Performance Estimate Source: CTA independent reporting, Globalanced Systematic estimates and www.managedfuturesdatabase.com. Past Performance is not indicative of future results Here is a key with Covenant and other "boutique" CTAs with near $500 million in AUM: Not only are they more nimble at entering and exiting markets, but they have a much wider choice in markets traded, benefiting from trends in commodity and niche financial markets that large CTAs can't practically enter. But perhaps the most important consideration is that when a trend changes direction investors should expect losses regardless of the trend following program. Trend followers all capture the beta market environment of price persistence and when that price persistence ends in a given market, temporary losses are almost certain to follow. The alpha is in how the programs risk manage trend changes: some may utilize volatility based position scaling methods while other programs may simply absorb the losses in a temporary trend change anticipating the longer term trends remain intact, among many factors. Institutional managers should recognize the risk management regime, trade hold period and markets traded of their investments to develop reasonably accurate performance and risk management metrics. Spread Arbitrage / Relative Value Market Notes: While trend traders had difficulty in May, certain relative value strategies showed signs of life. Emil van Essen, with $372 million in assets under management, was up 1.6% in May. In general agricultural spread traders noted opportunity in soybean complex spreads as cattle and hog markets, while certain corn / soybean spreads started to look interesting.

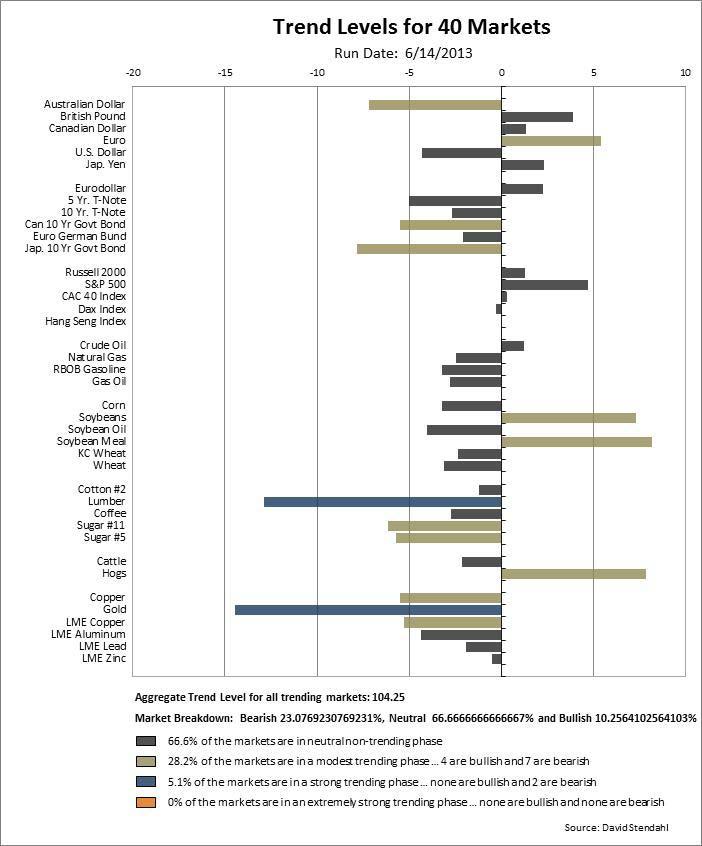

As mentioned in the article above, markets have been trending below optimal levels. |

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS