|

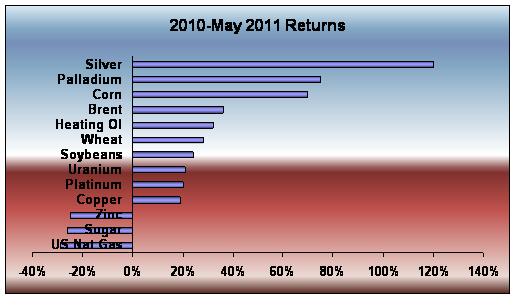

Volatility in Commodities: Reasons Vary When silver, by far the highest returning commodity of the past year, recently came down, the explanation that there had been a mini bubble in this metal widely accepted. A bubble had been suspected in gold, too. But in the past couple of months the price of gold appears to have gone up largely because of its role as safe haven as investors became more risk averse in the face of Middle Eastern political turmoil and the European debt crisis. There is so much sentiment involved in precious metals markets that prices can't be understood in terms of supply and demand, says Larry Kantor, managing director and head of research at Barclays Capital. But if the US dollar weakens again, as he expects, gold will continue to ride high. Other high-returning commodities are more amenable to supply-and-demand analysis to explain widely different returns (figure below). On the demand front, weaker growth in China has translated to weaker imports of certain commodities, while disappointing economic news in the United States put a downward pressure on the price of oil. But a third-quarter Global Outlook report from Barclays Capital does not see these developments as the end to the boom in many commodities. "Recent price volatility is commodities does not mark a fundamental turning point," says the report. "As long as China manages a soft landing, the demand outlook still appears robust."

Source: Selected commodities from A User Guide to Commodities from Deutsche Bank, May 2011. In certain key markets, notably oil, inventories and spare capacity are wearing very thin, so geopolitics and weather conditions pose the risk of upward price movements, according to the Global Outlook. Indeed, the US and other countries are releasing 60 million barrels of emergency oil reserves to make up for the collapse of Libyan exports. Barclays see prices increasingly determined by supply constraints and on the basis of this factor favors crude oil, copper and corn as well as gold for the next quarter. |

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS