|

Long Commodities vs. Managed Futures In the previous section, Ira Kawaller argues that long-only commodities do not on the whole add to a portfolio's return over the long term. This is an ongoing debate of increasing importance as long-only commodity index investments grow. As far as index data goes, long commodities make big returns at times and big losses at other times. The past few months demonstrated this. In September, the S&P Goldman Sachs Commodity Index gained 9.4%, but that was after losing almost 5% in August. By contrast, managed futures returns were solid for both months (Chart 1). One notices hat managed futures is less volatile and tends to vary within a narrower range. CHART 1 Long Commodities vs. Managed Futures in Recent Months ---------------------------------------------------------------------------------------------

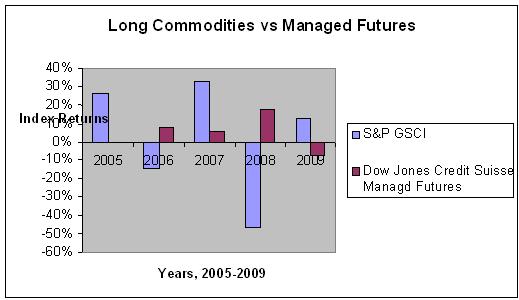

--------------------------------------------------------------------------------------------- Look back over the years and you see a similar pattern. A long-only commodity index like the S&P GSCI can make the outsized gains, like the 33% it returned in 2007. Managed futures indexes do not show that kind of profit even in very good years, although individual CTAs can have very high returns. On the other hand, the S&P GSCI went down by 47% in 2008, while managed futures proved its ability to act as a hedge in a market downturn (Chart 2). The key issue is preserving capital. Long-only commodities lose so much in bad years, an investor that stays with a commodity index-based fund has less capital to take advantage of the surges. Not so with a diversified portfolio of managed futures programs. Losses are muted - so more of a long-term investor's capital is preserved for making money when market conditions favor the strategy. CHART 2

|

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS