|

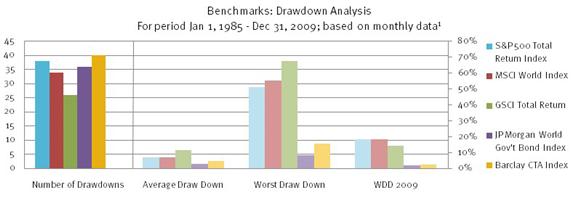

Managed Futures Myths, Debunked The following discussion is based on research from MF Global Alternative Investment Strategies. Adam Rochlin, senior vice president and head of MF Global Alternative Investment Strategies, provided commentary. The charts are from a report by his team. Chidem Kurdas edited the material. There are common misconceptions that get in the way of an open-minded assessment of investment options. We tackle three beliefs that cause investors to regard managed futures as an inferior asset class compared to stocks and bonds. Myth Number One: Downside Volatility Managed futures are volatile because prices change frequently. There is nothing wrong with volatility in general-it's just a measure of how far something goes up and down. But when people worry about this, they think of downside volatility and how deep the troughs are, not upside price change. Let's compare asset classes for the past 25 years. When you look at the number of negative periods, managed futures do have slightly more drawdowns. However, managed futures lost less than other investments. In particular, there is a dramatic difference in the magnitude of the worst drawdowns. Compared to US and international stocks, managed futures has much shallower troughs (chart 1). CHART 1

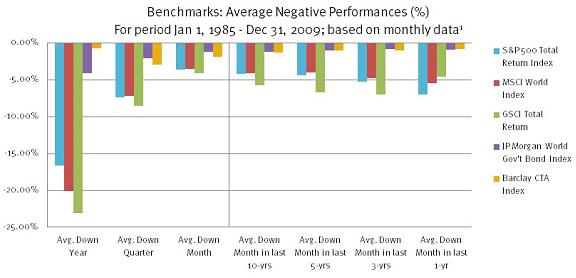

It is worth noting that the same pattern is seen for managed futures versus long-only commodity investments, represented by the Goldman Sachs Commodity Index (gold vs. green boxes in chart 1). Managed futures has more drawdowns but long-only commodities have substantially deeper troughs. The comparison favors managed futures for average drawdowns but is especially pronounced for the worst drawdowns. Similar conclusions arise when you look at the magnitude of negative performance for shorter periods within the full 25-year span. Compared to other asset classes, the troughs are less deep for managed futures for the last 10 years, five years and three years (chart 2). Only government bonds had comparable shallow losses. What it means is that managed futures is better at preserving capital, which allows commodity trading advisors to make more money over time. What is more, this differentiation in performance adds long term diversity to a portfolio. CHART 2

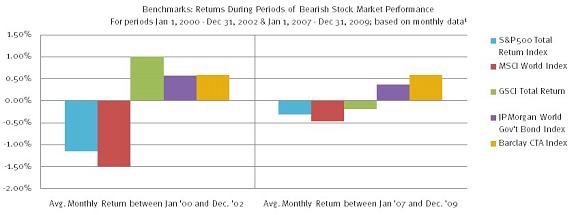

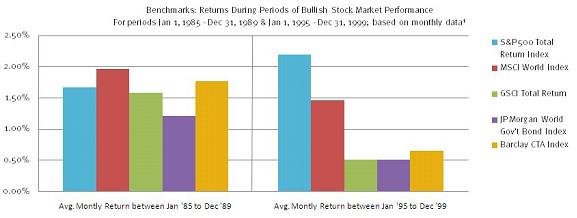

Myth Number Two: Only for Hard Times There is a perception that investing in commodities is very good insurance against extreme events like the debt crisis and global shakedown. During those times real assets tend to perform better than financial assets. If CTAs are insurance, investors reason, allocate to them when you need the insurance. But that is only half the story. Yes, managed futures does provide protection in equity bear markets. Chart 3 shows two bearish periods, 2000-2002 and 2007-2009, when having CTAs in a portfolio provided gains against the losses in US and international stocks and in the latter period in long-only commodities as well. And yes, in a striking bull market like 1995-1999, stocks leave managed futures behind. CHART 3

But managed futures still had positive returns in the bullish late 1980s and 1990s (chart 4). It is a misperception that managed futures perform well only when traditional asset classes underperform. You need to be in the strategy during bull markets as well as bear markets to get capital appreciation. CHART 4

It is not a good idea to invest only for bear market insurance because then you miss out on the market cycle. Trying to time entry and exit will hurt you more than help you, because very few can consistently time when to enter and exit a certain asset class. Warren Buffett may do it, but not many people can. To get the full benefit it is best to buy and hold, not time. Comparing managed futures and the MSCI World Index shows that these two asset classes are complementary. Nobody wants to miss the gains of international growth, but global stocks tend to go through sharp downturns˘â‚¬â€ťmanaged futures does well during those times, so there is a compelling case that putting them together is beneficial. Myth Number Three: Not for the Long Haul There is an impression that managed futures have not performed well over the long term and are exclusively a short-term strategy. But for the 25 years from January 1985 through December 2009, average returns from managed futures are comparable to the other benchmarks (chart 5). Over multiple durations of time, with the exception of 2009, managed futures˘â‚¬â„˘ average monthly returns have outperformed most other benchmarks. While managed futures does not perform better than stocks during up markets, this asset class has competitive monthly returns overall. The peaks are not as high for various periods, but the troughs are not as deep, so managed futures has the advantage of preserving capital over time. Note that even in 2009, a bad year for managed futures, performance was nowhere as bad as it was for equities in 2008. CHART 5

Regarding commodities, more than a few sophisticated investors look to this asset class for diversification and return, but increasingly they do not want long-only commodities. Long/short commodities is getting more attention. That should help CTAs attract assets. |

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS