|

by Bailey McCann, Private Equity Strategies The proportion of Limited Partners that make ‘direct’ investments (investments into private companies without the involvement of a private equity fund) has peaked, according to Coller Capital’s latest Global Private Equity Barometer. Between 2006 and 2012, the share of LPs making direct investments almost doubled, but it has not changed materially since then, remaining at about a third of LPs. Coinvesting, by contrast, has been increasingly popular, with the number of LP co-investors doubling over the last decade.

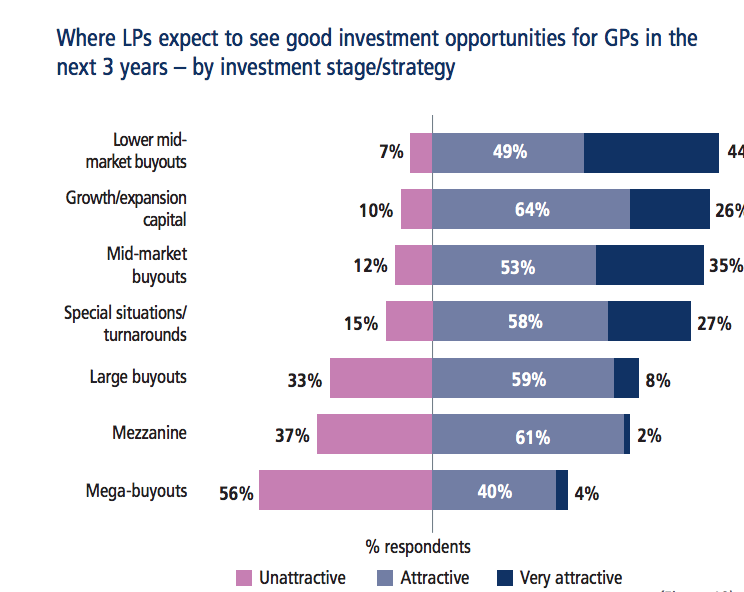

“This Barometer paints an interesting picture of an industry whose size is continuing to grow, but whose shape is starting to become fixed,” said Jeremy Coller, CIO of Coller Capital. “We’re seeing a parting of the ways in the investor community. Limited Partners who have adopted specialized approaches to private equity – investing directly into private companies, for example – will probably increase the proportion of capital they put to work in those areas. Investors who have not already chosen such routes will not necessarily do so in the future.” In addition to more specialized private equity strategies, investors are also looking closely at Europe. Many European investors see buyouts in France and German-speaking countries as being more attractive now than in the last few years (43% and 34% of European LPs respectively) – whereas the UK buyout market is seen as having become less attractive by 44% of European LPs. LPs from all regions of the world are also positive about the prospects for venture capital in Europe over the next five years. Fully three-quarters of European and Asia-Pacific LPs see the European VC sector as attractive or very attractive, as do over half of North American investors.

Read the full report here | |

|

This article was published in Opalesque's Private Equity Strategies our monthly research update on the global private equity landscape including all sectors and market caps.

|

Private Equity Strategies

Data Snapshot: Investors Eye European Private Equity |

|

RSS

RSS