|

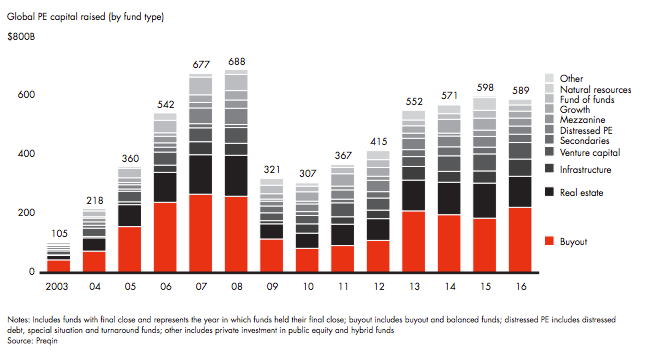

With investors on the hunt for yield, PE remains a favored asset for institutional investors. Fundraising surged as limited partners (LPs) continued to recycle distributions into new capital commitments. Returns also had another strong showing, continuing to outperform public markets by a sizable gap over both short-term and long-term time horizons. Global buyout activity, on the other hand, declined amid a challenging deal-making environment. A new report from Bain & Company shows that it is becoming harder for private equity to deploy its billions and still nd the kind of returns it is used to. In 2016, buyout-backed exits around the world dropped 23 percent in value and 19 percent in count from 2015 and fell even further from the record levels of 2014. But, asset sales of $328 billion in disclosed value from 984 deals actually constitutes an extremely strong run, helping the industry deliver its fourth-best year ever by value. With nearly all of the pre-crisis deals exited, buyout rms are adjusting to a new normal with longer holding periods of about 5 years – up from the historical average of about 3.5-4 years. Bain expects this trend to continue in the medium term, as a result of high purchase prices and limited sources of market beta, requiring general partners (GPs) to roll up their sleeves and do the time- consuming work of creating value with their assets.

“Deals are undoubtedly hard to come by. On average, studies show that PE rms see less than 20 percent of deals relevant to them in their pipeline,” said Hugh MacArthur, who leads Bain’s Global Private Equity Practice. According to MacArthur, when deals do materialize, they command high prices. And with an expected hold time of about 5 years, the margin of error for generating alpha and delivering acceptable returns to LPs has greatly narrowed. In response, GPs are codifying their battle-tested approaches – what they are good at, what has and has not created value, and where and how their funds have made money for investors – to build playbooks that consist of detailed, sequenced actions taken over time to maximize value from each investment. But could this be as good as it gets? Many GPs are apprehensive that the industry cannot sustain the torrid pace of fund-raising for much longer. Bain expects that distributions will continue to outpace contributions and LP commitment to the PE asset class will stay strong. However, the fund-raising environment may not be as favorable in coming years, making it important for GPs tfocus on what makes them stand out from the pack. | |

|

This article was published in Opalesque's Private Equity Strategies our monthly research update on the global private equity landscape including all sectors and market caps.

|

Private Equity Strategies

Data Snapshot: Private Equity Dry Powder Hits New Record |

|

RSS

RSS