|

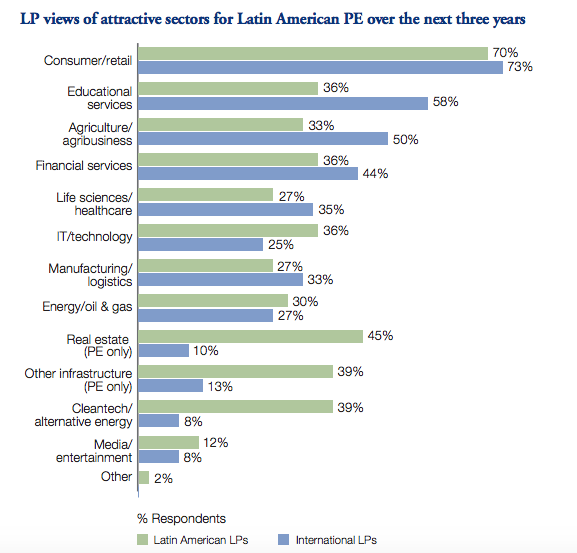

by Bailey McCann Private Equity Strategies Continuing with our LatAm spotlight - LPs in a recent Latin America Venture Capital Association (LAVCA) study said that they plan to increase their target allocations to private equity and venture capital in the region. Over two-thirds of Latin American LPs and about half of international LPs are planning to increase their target allocations to PE and overall alternative assets in the next 12 months. The LP study was completed by LAVCA and Cambridge Associates. 44 percent of Latin American LPs also anticipate increasing exposure to real estate and private debt. What’s the reason? According to investors, entry valuations and deal flow appear more attractive in Latin America than in other emerging markets. Investors also say that the macroeconomic picture across Latin America is more attractive than other emerging markets which have less diversified economies. But, not everything is rosy when it comes to the region. LPs are concerned about currency volatility and political risks - both of which have already been exhibited in countries like Argentina, Brazil, and Venezuela. To get around pockets of risk, pan-regional funds are still the most popular vehicles among LPs that want Latin America exposures. Nearly 80% of international LPs and over half of Latin American investors expect to access Latin American PE via pan-regional funds in the next three years, according to the study. Investors are also showing a preference for buyout and growth capital strategies. The graph below highlights sector exposures that investors are interested in -

| |

|

This article was published in Opalesque's Private Equity Strategies our monthly research update on the global private equity landscape including all sectors and market caps.

|

Private Equity Strategies

Data Snapshot: LPs Increase Allocations to PE In Latin America |

|

RSS

RSS