|

Billions of dollars are flowing into the US equity market, our data shows who the players are. By: Bailey McCann

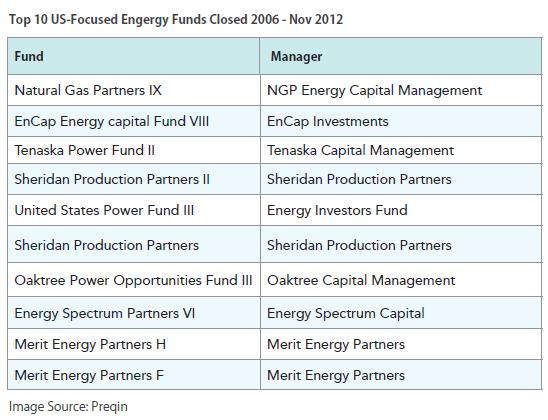

"Energy is like dropping a big rock in a pond - it has ripple effects out to a variety of other sectors," says Russ Steenberg, Global Head of BlackRock Private Equity Partners (PEP), by way of explaining his take on this bustling space inside private equity. He explains that the assets still to be found in the ground in the US are providing a wide range of opportunities for funds of all shapes and sizes. According to Steenberg, all structures are being explored in the sector beyond the popular master limited partnerships. According to data from Preqin, 53 energy focused funds have opened in the US since 2006, with raising $26.4bn in aggregate capital. 2007 was the best year for these funds, 13 such funds opened raising $5.5bn in aggregate capital. Some industry observers have been quick to write off the '06-07 vintage years, but Steenberg says that is likely premature."The vintage years of 2006-07 may turn out better than expected," he says noting that with a low risk for inflation and current cash flow levels, those funds may yet turn out to be winners. Other funds are still in the pipeline. As of November 13, 6 US focused energy funds were in market with an aggregate target size of $4.3bn. Some of the leading funds in the sector as of November 13 included fairly big names, Guggenheim Investment Management, TPH Partners, Oppenheimer Alternative Investment Management and SAIL Capital Partners are gracing the top tiers. Energy and Minerals Group currently leads them all with its second fund in the space.

| |

|

This article was published in Opalesque's Private Equity Strategies our monthly research update on the global private equity landscape including all sectors and market caps.

|

Private Equity Strategies

Data Snapshot: Energy Sector Sees Rise In Private Equity Interest |

|

RSS

RSS