|

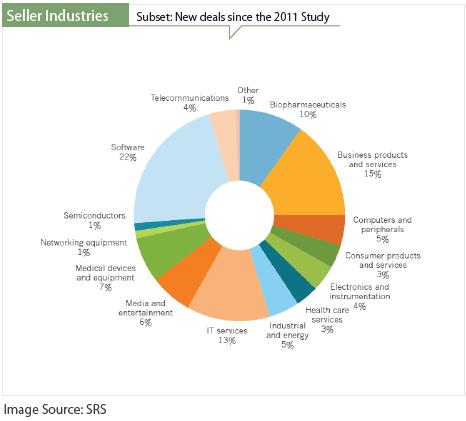

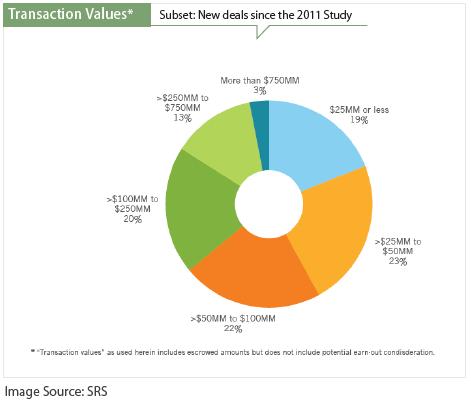

New data from SRS shows that sellers may find themselves with more leverage in the deal process and are using that to shop around. Bailey McCann, New York: Newly released data shows that sellers may find themselves with the opportunity to craft more sellside friendly M&A deals - a welcome shift from the volatile and challenging years of 2008-2010. According to the 2012 M&A Deal Terms Study released by Shareholder Representative Services (SRS), attractive sellers are finding themselves with a bit more leverage on various deal terms that affect postclosing consideration. The new study, which reports on over 200 data points and builds on data from prior SRS studies, covers 342 acquisitions on which SRS served as the shareholder representative, including mergers, asset purchases and stock purchases. In aggregate, these deals represent $55.3bn in stated deal value with $42.7bn paid at closing, $4.9bn held in escrow and $7.7bn in defined earn-out consideration. For the first time, the study analyzes equity investment data and termination fees, and includes more detailed data on carve-outs to indemnification caps and survival periods.  According to data in the report, Median deal size rose slightly to $75m in 2012 from $70min 2011. Smaller deals are on the rise too - deals of $50m or less grew to 42% of deals in 2012, up from 33% in 2011. More smaller deals and the overall lower volume of deals in 2012 compared to the prior two years indicates that buyers put cash to work on low-risk targets. Sellers with positive EBITDA at exit increased from 28% of the sample in 2011 to 38% in 2012 with companies taking a median of 7 years to exit. This may indicate that sellers are finding ways to reduce burn rates to achieve profitability prior to exit, giving buyers a more stable and mature pool of potential targets. "The financial performance of sellers has gotten better and better," notes Sean Arend, SRS in an interview with Opalesque. "This improvement is really empowering sellers to shop around for buyers and work on more favorable terms as they demonstrate better value." Increased maturity also seems to mitigate potential valuation gaps in uncertain economic times, and earn-outs continue to appear on the minority of deals outside of the life sciences sector. Sellers are also seeing an increase in available offsets against buyer indemnification claim amounts and an increase in deals that require that claims exceed a minimum threshold. Taken together, these factors are highlighting more positive conditions for sellers.

For buyers, the picture is slightly more challenging. While there are plenty of attractive opportunities, and low interest rates, macroeconomic uncertainty seems to be having a chilling effect on overall dealflow, and creating a backlog. "The downtick in M&A volume that we've seen points to a skittishness on the part of buyers as they look at political elections, slow growth, and changing regulatory environments," Arend explains. "That said, repeat buyers have plenty of cash on hand or borrowing capacity, and we are likely to see that volume pick back up going into 2013 as the markets get clearer, we now know the outcome of the election and we will soon know what's going to happen with the fiscal cliff. Once those issues are ironed out, I think we will see confidence pick up rather quickly." Other benchmarks are beginning to stabilize in the deal space - survival periods and escrow sizes are beginning to level off as are the use of earn-outs. The frequency and size of management carveouts is also down slightly, which had gotten more prevalent in the downturn. "Overall, the space is beginning to level off after a long period of instability, and sellers have slightly more leverage for now, but if there are more deals and more larger deals in 2013 in the wake of more macro-economic certainty, then it's hard to predict which way market leverage will sway," Arend says. | |

|

This article was published in Opalesque's Private Equity Strategies our monthly research update on the global private equity landscape including all sectors and market caps.

|

Private Equity Strategies

M&A Outlook: Sellers Begin Striking More Favorable Deals |

|

RSS

RSS