|

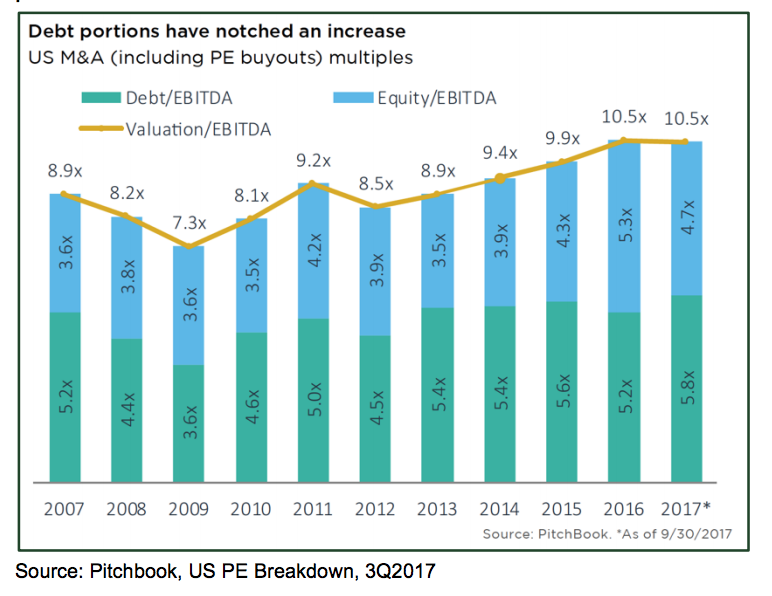

by Roger Beutler, CAIA Independent Private Equity Analyst The Cambridge Associates U.S. Private Equity Index posted preliminary results of 3.51% for the second quarter and 7.53% YTD, with the S&P 500 Index posting 3.09% and 9.34%, respectively for the same period. Globally, the CA Global Buyout and Growth ex. U.S. Index returned 7.75% in the second quarter and 12.05% YTD, compared to the MSCI World All Country Index at 5.78% and 14.10%. More meaningful long-term performance, especially when considering cash flows as measured by public market equivalent returns, remain favorable for private equity, rewarding long-term investors with a liquidity premium over public market returns. Nevertheless, the investing environment for private equity investors has become more challenging recently. While record setting public markets provide a favorable exit environment, higher valuations also potentially increase entry valuations for new investments. Total leverage for buyout deals has been creeping back up while equity participation decreased amid still cheap financing despite private equity funds swimming in an abundance of dry powder.

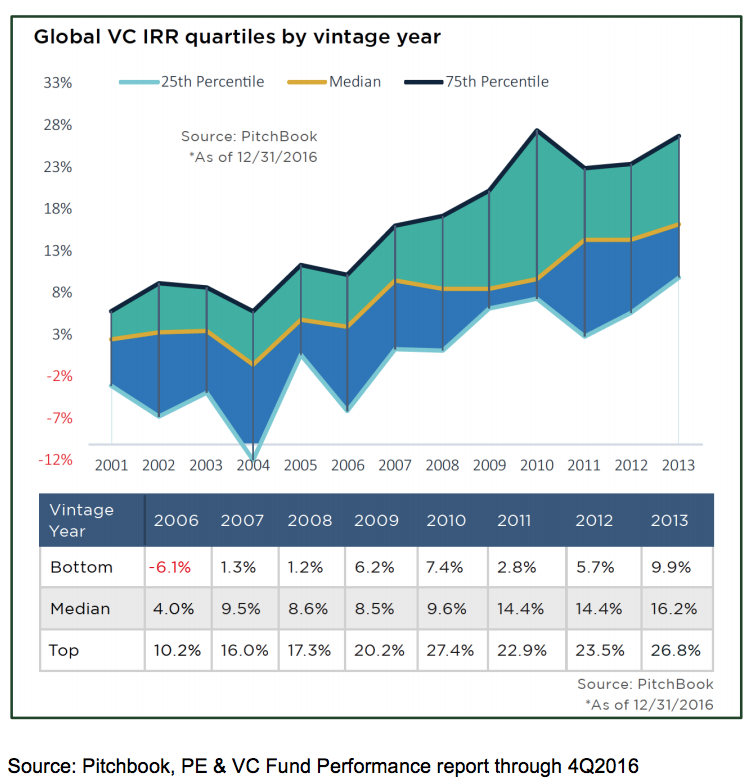

While sponsor to sponsor deals aka secondary buyouts have increased, M&A activity decreased significantly as corporations are wary of making high priced acquisitions late in the growth cycle. IPOs have been fairly stable but are only a small contributor to buyout exits. With close to 40% of buyout deals due to exit, private equity firms are starting to feel the pressure from investors to realize paper gains and refocus their resources on new deals, especially in light of the massive dry powder. Fundraising, despite plenty of dry powder, continues to be brisk. With Apollo closing its 9th fund at a record setting $24.7B, many investors continue to bet on marquee names and large funds as a safe haven and means to deploy money in order to reach asset allocation targets. U.S. Venture Capital, as measured by the Cambridge Associates U.S. VC Index, returned 0.96% in the second quarter and 4.75% YTD based on preliminary results. While the results of pooled public market equivalent returns over the long term remains mixed at best, investors should keep in mind that PE / VC was never an asset class where one adds value with average managers.

| |

|

This article was published in Opalesque's Private Equity Strategies our monthly research update on the global private equity landscape including all sectors and market caps.

|

Private Equity Strategies

Data Snapshot: Global Private Equity |

|

RSS

RSS