|

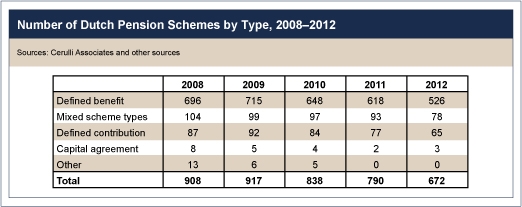

Opalesque Industry Update - The move to fewer, larger pension funds in key markets such as the Netherlands and United Kingdom could work to the advantage of asset management groups, according to the November issue of The Cerulli Edge-Global Edition. A trimming of pillar II pension funds-many defined benefit but also some defined contribution-is well underway in Europe. Switzerland's pension landscape, for example, shrunk from more than 2,700 vehicles six years ago to about 2,100 now. Cerulli understands that in three years there will be just 1,500. The Dutch pension watchdog is even more ambitious with a target of 100 funds. There were 672 pension schemes in the Netherlands in 2012. Elsewhere, more work is required. "The United Kingdom has more than 200,000 schemes, which is clearly impractical," commented Barbara Wall, a Cerulli director. "Auto-enrolment will give rise to fewer, larger pension funds known as 'Super Trusts.' With size comes economies of scale and skills, which should result in better retirement products and improved outcomes for members." Italy is also struggling with too many schemes. There are currently 361 so called "pre-existing" pension funds, each tied to a specific company. Asset managers and investors want the number reduced because some are so small they cannot invest in a meaningful way. "One likely effect of a fall in the number of pension funds in Europe is that larger asset managers could find working with the survivors easier," said David Walker, a senior analyst at Cerulli. "Mid-size and smaller rivals may be too small to absorb large allocations." Another potential winner, in the Netherlands at least, is premium pension institution (PPI) vehicles, because shuttering pension funds could join them. "This would be welcome news for a structure the Dutch pension industry hoped would take off, but has partially misfired. There are fewer than 10 PPIs," noted Walker.

Other Findings:

Press Release BM

|

Industry Updates

Europe's incredible shrinking pension funds landscape

Friday, November 01, 2013

|

|

RSS

RSS