|

ALCEDA

Disclaimer: The data are for information only with no commercial issues. They have been provided by the Fund Platforms and do not have any objective to solicit orders. Past performance are not reflecting future performances. MERRILL LYNCH

Disclaimer: The data are for information only with no commercial issues. They have been provided by the Fund Platforms and do not have any objective to solicit orders. Past performance are not reflecting future performances. Deutsche Bank

Disclaimer: The data are for information only with no commercial issues. They have been provided by the Fund Platforms and do not have any objective to solicit orders. Past performance are not reflecting future performances. LYXOR

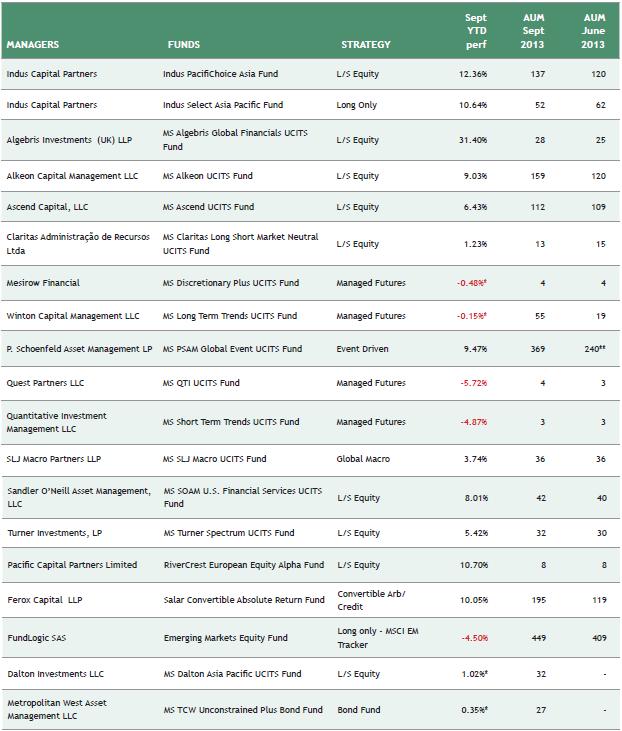

Disclaimer: The data are for information only with no commercial issues. They have been provided by the Fund Platforms and do not have any objective to solicit orders. Past performance are not reflecting future performances. MORGAN STANLEY – FundLogic

*YTD performance is equal to the LTD performance was launched in 2013. SCHRODERS GAIA

* Schroder GAIA Sirios Equity was launched in 27 February 2013. YTD performance data is shown for the Sirios L/S strategy (UCITS chain linked to offshore). GOLDMAN SACHS

|

|

This article was published in Opalesque UCITS intelligence.

|

RSS

RSS