|

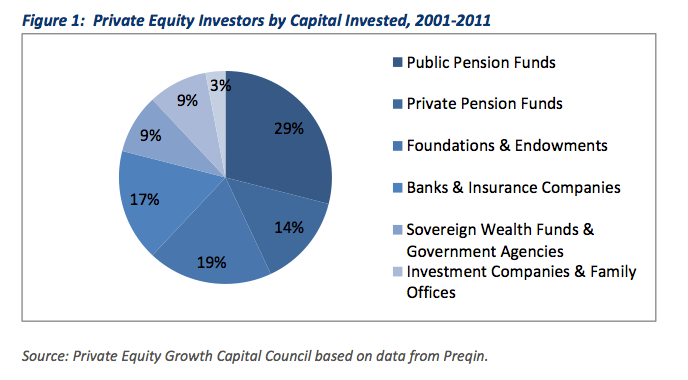

By: Bailey McCann, Private Equity Strategies In our last issue, we discussed the potential impact of institutional divestment around hot button issues like guns and climate change. In that piece, data showed that even if institutions like public pension funds are seeing returns from controversial investments, stigma around those investments and/or pending legislation, may in of itself prompt divestment even without a public outcry. Now, the Private Equity Growth Capital Council (PEGCC), has released a new whitepaper detailing just how intertwined public pensions are with private equity and what that will mean for the industry. The report highlights the significant amount of capital pension funds commit to private equity and the financial gains they receive from the outperformance of these investments. Despite losses from other investment strategies during the Great Recession, one bright spot for pensions is the superior performance of private equity funds, which helped buoy overall pension returns. The PEGCC research found that the median public pension portfolio received 8.8% in returns from private equity, compared to 3.7% in public equity and 5.7% in total portfolio returns, annually over the past ten years. Overall, 60% of the funding available in pension funds comes from returns on investment – setting up a high-pressure situation for the directors of those funds when investments fail to return. The long-term structure of private equity investments can provide a buffer from episodic market corrections, but lengthy recessions like 2008 can depress returns. Private equity too relies on investments from pension funds. Data in the paper shows that investments from public pensions account for 43% of all invested capital in private equity. According to the PEGCC, pensions are "essential to the private equity industry, just as private equity’s superior returns are vital to the financial health of pension funds." "Without private equity returns, public pension plans across the country would incur greater unfunded liability, possibly resulting in higher pension contributions by employees and a spike in taxes paid by local residents," Bailey concluded.

| |

|

This article was published in Opalesque's Private Equity Strategies our monthly research update on the global private equity landscape including all sectors and market caps.

|

Private Equity Strategies

Data Snapshot: Private Equity and Pension Funds Go Steady |

|

RSS

RSS