|

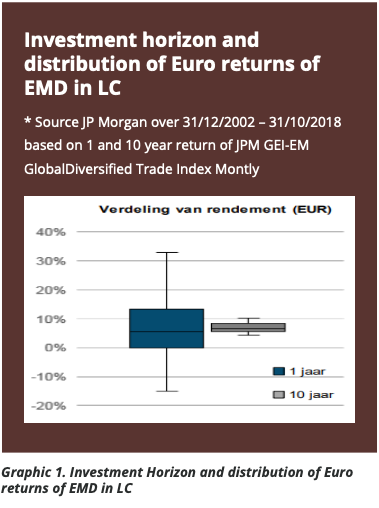

Thijs Jochems is a highly innovative thinker and well known for his out of the box insights with respect to investments and economics. Thijs has served as a member of several Advisory Investment Boards of Institutional Investors and family offices. Over the last decade alone, he has advised on well over Euro 150 bn in assets. Thijs previously worked in Investment Banking, amongst others as CEO of Credit Suisse Group Benelux,. Prior to this he held senior positions as Chief Investment Officer at Credit Lyonnais and Achmea Asset Management where he managed well over Euro 50 bn across all assets globally. Over the years held several positions in Advisory Boards and Supervisory Boards. He is also a private investor in activities such as economic modelling, renewable energy, sustainable agriculture, and gamification. In discussions with families, one often notices a fair amount of discontent about the service and offerings provided by the financial industry. What, one wonders, causes this discontent? Surely, it will not be the people, as many family office professionals are recruited from the financial industry. What then might be the cause of the subpar quality performance of the financial industry? The answer is not complicated: Old-school approaches are simply not at all suitable for handling new-era challenges. Welcome to the 21st Century, right in the middle of a multitude of structural changes that generated events that in scale, pace, and impact are unprecedented in the history of humankind. Climate change, energy transition, COVID-19, Brexit, AI, the fourth Industrial Revolution, to name a few. An era also, in which a new type of business model – the platform company - is really taking off. Like Facebook, Uber, Amazon and Alibaba, these businesses do not directly create and control inventory via a supply chain the way linear companies do. Instead, they provide the means of connection to serve both producers and consumers. The more consumers join the network, the more producers are motivated to provide supply, and vice versa. Here we see the rise of increasingly invasive companies that – almost by definition - operate on a winner-take-all scale because of the near- near-monopolistic nature of platform companies. When faced with phenomena for which there are no comparable events in the past, anybody’s guess as to the future is as good as anyone else’s if you still want to apply the old-school approach for risk assessment. You will find there is nothing much left to hold on to. Welcome to the land of uncertainty. Traditional construction of investment portfolios The traditional approach to constructing an investment portfolio in the financial industry starts with the design of economic scenarios. First, a central, most probable, scenario is designed and then some scenarios with a bias to the foreseeable risks that have the biggest impact are added. Next step, the approach looks for comparable eventsin history and the resulting distribution of return - outcomes for various financial assets. Finally, these historical distributions are ‘intelligently’ translated into future projections for returns on financial assets. This process represents the building stones for the old approach construction of investment portfolios for clients. All good practice one might say, provided thereare historical distributions to fall back on. There is also the issue of how that translation of economic developments into investments in financial assets should be done. Regulators across Western countries rigidly dictate how to rank the riskiness of financial assets, based on their volatility and correlation characteristics. But volatility proves to be quite a meaningless risk indicator for longer-term investors, as shown in graphic 1. Volatility changes considerably when the time horizon changes.

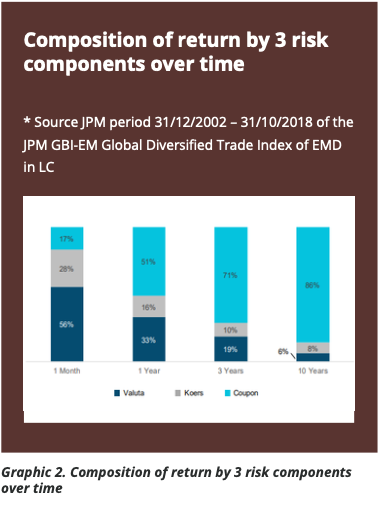

An example of an asset that is categorised as highly risky: emerging market bonds in local currency. A volatile asset indeed, but only if we look at it ona one-year basis. Look at it a few years down the line and we see how the return in Euros stabilizes over time. Already after five years the volatility of the returns in Euros is lower than that of European government bonds in Euros albeit with a much higher return in Euros. Yet, irrespective of the above, Regulators continue to assess volatility over a much shorter time period, thereby forcing the financial industry to adhere to this risk assessment framework. Disregarding unintended specific economic risks Another direction by Regulators concerns the assessment of risks in a portfolio and how these can be mitigated via diversification over financial assets. Until recently it was difficult to reduce risk with interest rates close to zero. Today, much higher interest rates facilitate more effective diversification over financial assets. But that still leaves other, quite often much bigger risks for an investment portfolio. One such risk factor that is seriously underestimated, is the concentration of economic risks.

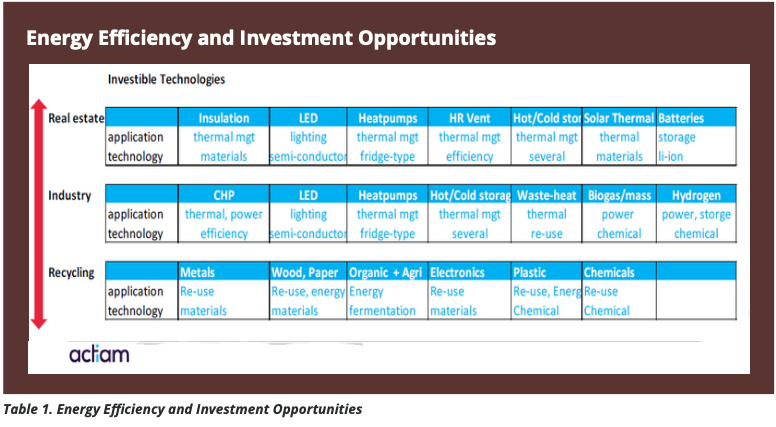

If a specific economic event causes a crisis, we witness that at first instance all financial assets will see prices go down. We assume that if the underlying economic value is more or less preserved, sooneror later this will be reflected in a recovery of the prices of the related financial assets. However,when an investment portfolio is unintentionally and predominantly exposed to one specific underlying economic risk the potential impact on the portfolio of that economic risk is disproportionally large. One reason for this phenomenon may be that the Regulators have not prescribed any rules to deal with the concentration of economic risks and hence it is not incorporated in the regulatory framework. Another reason may simply be the fact that it is hard to apply economic risk analysis to investment portfolios. It is a difficult task that is labour and know-how intensive, but it is possible. It is possible, and particularly so, if one is prepared to embrace a different approach for constructing investment portfolios. How to deal with the future without being able to use the past and without a crystal ball? The traditional approach of forecasting the future via macro-economic scenarios is comparable to running through a minefield blindfolded. The probability of ever reaching the finish in one piece is very low. Still, investors have to work with scenarios when they exchange liquidity for financial assets with unknown future returns. Why? Because they are investing in probabilities aiming to achieve future returns that will be higher than cash returns. But in scenarios without comparable historic events there are no past distributions of return statisticsto fall back on. Consequently, it is not possible to translate macro-economic forecasts, even if these would be meaningful, into financial asset returns. When investors can no longer speak in terms of risk, they are left with uncertainty. Without a crystal ball, how to arrive at a forecast with a sufficient level of credibility left to it? The financial industry could and should have takena step back years ago. Instead of continuing to tryan intelligent extrapolation of uncertain macro-economic developments to define the ‘long-term horizon’, they should have opened their eyes to ‘long-lasting trends’. Long-lasting trends as a different approach to scenario analysis Long-lasting trends - already in place today - with a high probability of long-term continuation providea b and rational foundation for scenario analysis. With it, investors have a tool in hand that enables them to make credible return projections for scenarios that have no comparable historical events. Another big advantage is that long-lasting trends can be translated into specific economic exposures. Five major trends have been identified that will continue to exist in the foreseeable future: AI, automation & the use of big data; the 4th industrial revolution; changing demographics; trade wars; and climate change of which energy transition is the most prominent. It goes beyond the scope of this article to describe in detail what the investment opportunities related to each of these trends are but below you will find two examples. Firstly, take Demographics. This trend can be grouped into two main sub-categories: population growth and aging. For each subcategory, we can identify the underlying economic exposures. Population growth in combination with increased wealth will increase the demand for calories, consumption in general and energy to name some consequences. An aging population will increase the demand for healthcare services. In all countries the costs of health care are unsustainable hence we will have to increase efficiency in health care. This entails among others further digitalization of healthcare in combination with growing demand for health tech, remote hospital care, and more. Secondly, let us go to energy transition, another long-lasting trend. Energy transition is nothing else than the electrification of our world based on renewables. Electrification will increase the demand for resources like steel, copper, lithium, and rare earth metals that are needed to develop batteries for laptops, wind turbines, electric vehicles, and more. Energy transition can also be divided into two main sub-categories: clean technology and energy efficiency. Look at energy efficiency. Table 1 shows just how many application technologies can be identified as investment opportunities within real estate, industry, and recycling.

The choice moving forward Families have many investment choices moving forward. However, instead of using traditional macro-economic scenarios to forecast the future, it may make much more sense to design scenarios based upon the long-lasting trends already active in today’s economy. Diversification over these long-lasting economic (sub-)trends can give investment portfolios much better protection against drawdowns than trying to find protection by diversifying over financial assets. Yes, in the end you will always have a portfolioof financial assets. The difference with this new approach is that you have not only consciously chosen your economic exposures but you have also diversified the underlying economic risks of your investment portfolio in a meaningful way. Of course, no one can aspire to know everything. That is why companies have a strategy and focus on their relative strengths. It is no different for the investment business of family offices. Their investment strategy should incorporate new-era insights which can improve the quality oftheir investment portfolios. Both with respect to drawdown probabilities and the robustness of risk/ return characteristics. This is a choice that families can implement relatively quickly from this day onwards.

| ||||

|

Horizons: Family Office & Investor Magazine

Long-lasting trends: A Shortcut to Effective Portfolio Management |

|

RSS

RSS