|

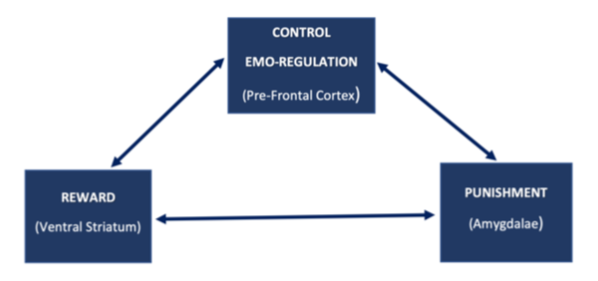

Dominik von Eynern comes from a business family now in the 5th generation and is a Partner of Blu Family Office. He holds a BA in Economics from the University of Augsburg and a Masters in Financial Engineering from the Goethe University in Frankfurt and has over 20 years of experience in principal investment and business development. Abstract Stonewalling is one of the four horse men in relationships indicating the beginning of the end. Stonewallers don’t share much about their world with others, a behaviour the agent is not necessarily aware of. This can have severe implications on successions, especially when all wisdom about wealth-creation and wealth-preservation is concentrated in one person. This constitutes Key- Man Risk! In this article, we highlight possible reasons for stonewalling with insights from neuroscience about our decision making and results from studies in behavioural economics. We look at key drivers of decision making in situations of change and think of possible implications and solutions in a succession- context. Decision Making – Main Features All behaviours are outcomes of conscious and unconscious decisions that arise out of an interaction of environmental influences and influences related to the motivations and goals of a person. Emotions are an integral part of the decision-making processes. They can be defined as complex affective states in which cognitions are intrinsically embedded and they can lead to decisions, we later regret. Decisions are context-dependent and based on our individual mental model of the world, which is constructed from representations of our past experiences. Building blocks of the mental model include attitudes, values and beliefs about self respectively others. It guides emotions and cognitions, which are at the core of decision-making processes. Our mental model of the world creates meanings of experiences derived from received signals, it governs the content of our conscious mind, determines the signals we send and biases decisions. Mostly, we aren’t aware of our decision- making processes as very little brain activity reaches consciousness. Cognitive scientists maintain, that 95% - 99% of our decisions are driven by the involuntary parts of our decision- making system and gazillions of unconscious processes underscore whatever is in our awareness. Thus, the conscious and ‘rational’ part of our decision-making process is reportedly only between 1% and 5%. This leads to biased decisions. Decision-making processes are predictive and anticipatory. Our brain seeks to identify and match detected patterns based on information extracted from our mental map of the world. However, the information about the present situation are incomplete and uncertain, plus the retrieved patterns tend to be incomplete, as they are derived from neurally and somatically reconstructed memories. To make sense of it all, we create ‘meaning’ and fill information-gaps according to the prevailing context by making inferences, applying heuristics as well as intuitions to complete patterns in an attempt to fit them to our personal mental model of the world. This affects outcomes of social processes, where two or more individuals cognitively and emotionally, create different meanings in response to the same signal. Combined with poor communication, this results in fear driven, premature conclusions, misunderstandings and destructive conflict. The Triadic Model of Decision-Making To simplify things, neuroscientists created the triadic model of decision-making. The model postulates, that decisions are motivated by rewards and by the fear of punishment, balanced by the CONTROL CENTRE. The CONTROL CENTER (Prefrontal Cortex) performs executive functions: it neutrally calculates, estimates, predicts, anticipates, reasons, makes inferences and is connected to many parts of the brain. It is responsible for performance optimization and emotional regulation.

The CONTROL CENTER is linked to emotive brain regions, namely the REWARD CENTRE (Ventral Striatum) and the FEAR CENTRE (Amygdala). The REWARD CENTRE is stimulated by the anticipation of reward, the FEAR CENTRE is stimulated by the anticipation of punishment, which elicits survival strategies like freeze, fight and flight. The FEAR CENTRE impairs the CONTROL CENTRE, because this brain region absorbs the energy required to enact survival strategies. An impaired CONTROL CENTRE increases our propensity to behave ‘irrationally’, which behavioural economists call ‘behavioural biases’. This insight is essential to understand decisions in social-change processes! The (Behavioural) Economy of Social Change Any change can be interpreted as trade-off between meanings: we lose one thing and gain another. We ask ourselves: What does ‘lose’ mean to me in terms of my current ‘being’? And, what does ‘win’ mean in terms of ‘becoming’? The CONTROL CENTRE predicts outcomes by conducting neural calculations of expectation values in terms of what we probably lose and win in the change process. The emotional system evaluates what it means to us and biases expectation values, driven by the FEAR and REWARD CENTRE. Nobel price-winner Prof. Daniel Kahneman researched how we respond when we stand to win or lose money and found, that we are risk averse and we exhibit loss-aversion. From a set a reference point R = 0, imagine you win $100 (R+$100). Now imagine you lose $100 from the same reference point R (R-$100). The study revealed, that R+$100 gives us 1 unit of reward, but R-$100 means 2 units of punishment to us! Both outcomes are symmetrical, but we create meaning of outcomes asymmetrically. We bias the outcomes with different emotional weightings: we hate to lose way more than we appreciate to win! Decisions about how to deal with proposed change are based on the same principal of risk- and loss aversion: is the expectation value of losing (the meaning of punishment) greater than the expectation value of winning (the meaning of reward) with higher ‘emotional bias-weightings’ attached to the expectation value of punishment, we tend to resist the proposed change! Decision-Making Biases in Situations of Change It has been researched how we deal with proposed change in a corporate ‘change-management’ context. Four biases have been identified and show, that we resist change systematically: 1. Negativity Bias: the brain’s main function is to keep us alive, so we assume the worst (anticipation of punishment), prepare for the worst and may seek protection from change-impacts. 2. Availability Effect: to make decisions, we prioritize the easiest available representation of information in our brains, often derived from emotionally salient events in the past. This makes us think fast, which is lifesaving in threatening situations, but it also prevents us from considering additional information that would enable us to make better decisions. 3. Attribution Bias: we need to find the meaning of cause, the source and reason for change. We are looking for accountability in the form of real or imaginary persons or, moral frameworks for our decisions. So, we need someone or something to blame. For (anticipated) negative outcomes, we tend to blame everyone and everything else, positive outcomes we tend to attribute to ‘self’. 4. Confirmation Bias: once we made a decision, we prefer to process information that confirm our decision as we want to find evidence that we are right! Thus, we tend to ignore information that challenge our decision. It gives us a sense of self, especially when we feel vindicated. But it limits our options and encourages self-fulfilling prophecies. If we take a negative stand towards the proposed change, benefits are hard to imagine. Hence, we resist change to avoid PUNISHMENT and seek REWARD for being ‘right’. Proposed change in a social context with individuals who lack psychological safety do not openly communicate! Thus, mutual trust cannot arise! Transparency and visibility of what’s going on is poor. This creates an ambiguous, socio-emotional environment, in which possible change-outcomes are highly uncertain. That makes it difficult to predict ‘reward’ with sufficient confidence and the anticipated meaning of change-outcomes is biased to ‘punishment’, which we fear! Fear responses initiate and increase the biases described above. We can also apply this insight analogous to a succession context. ‘Change’ in a Succession-Context Imagine, the next generation stands before the patriarch, suddenly asking critical questions, wanting to know more about the business and they may even aspire to take over one day. His decision-making system predicts ‘change’. Confronted with uncertainty, he feels threatened to lose his rewarding status-quo. That elicits a feeling of fear: the fear of ‘losing control, the fear of losing the comfort zone, the fear of losing social status, significance and purpose. An entrepreneur often identifies with the business, the status-quo and the associated social emotions described above. Thus, he fears to lose his identity! This is a severe attack at a very deep, neurological level and triggers an extremely strong fear response. The FEAR CENTER takes over, the proposed change is resisted and the patriarch seeks protection. Stonewalling The fear of change elicits defense strategies like stonewalling to protect the status quo by not sharing material information, as transparency may accelerate the change he fears. However, stonewalling creates the illusion of safety, which can be dangerous for the stonewaller as well as for the wealth-succession. The stonewaller invests a great deal of mental and emotional energy to keep the wall up in an attempt to avoid all problems and stresses related to change.

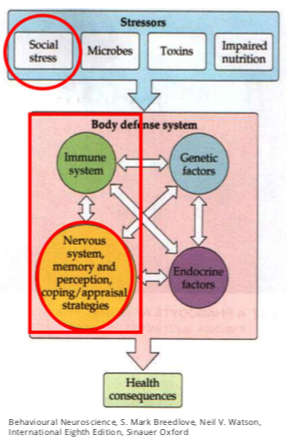

Consistency Bias The next generation could challenge the stonewalling-behaviour of the patriarch and he may become stubborn over this. Robert Cialdini found, that humans want to be consistent with their self-image, habits and identity. We fear to encounter sunk costs after all the efforts we invested into self-image and habits. The next generation may be frustrated and respond with stubborn behaviours, even if the patriarch changes his behaviour towards disclosure. This non-cooperative behaviour of both parties inhibits generative collaboration, consumes a lot of socio-emotional energy and creates stress for everyone. Implications of Fighting Change: Stress The patriarch is endowed to his legacy, which he values higher than any impartial 3rd party would do (endowment effect). Hence, he cannot simply dissociate to let go. He’s forced to stay associated and manage his resistance by keeping up that stonewall. Resisting change is an immensely draining strategy which ends in ego-depletion. This can create chronic stress. Normally, stress is a short-term response to internal or external stimuli which helps us to overcome obstacles and it temporarily disrupts our homeostasis (i.e. the way our body remains on an even keel). It originates in the FEAR CENTRE (Amygdala) as a response to signals we perceive as threat to our autonomy. Stress responses are driven by actual, historical respectively imagined social processes that leave us with unresolved conflicts or, when we are emotionally constipated and deny ourselves the completion of emotional cycles. Other socio-emotional stressor-examples are the fear of social rejection, fear of being judged by others, the fear of failure and the fear of losing. In general, stress increases biases (irrationality) in decision-making-processes, reduces our capacity for patience, narrows our mind, makes us more selfish, reduces empathy and our ability to trust our self as well as others. This down regulation of the social engagement system inhibits cooperative behaviour. We are often not aware of stresses as they linger on for a long time after the first stress-initiation. That can be perilous, as stress compounds and becomes chronic. Chronically high stress levels make us susceptible to minor stressors and over a period of time, this can lead to the collapse of the inner-self and permanent states of social anxiety, a hapless feeling of being out of control creating excessive fears, worry, panic, dread, terror and depression, a pathological sense of loss of control. Sustained stress levels inhibit the return to a homeostatic state, which creates even more stress. Toxic stress inhibits regenerative processes and it impairs the immune system, which increases the risk of illnesses. High body tension changes the posture sub-optimally, which can affect joints. Elevated heartrates and increased blood-pressure puts the cardio-vascular system under strain. Heart diseases, heart attacks, strokes, inflammations, cancer and auto-immune diseases become more likely to occur. Driven by an unresourceful mental state, the unresourceful physical state exacerbates the unresourceful mental state, and this negative feed-back loop morphs into a destructive downward spiral, likely to end in pre-mature death. Combine this with Key-Man Risk in conjunction with the lack of governance structures and any wealth-succession is at serious risk.

The End of Wealth is Neigh The patriarch is alone at the top and has no one to share the emotional burden with. Ego-depleted and chronically stressed, he has a higher likelihood of falling ill and dying quicker than expected. All happens very sudden, nothing is prepared, no one has a clue what to do or where things are. The succession is in limbo and creates a power vacuum that can be exploited by so called ‘trusted’ advisers. The created vacuum of power also gives rise to destructive family conflicts. Thus, the legacy of decades of hard work respectively previous generations can be destroyed in a couple of weeks – a stunning asymmetry in time with high financial and ‘socio-emotional’ costs for all stakeholders. The fear of change is a behavioural risk that often flies under the radar. At the core of the problem is the asymmetrical distribution of information, driven by the lack of psychological safety of all involved individuals. Hence, the patriarch and family members fail to communicate openly and trust one another plus, efficient governance structures that reduce ambiguity are not established. A perilous strategy to play. A True Story One of the business families we work with offers a typical case of what we mean with stonewalling. The grandfather started the family business. The firstborn male took over after the death of the founder and managed to scale up the business. In the meanwhile, the 3rd generation was growing up in a bubble, leading an exuberant lifestyle beyond their means. The patriarch was absorbed with creating financial wealth, ignoring the elephant in the room: the hidden risk of wealth succession. Attempts of the next generation to get information about the business or even to get involved was walled-off by the patriarch. He was successful, did not want to invite challenge and this is how he has always done it. Thus, he ignored succession-planning of any sort. In response to the behaviour of the patriarch, the members of the 3rd generation turned their back on the family-business and pursued other interests. During the financial crisis, the succession-risk materialized: the patriarch passed away, taking all his secrets and knowledge into his grave. He left behind a pampered next generation which was suddenly mandated with the daunting task to navigate the family business out of crises. The business was in deep trouble, the successors had no knowledge of the matters at hand, no formal training and no structure in place that could give orientation. It was an unplanned succession no one was prepared for. Advisors were quick to offer advice to the next generation: “Sell everything and live happily ever after” whereby they minded only their own interests. The advisers just added to the confusion of the next generation who deep inside, wanted to keep the business. They felt like a ‘talented pianists owning a piano but not able to play it’. This image triggered in them a strong sense of gratitude and belonging to family values, so they decided to keep the business and turn it around during the crises. Not an easy decision, because this implied changing advisors and remaining accountable for their own decisions. After all, it was the right thing to do, because the family managed to turnaround the business successfully and now, it is back on track again. The successors created a new business model, based the business on a solid ground and now, they have the intention to introduce the next generation to the family business early on. They also want to put in place a well-structured succession plan. But they face challenges, because the next generation has a very different set of values and totally different interests, which makes the communication between the current generation and the next generation difficult. This family successfully managed the business turn around with the support of appropriate advisors, who were willing to consider the purpose of the family above mere numbers of excel spreadsheets and their own business interests. The sale of the business during the crises could have been detrimental for family wealth not, only in economic terms but also in the sense of relationships among family members and individual life perspectives. More and more, we come across similar cases. They are symptomatic for the lack of ‘hidden succession- risk-awareness’ in business families. Key risk-driver is the lack of open communication and the stonewalling between family-members. Hidden succession risks are real and must be managed to preserve socio-emotional as well as financial wealth of families for generations to come. Ideally, all individuals (including the patriarch) are coached for psychological safety, which is the prerequisite for open communication, mutual trust and cooperation. This must be followed by the creation and ratification of a constitutional family & business- governance, which reduces ambiguity. It enhances transparency, increases mutual trust and that nurtures psychological safety in turn. This enables generative cooperation for successful, intergenerational wealth-transitions and mitigates hidden risks in wealth-successions. 1. Thinking, Fast and Slow, Daniel Kahneman, Penguin 2. The Neuroscience of Leadership Coaching: Why the Tools and Techniques of Leadership Coaching Work, Patricia Bossons, Patricia Riddell, et al., Bloomsbury Information Ltd 3. Influence: The Psychology of Persuasion, Robert Cialdini PhD, Harper Business 4. Behave, Robert Sapolsky | ||||

|

Horizons: Family Office & Investor Magazine

Dominik von Eynern: Stone-Walling Effects in Family Businesses |

|

RSS

RSS