|

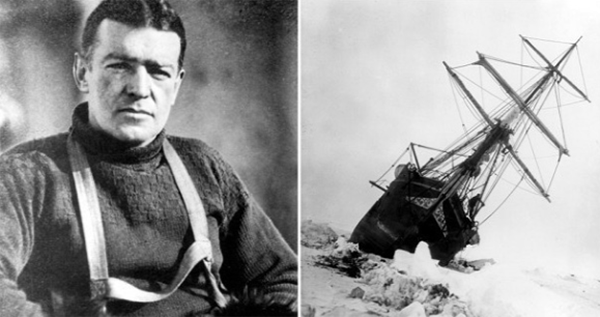

Lonnie Gienger is CEO of Wilkinson Corporation, a national real estate investment and operations platform that has transacted on over $2.2 billion of real estate creating strong impact results and investment returns, with a focus on turning apartments into centers for human flourishing. Lonnie’s passion is developing companies and families that create lasting positive impact on society. He’s been married for 36 years to his childhood sweetheart and their four adult children and spouses enjoy building various businesses together. The most commonly understood definition of legacy is the amount of money left to heirs, however, few leaders would be satisfied with that definition alone. In our most honest moments, the legacy we really care about is less about the size of our great grandkids’ portfolios and more about the soundness of the principles by which they live their lives. It’s more about the level of harmony and shared purpose we pass down to our future generations. What’s more, we know that if these things are in place, the money is more likely to stay in the family and grow. Some families create significant wealth but do not share much harmony, clarity of vision, or purpose. Others create all that in one generation only to lose it in the next. How do we create a legacy that will last through generations? I’m not the world’s greatest expert on this subject, however, I have diligently pursued this cause in my own family for many years. Although our family is far from perfect, we are regularly asked to share our journey on this subject at gatherings of family office leaders who are focused on creating enduring legacies. In this article I will introduce a process we’ve learned and implemented for discovering and passing on values that will promote and buttress success in a multigenerational way. I will demonstrate how to discern and develop treasured ideals to form a living, lasting legacy. Creating a legacy based on enduring values is a concept that has been foundational to many of the highest impact families throughout history. British noble families had coats of arms embellished with their family values. Sir Ernest Shackleton (1874-1922) is an example of this. The Shackleton family motto was “Endurance.” Ernest, the polar explorer, named his ship Endurance when he set out to lead a group of men across Antarctica. Shackleton’s endurance was tested, but not by the cross-continental trek. His ship got stuck in pack ice near Antarctica and slowly broke into pieces with oceanic shifts. For more than a year, Shackleton modeled endurance as he and his men camped on an island of ice. Then they endured seven days in the icy sea in small boats as they sought land. They persevered for an additional four months in an uninhabited, polar wilderness.  Ultimately, Shackleton set out in a lifeboat, steering through a hurricane and scaling snowy mountains by foot to find rescue. Shackleton delivered every last one of his twenty-eight men to safety after more than 400 days of exposure, isolation, and dwindling supplies. At one point, the men resorted to eating penguins to survive. Without the Shackleton family value of endurance, great tragedy might have resulted. As it is, Shackleton stands tall as a great example of leadership under fire—or ice. Family values are not just admired virtues. They are virtues that family members live out because it is who they are. As the next generation observes prior generations of the family doing this, it’s likely they will live out similar values. My own grandfather was an exemplar of integrity. There’s a story about this everyone in our family knows. He returned home after buying a brand new, bright green 1959 Ford Fairlane 500. He closed the transaction after banking hours on a Friday evening and gave the dealer the check, expecting to pick up the car on Monday after the check was cashed. The car dealer immediately handed over the keys. Grandpa said, “Aren’t you concerned about signing over the title before you cash my check?” The dealer pulled out two other, much smaller checks from his desk drawer and said, “These two I worry about, but your check I would never worry about because I know I can always trust you and your family!” If you ask my many cousins what the best part of this story is, they’ll tell you it is that when Grandpa came home with this beautiful new car, the first thing he told Grandma was what the dealer said about his check and the trustworthiness of their family. It was an example for all of us that spoke loud and clear: “In our family, integrity is important. My word is good. Everyone knows when I say I will do something, I do it.” The wealth of that value of integrity still lives in our family. Example is powerful! Yet, example alone can be a hit-or-miss proposition. What if no one had ever shared that story for the next generations to hear? I might have missed a life-changing lesson. That’s why we shouldn’t leave values to chance. It is always more powerful when the values are consciously arrived at, discussed as a family, and incorporated into family life so that they are referred to often as the basis for decisions and actions. In this way, values become more than words on a screen; they become part of the family tradition. The very definition of tradition is that it is “consciously transmitted beliefs and practices expressing identification with a shared past.”1” The idea of consciously developing and transmitting a family legacy of values became important to me during a life-changing moment. That epiphany was a game-changer for me. An Epiphany: A Family Legacy on Purpose Allow me to give you a little background to help you understand how this topic became so important to me. I have started and led a number of companies and provided strategy coaching to dozens of C-suite executives. For several years I’ve been CEO of Wilkinson Corporation, a vertically integrated real estate investment and management platform driven by clear values and a quadruple bottom line strategy. We’ve done over $2.2 billion in total real estate transactions and have had over 2,000 employees in eighteen states. I share this simply to let you know that I love developing teams that work together based on shared values and strategies to do great things. But for many years, I never thought about applying this same intentional approach to leading my family. It’s no wonder that early in my career, my businesses thrived more than my family. Eighteen years ago, I had a conversation that dramatically changed my paradigm about how to transfer values and purpose to the next generation. I was presenting at a leadership conference, and during the first break, an affluent gentleman walked up and said, “Lonnie, I need your advice. I’ve got a thousand employees. We go out and do businesses, but they’re driving me crazy because as soon as I leave for conferences like this, I just know they aren’t making the right decisions—they are not doing what they should be doing.” And I asked him the question that I always ask in similar conversations: “Well, for starters, do you at least have clear, written mission, vision, values, and strategies for your company so your people know how to act when you aren’t around?” He said, “Well, I don’t have them written down, but my team knows what we stand for and where we’re going.” I replied, “Greg, if you don’t have a clear written direction and strategy, your company probably won’t create a legacy of success.” Then, almost indignantly, he said, “Well, do you have clear, written mission, vision, values, and strategies for your family?” I bit right into it and said, “Well, Greg, I do for my business, but I don’t have them written down for my family. But it’s my family. They know what we stand for and where we’re going.” Then Greg said, “Lonnie, if you don’t have a clear, written direction and strategy for your family, your family won’t create a multigenerational legacy of success. What you’re telling me is that you care more about your business success than you care about your family legacy.” Ouch! That conversation changed the trajectory of my family! For the last eighteen years, Greg has mentored me on how to lead more strategically in my family and I have mentored him a bit on how to lead more strategically in his businesses. If the goal is to create a multigenerational legacy of success in our families, it makes sense to lead them as intentionally as we do our businesses. Developing a Family Compass  My father gave me a compass when I was a boy. I was fascinated by the fact that wherever I stood, the needle always pointed north. I could always figure out the direction I was facing as long as I had the compass. Similarly, the development of a family compass helps everyone to go in the same direction. It points the way. Having a clear family compass includes three elements: family values, the family’s mission or reason for existence, and a compelling vision of what the family looks like when it is accomplishing its mission. Your family compass will help you weather the storms of life and business; it will steer you into safe and lush harbors. Your family compass will keep showing you the direction in which to go. Then you can pass that family compass downto the next generation, and it will direct them to endure and prosper as well. It will help you create a lasting legacy of unsurpassed value. Let’s take a look at how to develop the first all-important compass component of family values. Family values are the uncompromising, non-negotiable principles that define and guide a family. They are what a family wants to stand for in this world. They are the basis for decision-making, setting priorities, allocating resources, planning, and execution. They also set the tone and standards for how people are treated. Shared family values foster high levels of loyalty, harmony, and empowerment. Business principles of productivity tell us that high levels of these qualities will propel any group toward success. Here is a strategy to discover your family values, broken down into five activities. These are brainstorming sessions: just write down whatever comes to mind. Activity 1.

Activity 2. Look through all your answers and identify principle- based words and phrases that are the most common themes. The list of sample values below might help you brainstorm your values. SAMPLE ONE-WORD VALUES: Accountability, Authenticity, Boldness, Community, Compassion, Confidence, Courage, Creativity, Dedication, Devotion, Education, Efficiency, Endurance, Enthusiasm, Excellence, Faith, Friendship, Generosity, Goodness, Grace, Gratefulness, Growth, Honesty, Honor, Hope, Humility, Humor, Ingenuity, Joy, Justice, Kindness, Leadership, Learning, Loyalty, Mercy, Openness, Passion, Patience, Peace, Perseverance, Respect, Sacrifice, Self-discipline, Serving, Steadfastness, Stewardship, Teamwork, Transparency, Trustworthiness, Wisdom, Zeal Activity 3. From the concepts you have brainstormed in this exercise and from your review of the sample values, make a list of all the values that are important to you. Activity 4. Prioritize the 10–20 values that represent the guiding principles that you consider most important for your current and future generations. Activity 5. Have your spouse and older children go through the same process as the above. Then, use the following process to synthesize what’s most important to all of you.

These brainstorming, idea-generating, and codifying activities should give you and your family a strong framework of the things you treasure most and want to pass down generation upon generation. The Tradition/Innovation Paradox: The Best of the Old and New What if our next generation’s values differ from our own? The process above should help to find agreement and incorporate differences. It is well to keep in mind, however, that every multigenerational family enterprise has faced this issue. It is so well known, it is called the Tradition/Innovation Paradox. Family enterprises have their traditions, which they want to preserve; at the same time, they must be open to innovation or they will not be able to compete. They must manage the paradox of tradition and innovation well to sustain success throughout time. How do successful family businesses do this? For one thing, they look at differences as opportunities. The tradition/innovation paradox is not only the greatest challenge of family businesses, it may be seen as their greatest opportunity, too. Such a perspective is very wise as one article notes, stating “Innovation requires breaking with continuity to develop new competence and skills.” In fact, “Family business prosperity across generations depends on innovation” [emphasis added]. The health and wealth of our families over generations will depend on innovation, as well. We can see any differences as presenting not only challenges but opportunities to do things in a new way. Managing the paradox between your tradition and your heirs’ divergences means embracing the best of the old and the new, yet seeing significant alignment between the two. This alignment is like a river of shared culture that flows through many generations. We are now on the second generation of implementing our family compass. We taught our kids to look for potential spouses who had values that already aligned with our Gienger family values and, fortunately, they have chosen wisely. Now our three married children are establishing their own family compasses in the second generation that align with and build on the first generation family compass. Their values reflect my wife’s and mine, yet they are crafting their statements of non-negotiable guiding principles in ways that are uniquely important and meaningful to their family. We are not in any way trying to force our future generations to be clones of us. We never told our kids that their families had to have the same exact values as ours or use the same words. Yet because our family values are so ingrained in our kids, they attracted and chose spouses with similar values, and their purpose and principles resonate deeply with ours, even as they forge new pathways. Even though the words aren’t exactly the same, if you look closely, you’ll see significant alignment between the values my wife and I established and the values our married kids are establishing for their families. For example, one of our first-generation family values is “Continual Life-Long Learning and Adventure.” Similarly, one of the family values of our daughter and her husband is “Growth: Continual Life- Long Learning and Mastery.” What if every next generation of your family develops and lives out values that are in alignment with and build on the best of the prior generation’s values tradition? Imagine the potential of your legacy if each iteration of your family built on the strengths of the prior generation while still being fully empowered to be architects of their own destinies. Your family could have a profound impact on this world! Every leader wants to bequeath intact all that he or she built and sacrificed for over many years. That’s the heart of a parent and founder. At the same time, the next generation needs to forge a future that, by definition, will be different from—and hopefully better than—the past. Defining and synthesizing the values of each generation assures that a legacy will not only thrive in one generation, but that it will be vibrant for generations to come. 1 Dacin, M.T., Dacin, P.A., & Kent, D. (2019). Tradition in organizations: A custodianship framework. Academy of Management Annals, 13(1), 342-373, p. 356, as quoted in Erdogan I., Rondi E., De Massis A. (2019). Managing the tradition and innovation paradox in family firms: A family imprinting perspective. Entrepreneurship Theory & Practice, In press. 2 Schuman, A., Stutz, S., and Ward J.L. (2010). Family Business as Paradox. Palgrave MacMillan, 2010, New York: a division of St. Martin’s Press. 3 Erdogan I., Rondi E., De Massis A. (2019). Managing the tradition and innovation paradox in family firms: A family imprinting perspective. Entrepreneurship Theory & Practice, In press, p. 3. 4 Jaskiewicz, Combs, and Rau (2015) Jaskiewicz, P., Combs, J.G., & Rau, S.B. (2015). Entrepreneurial legacy: Toward a theory of how some family firms nurture transgenerational entrepreneurship. Journal of Business Venturing, 30(1), 29–49, as paraphrased in Erdogan I., Rondi E., De Massis A. (2019). Managing the tradition and innovation paradox in family firms: A family imprinting perspective. Entrepreneurship Theory & Practice, In press, p. 3.  | ||||

|

Horizons: Family Office & Investor Magazine

Creating a Multigenerational Legacy of Harmony and Purpose |

|

RSS

RSS