|

Matthias Knab: Max, when I look into our online news archive on Opalesque, the first time we wrote about your firm was 15 years ago, in February 2005, so we go back a long time. Itís 2020 now and weíre all living in a different world and having been in touch with you throughout these years I see you have created a number of highly interesting companies and investment opportunities. But letís look back for a moment to fully understand where youíre coming from and the level of your and your teamís expertise. Tell me, how did you and your father start out? Max Gottschalk: Gottex Brokers was founded in 1986 by my father Joachim Gottschalk as an inter-dealer broking company. In 1991 my father setup Gottex Fund Management to manage a fixed income hedge fund to taking advantage of the Euro convergence trade for a number of institutional investors and sovereign wealth funds. It was one of the first fixed income arbitrage hedge fund and was set up very specifically to take advantage of the convergence of European currencies to the Euro. As European yield curves converged together for the introduction of the Euro currency in 1998, it created a number of arbitrage opportunities in fixed income instruments. These trades were very lucrative in the nineties, but such arbitrage disappeared in 1998 with the virtual introduction of the Euro in 1999 which was then followed by the issue of the Euro notes and coins in 2002. As the opportunity played out he returned the capital to investors but was left with an infrastructure. At that time, the hedge fund industry was emerging and he approached me, and my business partner, John Paul Bailey, to help him and the remaining team to create a fund of hedge fund product. Eurozone as of 2020:

After thorough research we launched the Gottex Market Mutual Fund in June of 1999 with about 3 million of seed capital, mainly coming from my father and Pierre Mirabaud, and we grew the fund to 16 billion by 2007. End of 2007, we took the company public. We were in good company, as at the same time Blackstone and Och Ziff went public, an interesting time to be floating. It was a big success; we were the largest IPO in Switzerland in 2007 and in fact the only fund of hedge funds to ever go public. 2008 came along and the financial crisis hit all asset classes, including hedge funds. The liquidity crisis affected a number of strategies, and while our funds faired extremely well relative to our competitors, the financial crisis changed the industry overnight. Investors changed their approach to investing in hedge funds. Hedge funds of funds started to lose out to consultants and private banks who set up their own hedge fund advisory arm. As a public company, Gottex was active in using our public stock to acquire other funds of funds, so we did several mergers and acquisitions. And in 2015, both my father and I exited the fund of funds business, after a merger with EIM. Subsequently we set up Vedra Partners Ltd., our own family office. Today, Vedra Partners Ltd. is a multifamily office based between London and Switzerland that looks after nine families. Matthias Knab: I understand that Vedra Partners isnít the typical multifamily office but more an investment partnership, could you tell us more about your concept? Max Gottschalk: Correct, Vedra Partners is a multifamily office where all families are shareholders proportional to their assets, so itís a very fair proposition. This is about sharing infrastructure and leveraging the infrastructure we have built for the benefits of all our families. We donít manage public fund products, however, each of the families can use the infrastructure benefit from the pooled assets and fees that were negotiated with third parties to manage their assets in the most efficient way possible. We donít look to make money from our families and so the fees that the families pay to the family office covers expenses, and any profits then gets distributed back to the families, proportionally based on their contributions. We want to run this business as efficiently and as profitable as possible; there is a pure alignment of interests between everyone. We are very cost conscious and fee sensitive. We are set up as an institutional platform therefore get institutional pricing. We get covered by the banks as an institutional investor, so we get great execution, great research, great access to good ideas and so we are almost set up as a hedge fund. We advise the various families as to the allocation of their portfolios and managed accounts, applying a multi asset approach aiming for a 60/40 equity bond allocation by using mainly ETFs for the equity allocation and direct corporate and emerging market bond investments for the fixed income part.. We are long-term investors and typically end up with generating performance that is better than what a traditional private bank or even family office would offer. Matthias Knab: Why do you think Vedra Partners can offer better performance than private banks or even family offices? Max Gottschalk: What we have come to realize over the decades in working in asset management industry is that itís very easy to pay fees out to managers, which ultimately reduces the overall return of a portfolio, hence our strong focus to reduce the overall cost associated with running the money. When clients, investors work with asset managers and wealth managers, they would normally allocate capital to different asset classes through a selection of third party fund managers. When you analyze portfolios by private banks or of the wealth managers, you end up with a diversified portfolio of managers, or, for lack of a better word, fund of funds. When you then look at the underlying positions, you end up over-diversified with thousands of underlying holdings across assets Ė equities, fixed income, hedge funds and other asset classes Ė and ultimately you end up dumbing down the return to the benchmark but minus all the layered fees, so fund manager fees, the fees paid to the wealth managers of the private bank, and the transaction costs associated with regular rebalancing of the portfolio. Over-Diversification  ... is costly and ineffective. I would say itís typical that an investor would pay 2-3% a year as the total expense ratio in these types of programs. Consequently, we typically begin any year with a head start of about 200-300 basis points over traditional offerings. If you can save a family just 1% a year in fees or in performance, you can suddenly see the benefit, particularly when that accumulates through compounding over 5, 10, 20- year periods. Matthias Knab: Max, I have followed some of your investments when you were living in Hong Kong, so I know you are very experienced and active in venture and private markets as well. Can you tell us more about your work here and your most recent projects? Max Gottschalk: Throughout my career, I have always been investing in, starting or managing private companies, in startups and venture companies, and so I have always been very active in the private space. I always liked meeting entrepreneurs and backing growth companies and new technologies. In the last few years, I have also made several private investments within Vedra in different industries, which has been extremely rewarding. A while ago, I decided to dedicate a considerable amount of time and effort working in philanthropy, and as I always had a passion for oceans and for the environment, I joined an ocean charity in the UK. Obviously, we are in a point in time where climate change is becoming a real issue and the environment is high on the agenda of peopleís mind. Working for an or an environmental charity is challenging as you become acutely aware of the issues and it gets clear that one needs to do something about it. We canít just continue to destroy and abuse our planet for economic benefit but need to be a lot more responsible in the way we look after it. I also realized that philanthropy has serious limitations. For each dollar that gets given to charities, 5% goes towards the environment and only 0.5% goes towards the oceans. Very little amount of money ends up where it should be. Of course, there are plenty of other agendas and good causes to give money to, but the broader realization is that in order to fix the environmental issues humanity is facing, we need large amount of capital to be invested in new technologies and new companies. As I got more familiar with these issues and the limitation of philanthropy, I came across Chris Gorell Barnes and George Duffield, two of the co-founders of the UKís Blue Marine Foundation. They have been active for ten years in ocean conservation and are one of the more successful charitable foundations in Europe and the Middle East, having raised millions and played a pivotal role in the protection of nearly 4 million sq kms of ocean. They have also developed and introduced sustainable fishing practices that are being used all around the world, and so they are a very successful and influential charity. These co-founders approached me because they felt there was an opportunity to create an investment vehicle out of some of the opportunities they were seeing coming through their scientific and academic network and ecosystem. Thatís when I started the journey to research more closely the investment opportunity in that sector. At the same time, I also started to look at impact investing and the investor appetite for it, and that made me even more convinced of the investment case. I think there are great opportunities coming out of the ocean economy and the blue economy, but then I also feel that there is a very large appetite for fund investors to allocate capital in this space. When I researched what is currently available in terms of supply of products, I was also surprised by how few authentic products are currently available. Despite the clear momentum towards ESG and sustainable investing, I found that so many of the products out there are not true to the cause. There is a lot of greenwashing and blue washing taking place, where people claim to be ethical or sustainable or impact investment funds, but, are not. The more I looked into it, I felt that there was an opportunity to create a fund or a structure that was very true and authentic in the way it approached impact, and so with my team, we started from a blank sheet of paper and built a process around impact that is transparent and also would enable institutional investors to invest in.

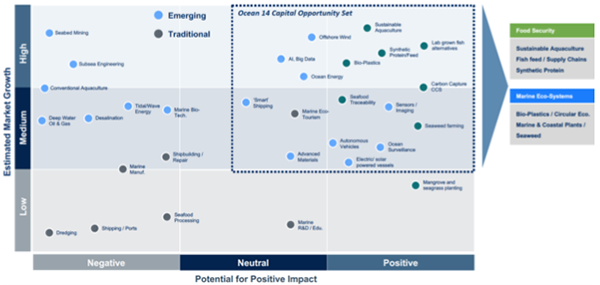

In 2019 we spent a lot of time setting up Ocean 14 Capital, a fund vehicle that invests in private companies, emerging technologies and companies coming out of the ocean economy. We are looking to raise $200 million for our first fund and are very excited by the opportunities we are seeing. Matthias Knab: Can you tell us more about the deal pipeline land the type of investments you are targeting? Max Gottschalk: We have so far identified close to 300 companies and potential investments for the fund. This is already very encouraging and given that itís still early days for the whole sector there will be a lot more. We have also come across incubators or seed fund managers that are focused on the oceans, probably about 10 or so funds have been set up in the last couple of years. These are an excellent source of investment ideas as they continue to develop, incubate and seed companies that we can take on in our portfolio and prepare them for exit. We have also seen some of the larger groups like Partners Group, KKR, TPG, Bain, and others all launching impact investment funds which are $1-2 billion in size. With our $200 million fund, we strategically sit very well between the smaller funds and the larger funds by taking companies with an enterprise value of 30 to 50 million, investing $10 to $15 million in these companies and prepare them for exit in three to five yearsí time. I mentioned that from a timing perspective, we feel itís early days for ocean investments, and are extremely encouraged by the quality of the investment opportunities that we come across. The business case is very strong, and we feel very confident to generate a target return of 15% plus net to our investors in our first fund. Looking at the exit side, we also feel we are early enough to see a lot more capital coming in this direction in the next five years or so. This means that we are still able to invest in these companies at attractive valuation today and benefit from the flow of capital as more money comes in towards impact in oceans.

Matthias Knab: Can you also share with us more details on the team you have assembled for Ocean 14 Capital and how exactly it interfaces with or is supported by your multifamily office Vedra Partners? Max Gottschalk: We are very fortunate having been able to partner with two of the co-founders of Blue Marine Foundation and implementing this very unique partnership between truly impactful individuals and Vedra Partners as the investment group. This allows us to combine a deeply rooted, impact-focused group of individuals and network of scientists with the investment acumen coming from Vedra and the people in that team. The founders of Ocean 14 are the two founders of Blue Marine Foundation, Chris Gorell Barnes and George Duffield and me. We have built a strong team around us to support our activities. Mary Minnick has joined us as a Partner, she comes from Lion Capital where she has had 12 years of experience in private equity as a partner. Before that, she spent 23 years with The Coca-Cola Company where she ran sustainability development; she was also COO of Coca-Cola Asia and Chief Marketing Officer for Coke globally. So, you can see sheís someone with great C-level corporate and private equity experience; she is chairing our investment team. Sriram Natarajan joined us from Deutsche Bank to be our COO, and then we have one analyst on the impact and one on the venture capital side as well as a data quant helping us to capture and work with the data from our underlying investment. That part is very important as well because we are also committed to measure and document our impact objectively, something I am sure we will talk about later as well.

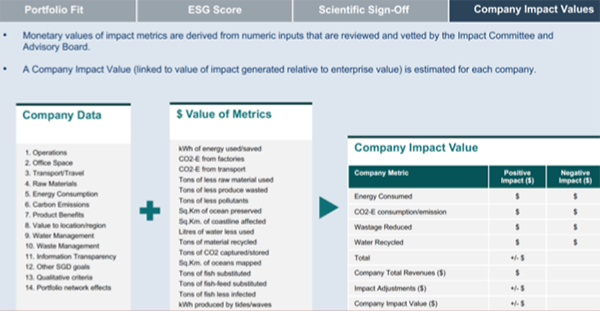

This Ocean 14 Capital team is then supported by 12 people and the entire institutional infrastructure of Vedra Partners. Through connection to Blue Marine Foundation, we have put together a Board of Advisors to help us source and validate investments and create value for our investment portfolio. Itís quite a large and influential body, so as of today we have 25 advisors signed up with a contractual agreement to Ocean 14 Capital where they provide us consultancy service, finding deals and then also introduce us to investors that want to actively engage with the fund. These advisors are some of the worldís best scientists from marine science, marine biology, we have experts on aquaculture, on coral reef management, on biodiversity, so we have probably put together one of the most comprehensive Board of Advisors in the world to help us source deals and making sure that our investments are good investments and help us create value. We have been very careful in crafting this Board and provided our advisors with a carry in the fund, so they are totally aligned with the success of the organization and in providing us with value. Apart from these relationships with scientists, we have also connections with governments, other businesspeople and teams from the impact sphere Ė people who have been instrumental in the last 5-10 years developing impact measurement tools and impact reporting methodologies. For Ocean 14, impact must be at the heart of what we do. While we are an investment company and need to deliver strong performance to attract capital and so are driven by financial return, we have an equal focus on achieving a positive, measurable impact that we can then report back to investors. The way we do this and provide transparency for investors is by breaking down the return of an investment in two components. One is the financial return that will give investors a Net Asset Value at the end of the investment and giving them an internal rate of return. But then with our impact team, we are also looking at measuring impact by providing a dollar value to the impact. The aim here is to provide a direct relationship between financial investment and impact return in dollar terms, giving investors a Net Impact Value (NIV) and impact internal rate of return together with impact value and impact ratios. So what we are looking to do is providing a simple and transparent methodology so that investors at the end of each year nominally have a return on their investments together with the impact return thatís measured, audited and reported back to them. We decided from the start to have a very solid approach towards impact investment measurements. That is important because as investors are going to require the transparency as to the impact of each investment. They want to know the impact of their investment in order to report it back to their respective stakeholders. We are working with auditors and impact experts to develop and introduce a methodology to do that and plan to publish a white paper on impact measurement or impact management tool paper sometime in Q1 or Q2 this year. We are quite excited about this part of our work. We think of impact measurement as a really important step one has to take, and we are committed to lead the way in developing such tools.

Matthias Knab: And how are you expressing or implementing the impact measurement in your investment processes? Max Gottschalk: We have set up separate investment and impact due diligence processes. Our impact process runs in parallel to the investment process and the impact committee has veto rights on any investments we do. Unless the impact committee feels that the investment has impact merit and meet our impact KPIs, the committee has the right to stop the investment committee making an investment into a company irrespective of the quality of the transaction. We are setting impact objectives and KPIs that each investment must meet in order to be eligible. The impact team will be responsible for defining those KPIs and then also making sure that they are comfortable that the company can meet them. They will then also be working with the companies in measuring, auditing and reporting the impact. Matthias Knab: Can you also give us some examples of companies and opportunities that you see in the maritime space that excite you? Max Gottschalk: Letís start by looking at the ocean or the blue economy which is a fairly large economy in itself. It is a three trillion dollars a year economy. It feeds about one-third of the planet, so 3 billion people rely off the ocean for protein daily. Oceans are not only a very important food source of protein for humans but it also employs more than 200 million people. There is a tremendously buzzing economic activity that goes around the oceans and with about 16-17 underlying industries very diverse, spanning from transport, tourism, renewable power, mining, fishing and so forth. We are focusing on those sectors that are both fast growing but also have a positive impact. A number of industries, like deep sea mining, can offer high growth but clearly is bad for the environment, so we will avoid such areas. We are using the sustainable development goals (SDG) set by the United Nations Ė SDG 14 is ďLife under WaterĒ Ė hence our name Ocean 14 Capital. We have broken down SDG 14 into two areas. First, food security, like sustainable fishing where we will focus around the aquaculture and the fishing industry which today is a $250 billion market and growing at about 7% per annum. Half of the fish we eat today is produced by aquaculture and aquafarming, and that industry is growing around 10% per annum for the next foreseeable future. Most of the growth and demand will be met by aquaculture and so that sector offers some interesting opportunities and even some disruption opportunities through technology that are interesting. We also research new technologies and practices in the fishing industry which is a field we are excited about. There is also the sub-sector of fish food we are also looking at very closely. We see an opportunity in insect protein as a fish food ingredient, this is also a high growth business as demand for insect protein far outstrips supply. It is estimated the supply wonít be able to meet the demand for at least the next five years. Itís a high margin business, so typically around 80+% growth profit with a 30% EBITDA margin. Secondly, we will look for Marine Ecosystem investment opportunities and the large CO2 sequestration possibilities. The ocean is at the heart of the solution for climate change and there are plenty of ways in which the ocean can capture the carbon that we are emitting each year. Currently, 25% of the carbon thatís emitted is captured by the ocean each year. For example, seaweed plantations will benefit from increased investments because of their ability to capture a lot more carbon and more rapidly than trees, while also providing a source of food. That alone is an area that offers strong investment opportunities.

As we all know, way too much plastic ends up in the ocean, and so waste management and bio-plastics are other areas with great investment return potentials. | ||||

|

Horizons: Family Office & Investor Magazine

Max Gottschalk: Early Days for Ocean Investments & Impact Measurement |

|

RSS

RSS