|

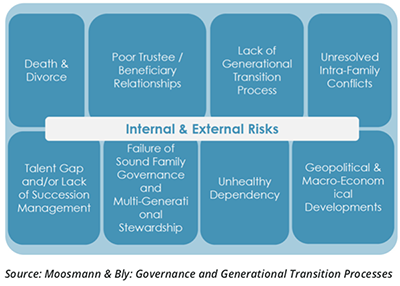

Dr. Kurt Moosmann, who knows much about the common pitfalls of generational transitions, gives recommendations and warnings and some real-life examples. He is the owner of Moosmann Advisors Ltd , a Swiss-based advisory shop specialized in serving first generation entrepreneurs to multi- generational business owning families and family offices. Opalesque: What should a successful generational transition process consist of? Kurt Moosmann: It’s complex in the sense that one has to know where one starts from and what with. For instance, entrepreneurial families, whatever generation, often own active businesses and other illiquid investments. The business is generally considered the goose that lies the golden eggs. So, it’s really a question on how to transition the operating business to the next generation, while maintaining the human capital within the family and continue building domain expertise, whilst diversifying risks by deploying other investments of their asset holdings wisely. To a certain extent, maintaining the capability of injecting private funds back into the business in an event of unexpected liquidity constraints, has proven to be vital e.g. during the last Financial Crisis. Opalesque: What are the causes of an unsuccessful generational transition? Kurt Moosmann: We know that only 3% of the family businesses will actually transition into the fourth generation successfully. Although every family case is particular, it is still possible to summarize the five principle causes as follows:

The elephant in the room

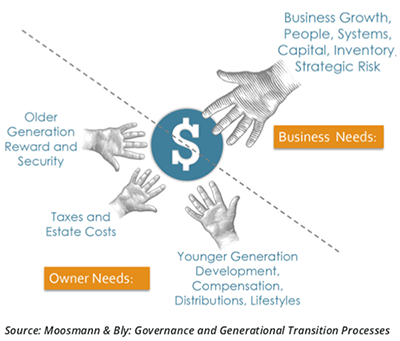

Opalesque: Tell us more about uncoordinated financial demands on business profits. Kurt Moosmann: The uncoordinated financial demands on business profits is often seen when owner needs do not correspond with the needs articulated by the respective family-owned businesses. For instance, when on the one side, the older generation seeks a well-funded and secure retirement or the younger generation is rather interested in deploying the wealth in a more sophisticated or diversifying manner. Whereas on the other side, the running of the business requires sufficient funding to cater to the various business requirements. As businesses grow over time and become more international, further complexities arise that need to be carefully managed. In a more globalized context, understanding and properly managing the foreign tax and reporting obligations become a crucial part in safeguarding these assets in an efficient and sustainable manner.

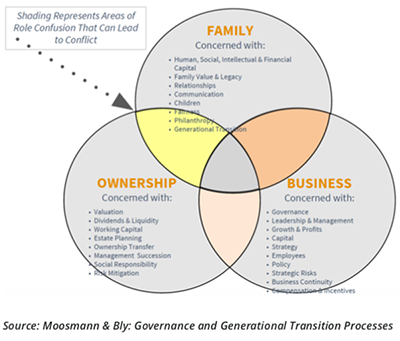

Opalesque: Do families generally understand how complex transitions can be? Kurt Moosmann: No. Though it depends in which stage the family finds itself. The big transitional issues erupt usually between the second and the third generation, from the siblings’ generation to the cousins’ generation. You often hear about third generations having difficulty in maintaining the wealth of the family, whether they’re involved with the business or not. Opalesque: Tell us more about the issue of unclear boundaries. Kurt Moosmann: The Three-Circle Model of the Family Business System (developed at Harvard by Renato Tagiuri and John Davis in 1978) addresses these unclear boundaries and interdependencies between the family, the owners and the business itself. This really tackles the issues that need to be addressed when you want to transition successfully, which is especially complex when it involves an active business. In such circumstances, the aspects of human, intellectual and social capital require proper attention and obviously raises the level of complexity in ensuring that a business-owning family can transition, strengthen and grow the company in the future. Without a business involved, one often refers to the more common gift and estate planning instruments to transition family wealth, such as inter-vivos gifts or by way of testamentary disposition. Unfortunately, however, experience has shown that still nowadays a large number of savvy business owners or wealthy individuals even fail to write a last will.

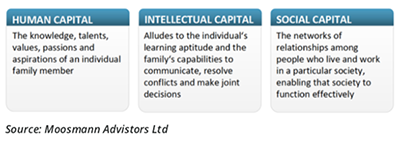

Opalesque: Which brings us to third issue, the lack of non-financial capital development. Kurt Moosmann: I really believe a successful generational transition requires an understanding that there is correlation between human capital, intellectual capital and the financial capital. And frankly the financial capital is the least important,it’s really more about understanding the correlation between the knowledge, talents, values that family members might have and their learning aptitude and the family’s ability to communicate. Over the past years, we have witnessed a growing number of families that have expressed a large interest in ESG compatible asset classes. In many multi-generational scenarios, there are families who have even created their own foundations or have embarked on a more economically sustainable path. It is therefore important to review and to define a decision-making process that blends and unites these various aspects of family wealth.

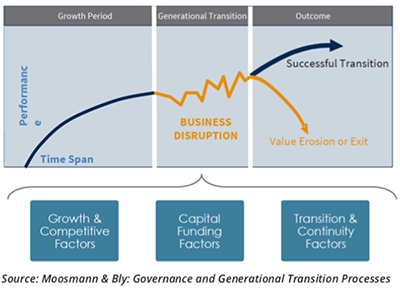

Opalesque: What about the issue of inadequate operating business oversight? Kurt Moosmann: Generational transition often leads to business disruption. This is where you want to watch that such a hand-over doesn’t result in a value erosion. Transitions are often coupled to extensive liquidity needs, as it might involve a different capital structure. Moreover, principals tend to have plenty of difficulties in preparing for an orderly transition. If you look at the market where you have business- owning families dealing with transitional issues, you will find that more than two thirds of all business leaders, irrespective of being a family or non-family member, are 65 years old or older without having a clearly defined transition plan in mind. And if you imagine how long it takes to actually find and integrate the right successor, then you understand why such firms often will struggle later on in the process.

Opalesque: Could you give us some examples of how you solved some transitional problems? Kurt Moosmann: There was a case where a multi- generational family group decided to sell its family enterprise. After the transaction had successfully been completed, the family members had lost the family’s common denominator for remaining together, and instead was now holding a pot of cash with no sense what the next step ought to look like. As one would expect, most family members wanted to take their share and run. But simultaneously, they had understood that keeping the wealth concentrated would enable the family to grow and diversify the capital more efficiently, thus allowing them to work towards a new common goal. So, we proposed a strategy that I refer to as “the Golden Cage principle”, where you try to convince the family members to stay together, like in a virtual “cage” – if they agree to that – and they have to agree to stay within the family group and have their assets centrally managed e.g. by an investment committee. In this and other similar cases, where a large number of family members are involved, a new corporate is created thus representing the family’s liquid wealth. This way the family’s investment committee or its decision body has the ability and power to propose a long-term investment strategy. In recent years, numerous entrepreneurial families have reinvested substantial amounts directly into other family-owned business enterprises across the globe, and in the US in particular. Yet, each family member, contrary to the overall objective, still has the ability to exit the family group at the end of each fiscal year, at a certain discount. What is interesting is that if you were to close the door of the golden cage, everybody would want to leave the group because, psychologically, they would be feeling trapped. But if the “door” stays open a little bit, family members are interested in giving it a chance. That’s the way we were able to keep the family together and to build a new and successful family venture. Another case took place in a first generation family where the principal had built his business. He had four children, two of whom were actively involved in the business. The founder of the business had yet to constitute a basic family governance. Although the two children, in their mid 40s, had been working for the family business for a number of years, the principal had felt that his children were not prepared to take on the reins of the family business. On the other hand, he had showed little interest in spending lots of time on creating a continuity plan for the family’s business interest. After an extensive phase of animated discussions, the founder, at first, was reluctantly prepared to create a simple governance structure. During the preliminary phase, the family had to decide on various aspects that are so paramount to any family setting. A family constitution was crafted, reflecting the joined values and reasons for building a basis for the long term sustainability. It was also a time during which the next generation had to understand the responsibilities that coincide with the right to lead in the future. The value question was very interesting because they needed to get a clear understanding of what the core values of the family were; that took them quite some time. They also had to find a communication process to overcome disagreements and future problems. This family was able to draw up their constitution, find a mutual understanding about their mission and values and ultimately obtain the common notion of what in their eyes merits the efforts to build a common ground for a unified family as well as for their business. When families are involved in running a business, family governance is at the forefront of that equation. It is my sincere opinion that a family must first govern itself before governing the family business. | ||||

|

Horizons: Family Office & Investor Magazine

Transition – A family must first govern itself before governing the family business |

|

RSS

RSS