|

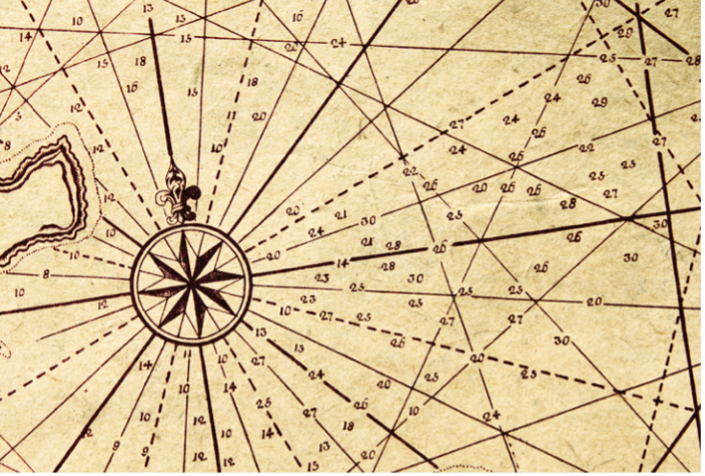

Zita Nikoletta Verbényi is the Founder and Legacy Aesthete at The Legacy AtelierTM (www.thelegacyatelier.com) and the 1st PhD Candidate in Family Legacies. She is a top recommended family business adviser in 2021/22/23 by Spear’s 500 and a Fellow of the Royal Society of the Arts. As a top legacy expert, Zita holds a wealth of expertise, experience, and profound insights into the most critical dynamics and matters facing business and legacy families, and individuals of substantial wealth, having worked with them closely for 10+ years, including 4 years at Campden Wealth in a senior role. Legacies belong to individuals, families, objects, stories, historic events, institutions, countries, and beyond. Legacies leave traces and impact, and span over decades, centuries, and millennia. However, who is to decide what is a legacy? More importantly, who is to determine who holds a legacy, what that legacy is, and how it can be captured, narrated, catalogued, preserved, showcased, re-energised, and kept under control? In addition, how can one harness their legacy and ensure its longevity for generations to come? Legacies hold different meaning to everyone, and each reference point used for evaluation purposes may change depending on a plethora of reasons and circumstances. Legacies may be shaped, influenced, scaled, positioned, framed, and maximised in various ways. The Importance of Purposeful Mapping A purposeful mapping, a legacy scaping is essential, otherwise one may only see a reduced, distorted view of their legacy. Using an analogy with the Mercator map projection, introduced by Gerardus Mercator in 1569 according to Britannica, its purpose was to serve as a navigation tool for European sailors and projected the world according to that specific scope in mind. As a result, the projections and representations of continents and countries were distorted, showcased a European imperialist attitude with the established centre, as well as created an ethnic bias. As this projection of maps has been used for centuries also for non-navigational purposes, including educational ones, it’s well documented that such projections have been distorting the perception of our world from a young age. Up until one learns about goal-oriented mapping, generalised projections give the illusion as if they knew their legacy based on some corporate chronological timelines and scattered historic evidences.

What is a legacy? A Paradigm Shift Indeed, current references, scopes, extent of elaboration, and preservation practices around legacies within family business, family office, and investment circles are restrictive, outdated, and filled with incongruent statements. Current practices proposing to cover legacies focus mostly on the businesses, philanthropy, finances, and legalities, as well as family governance. These don’t onlymiss invaluable opportunities to provide a broader representation of intertwined individual and family legacies, e.g., with the creation of fascinatinglegacy portrayals and legacy collections. Current practices also reduce any legacy harnessing and maximising efforts, and guidance on how to ensure the longevity of extended legacies. A more extensive representation, and showcase of layered legacies, as well as the complex mechanisms with which legacies may be captured, preserved, harnessed, and transferred are essential to safeguard and futureproof a family’s identity, harmony, heritage, traditions, as well as ensure the longevity of their family legacy. Following on from the mapping analogy, there may be multiple purposes for mapping, knowing more of, cataloguing, portraying, and showcasing individual and family legacies by their creators and the current guardians. How do they ensure not to distort the sheer impact, responsibility, prestige, and meaning behind their layered legacies, and how can they pass the legacies on to others to also appreciate and cherish these? How does one capture and understand what their legacy is and what other legacies surround them, as well as how can they decide why and how to convey these legacies to others, including family members? It’s vital that the ones who will be receiving these legacies trust the process and have a fidelity of access, position, standing, equity, as well as reputation-related know-how to navigate their own and family legacy landscapes, and beyond. What gets mentioned, how it gets represented,and showcased may hold power, immensebenefits, as well as multiple risk factors for family members, clients, shareholders, other stakeholders, employees, community members, and beyond. Any misrepresentation and not appropriately attributed characteristics may mean the likelihood of any long- term consequences not only for the family, but also their communities.

Family Case 1: The head of a multigenerational business family prior to a succession realised that they only had their business history partially documented with a chronological timeline describing the milestones and key business achievements. The family leader felt that they could bring the family members together based on their family legacy if they understood more about their multigenerational family, business group, the original purpose of their foundation and family office, the various characters over the different family eras, along with the relevant contextual insights, as a part of an identity project. Eager to also learn more about how they navigated through turbulent times, they used their family legacy to bring together and align the family members on who they were, and where they were going as a family. They were keen to collect, catalogue, archive, re-energise, narrate, and showcase their family legacy, and reinvigorate each foundational aspect to be able to gradually pass these on especially to the next generation members. In this case, a legacy project held three purposes:

Legacy Curation & Preserving Legacies Mapping, capturing legacies, as well as collecting, cataloguing, archiving, framing, narrating, re-framing, and showcasing legacies is vital for each generation of legacy creators and guardians. Thinking through and deciding on how the depiction of a legacy sits, what is highlighted, what is it centred upon, and cropped, as well as how it is evaluated and communicated are helpful exercises for family members. Joint and driven family conversations about legacies on what’s included, what the dominant perspectives and overarching narratives are, how these are portrayed, as well as what is valued and permitted in a legacy are critical to discuss. These are all questions that require careful considerations, however, without these, the resilience and control that individuals and families wish to create over their legacies, as well as the longevity of these may not be as solid as families would expect. Legacies Evaporate if not Preserved Family members need to trust the insights they are given by the family, however may also be able to question these if they felt it was necessary. Family legacies are symbolic representations of the families over the course of various generations, parts of their identities, their very foundation and serve as their family-unique competitive advantage. Shaping and preserving complex, multifaceted, and intertwined legacies by each generation is vital, otherwise these will evaporate over time and families get fragmented. It’s only an illusion that legacies stay around in the long run. Legacies need to be cared for, tapped into, and harnessed by the family members, and some insights may be even shared with shareholders, and community members to benefit them also. Legacy workshops and legacy projects, such as legacy curations including legacy recordings, curated videos, legacy portrayals, legacy collections, legacy saloons, legacy exhibitions, and private family and or family business museums are fascinating ways to capture, curate, preserve, and showcase legacies in meaningful ways. Some already existing archives and museums may need recalibrations, and re- energising, so that family members could also benefit from their ancestors’ wisdom, best practices, and overall legacy journeys. All these projects bring family members together, enhance their family anchoring, engagement, alignment, as well as enable family members to use their family legacy as a resource for education and inspiration. Such projects also help with family business branding and marketing as well as enhance business development and help with shareholder and stakeholder anchoring, engagement, and alignment too. Family Case 2: A founder (first generation member) had achieved much success, impact, and legacy over forty years nationally and internationally, however, did not know how to make sense of it all, with whom to share it an how, and especially, how he could pass his legacy on to his next generation members. In this case, a legacy project held three main scopes:

Family Case 3: A multigenerational business family were approaching a major business anniversary and wanted to recalibrate their family legacy, update and extend their legacy curation after fifteen years, and bring together the family members, shareholders, and community members in meaningful ways. In this case, the legacy project held three purposes:

Showcasing, Inspiring with & Transferring Legacies Legacies need to be passed on, transferred, and celebrated however how can families prepare their legacies to be shared with and received by their next generation members? In what ways and for what specific reasons? What have the family members achieved and with what impact layers within their fields, industries, and the society? How can family members embrace their individual and family legacy journeys in a more well-informed way? A legacy is a trans-contextual information ofideas, experiences, objects, and portrays different representations on many levels. Legacies are moving, shifting premises, fusing different threads, and fields. Whenever family members introduce a broader perspective about their family and individual legacies, they realise that legacies are their very foundation, their essence. Legacies connect family eras, generations, family members, as well as the myriads of activitiesthat they hold. Legacies are rooted in heritage,and showcase a legacy landscape of layers and patterns, and continuously draw upon previously unimaginable insights which help anchor, engage, align, educate, and inspire everyone who happens to have an encounter with these legacies. | ||||

|

Horizons: Family Office & Investor Magazine

What Is Your Legacy? |

|

RSS

RSS