|

|

In the world of finance and business, success often hinges on the ability to recognize and seize opportunities as they arise. However, just as important, if not more so, is the ability to discern threats – particularly when they come from people we might consider colleagues, partners, or even friends. The Dark Factor of Personality, or ‘D-factor,’ has become an increasingly discussed concept within the fields of psychology and business, and understanding it might be key to safeguarding your wealth and interests.

What is the dark factor of personality?

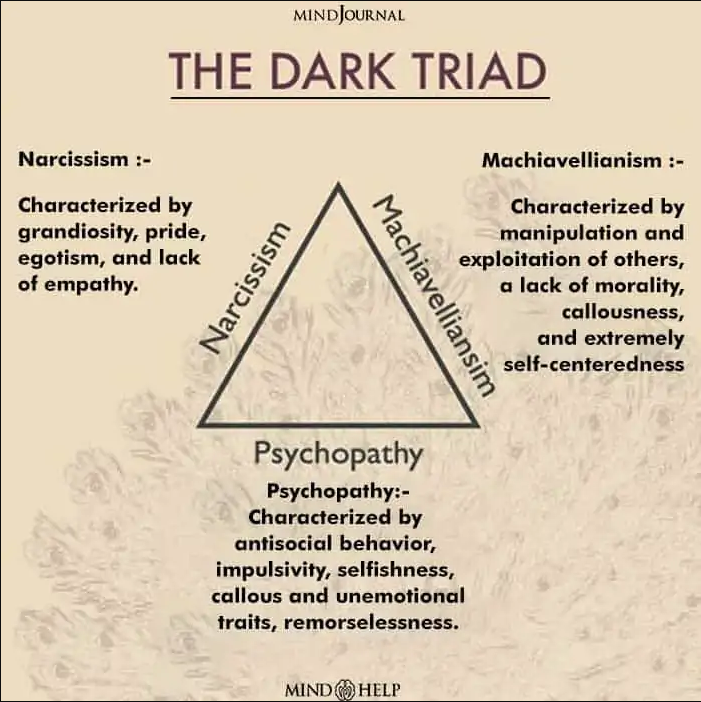

Derived from psychological research, the D-factor represents a singular underlying dimension that connects various negative personality traits, such as narcissism, Machiavellianism, and psychopathy. In essence, a high D-factor indicates a person’s high propensity to prioritize their own goals at the detriment of others, coupled with the belief in their right to do so.

Recent studies suggest that individuals with pronounced dark personality traits are not just found in correctional facilities but are also present, sometimes in high numbers, in the echelons of business leadership. This is hardly surprising: traits like excessive ambition, ruthlessness, and a keen sense of opportunism can drive success – but also can lead to ethical lapses, fraud, and harmful business practices.

Recognizing the threat

For the financially astute and wealthy, being able to detect these traits early is imperative. Here are some signs to look out for:

- Exploitative behavior: Does the individual often take advantage of situations or people for personal gain, even if it means harming others?

- Lack of empathy: Are they dismissive of others’ feelings or needs, focusing solely on their personal ambitions?

- Deceitfulness: Do they have a history of bending the truth or outright lying to further their agenda?

- Narcissistic tendencies: Is there an excessive need for admiration or an inflated sense of their own importance?

- Cynical worldview: Do they generally distrust others’ intentions, believing the world to be a ‘dog-eat-dog’ place?

"The general tendency to maximize one’s individual utility — disregarding, accepting, or malevolently provoking disutility for others —, accompanied by beliefs that serve as justifications."

More information & free tests: https://darkfactor.org/

Guarding against the D-factor

For professionals and wealthy individuals, being aware of these traits is the first line of defense.

But awareness alone is not enough. Someone may brag about his or her IQ, but they won’t wave their D-factor value in front of your face. So it’s up to you to find out.Here are proactive steps to consider:

- Thorough vetting: Before entering into business partnerships or hiring top executives, conduct comprehensive background checks and psychological assessments. This might seem excessive, but the cost of overlooking a malignant personality can be far greater.

- Promote a culture of integrity: Ensure that your organization or venture prioritizes ethical behavior, transparency, and mutual respect. Such an environment can act as a deterrent to those with high D-factors.

- Engage in open communication: Encourage a culture where employees and partners feel comfortable voicing concerns or observations about others’ behaviors. Early detection of deceitful or harmful actions can mitigate potential damage.

- Invest in advisory: Surrounding oneself with trusted advisors – be it in law, finance, or psychology – can provide valuable third- party perspectives on potential business associates or decisions.

- Trust your gut feelings: In addition,don’t miss to check and trust your gut feelings. Is something wrong? Are you pushed in the wrong direction? Know when to say no. Is something not right? Sometimes, a small thing can tell a big story.

Benjamin Hilbig, a psychology professor from the University of Mannheim (Germany) co- developed a method to measure the evil in people, termed the D-Factor.

The D-Factor:

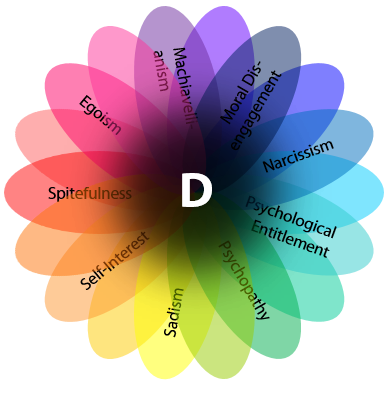

- The D-Factor is a measure to identify people’s tendency towards behaviors society might label as “evil”, such as egoism, malice, sadism, narcissism, and excessive entitlement. All these traits correlate with each other and share a common core, which researchers, including Hilbig, have named the Dark-Factor or D-Factor.

- The D-Factor is similar to intelligence measurement, where multiple facets are examined and often correlate with each other.

Objective of the Research:

- The primary goal is not philosophical but pragmatic. The research aims to understand what “evil” characteristics have in common and how personality influences behavior.

Measurement:

- The D-Factor is determined through questionnaires. The questions are designed to gauge participants’ malevolent tendencies, and the results range on a scale of one to five. A D-Factor score above 2.6 indicates a person is “eviler” than the average respondent.

Data Integrity:

- Though there’s a tendency for respondents to portray themselves in a slightly better light, when individuals are seeking to understand themselves better, they tend to be surprisingly honest.

Demographics and the D-Factor:

- Age: The D-Factor tends to decrease with age. Older individuals statistically become “kinder”. The exact reason for this is unknown, but it may be due to societal norms forcing adaptation over time.

- Gender: On average, men have a higher D-Factor than women. However, variations within each gender are larger than the difference between genders.

The reasons for this difference could be the societal roles and expectations placed on each gender, as well as men’s frequent occupancy of power positions.

Career Implications:

- Individuals with a high D-Factor are typically found either in leadership positions or in prison. However, this is

a broad generalization. Still, people with a low D-Factor are less likely to be found in either of those places.

Criminality and the D-Factor:

- Research in Denmark, which maintains comprehensive records on its citizens, shows a clear correlation between the D-Factor and criminality, across various types of crimes.

Development of the D-Factor:

- The formation of these “evil” traits is influenced by both genetics and environment, specifically their interaction. A person might be born with a predisposition, but it might only manifest fully under specific circumstances.

Final Thoughts

In business, as in life, not everyone plays by the rules. The Dark Factor of Personality, while fascinating from a psychological standpoint, offers a cautionary tale for those looking to protect their assets and legacy. By staying informed, vigilant, and proactive, you can ensure that your business and wealth remain resilient against those who might seek to compromise them.

|

RSS

RSS