|

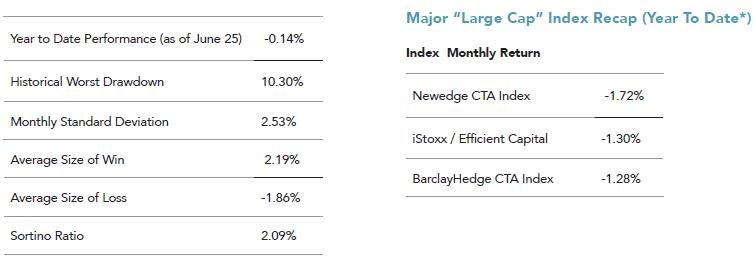

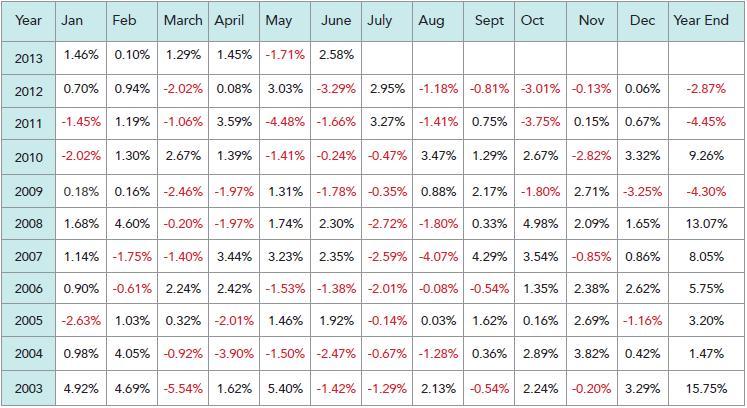

Newedge CTA Index Monthly Performance

*Past performance is not indicative of future results. The performance of an index may differ from individual CTA performance. These CTA index contain the largest CTAs whose performance believed to have been audited by the National Futures Association (NFA). Performance sources are as of the last reporting date before publication: http://www.newedge.com/content/newedgecom/en/brokerage-services/prime-brokerage/newedgeindices.html; Pinnacle Award Winners AnnouncedThis past week at press time the Pinnacle Award winners were announced on the eve of the Managed Funds Conference in Chicago.

A lifetime achievement award was given to Keith Campbell, founder of CTA Campbell and Company, who was profiled in the last issue of Opalesque Futures Intelligence. |

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS