|

By Mark Melin

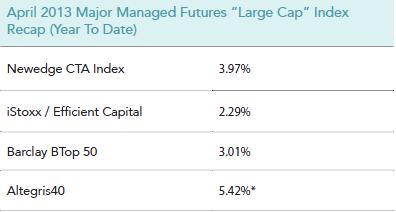

These CTA index contain the largest CTAs whose performance believed to have been audited by the National Futures Association (NFA). Performance sources: http://www.newedge.com/content/newedgecom/en/brokerage-services/prime-brokerage/newedge-indices.html; *All performance as of 5/14/2013. Altegris performance is as of 4/13/2013 according to their web site. Past performance is not indicative of future results. Investments in indexes are not widely available and individual performance may vary. Top Trending Markets / Relative Value Thoughts: Energy Complex / Natural Gas: The top trending market to the upside has been natural gas, having started to trend February 15, short term trend followers might have received buy signals around March 1, while some mid-term time horizon algorithms March 15. On a short term basis, some trend algos started to receive counter-trend signals just after May 2 while longer trend models are holding positions and enduring volatility with an eye to the larger picture. Short term relative value CTAs might have noticed the divergence with Oil that occurred during the start of April, as prices have reached a relative convergence point near the start of the month. Metals / Gold: While natural gas has been trending higher, metals markets have been trending decidedly lower, with gold taking the lead followed by zinc, copper and lead. Gold in particular has experienced strong short-term and mid-term price persistence, first identified in December. However, some short term models appear to be showing signs of indecision. Certain relative value traders have been eying the relationship with the Canadian Dollar as this correlation can appear interesting at times. Other relative value trades include long gold short copper, but the divergence on this spread has not hit in certain algorithm execution points as of this writing. Financials / Currencies: Certain value tables noted that the Canadian Ten Year Government Bond has been diverging from the Canadian currency. Trade signals are said not to have been activated, yet, but the market is shaping up for a relative value position, according to sources. Historical Probability Factor Analysis: One strategist using historical probability modeling noted that since 1999 10 Yr. T-Note generated a total return of 41.7% based on its top 20 grossing months. During this time the S&P 500 returned -43.9% for the periods, as traders are looking to capture trends and relative value opportunities. According to this algorithm developer, citing key trade factors, top markets that are accurately following their seasonal charts include the British Pound (BP), Paris CAC-40 (FCH) & S&P (SP). Top 5 markets that offer consistent near-zero correlation against Crude Oil: ED, LH, JGB, JY & LC. |

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS