|

During the past 19 stock market crashes, a diversified managed futures portfolio has only experienced negative performance five times. Why does this happen? If managed futures performs positively when the stock market is negative, is the reverse correlation true? Will managed futures experience negative returns when the stock market is positive? The year to date rise in both the S&P 500 index and equally strong performance of the Newedge CTA index warrants consideration. Or perhaps conversely, when managed futures delivers negative performance has the stock market been delivered generally positive returns? Strategic Thinking Regarding Why Managed Futures Performs During Negative Stock Market Periods When a stock market crashes, it volatility often preceded the larger price trend, if one were to look at the VIX / S&P correlation during crisis. Market crashes often start with a surprise event that has altered market perceptions regarding the safety or viability of particular assets. By contrast problems, when systematic problems are identified before hand, are not a surprise and do not necessarily cause the same type of crisis crash. This relates to managed futures in the following respect: This type of logic is used to model portfolios through a debt crisis. (See related article below Fed President Evans Talks Quantitative Easing While Crisis Risks Questioned by Dr. Bob Swarup)

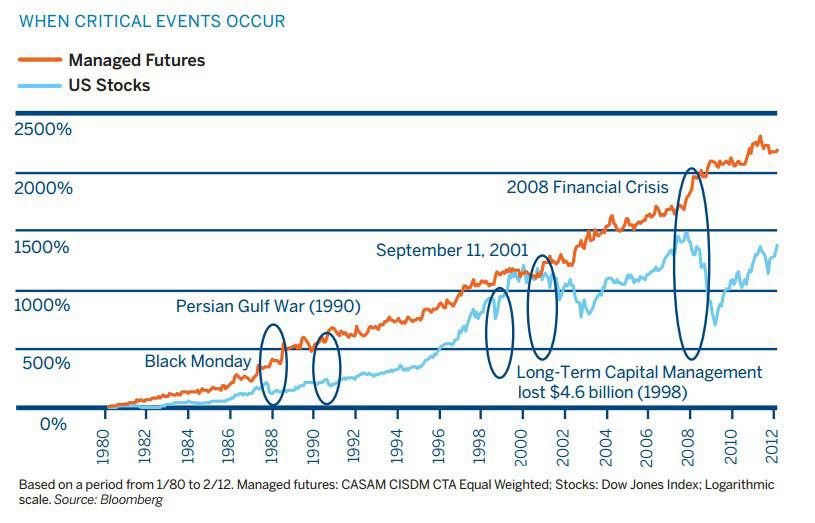

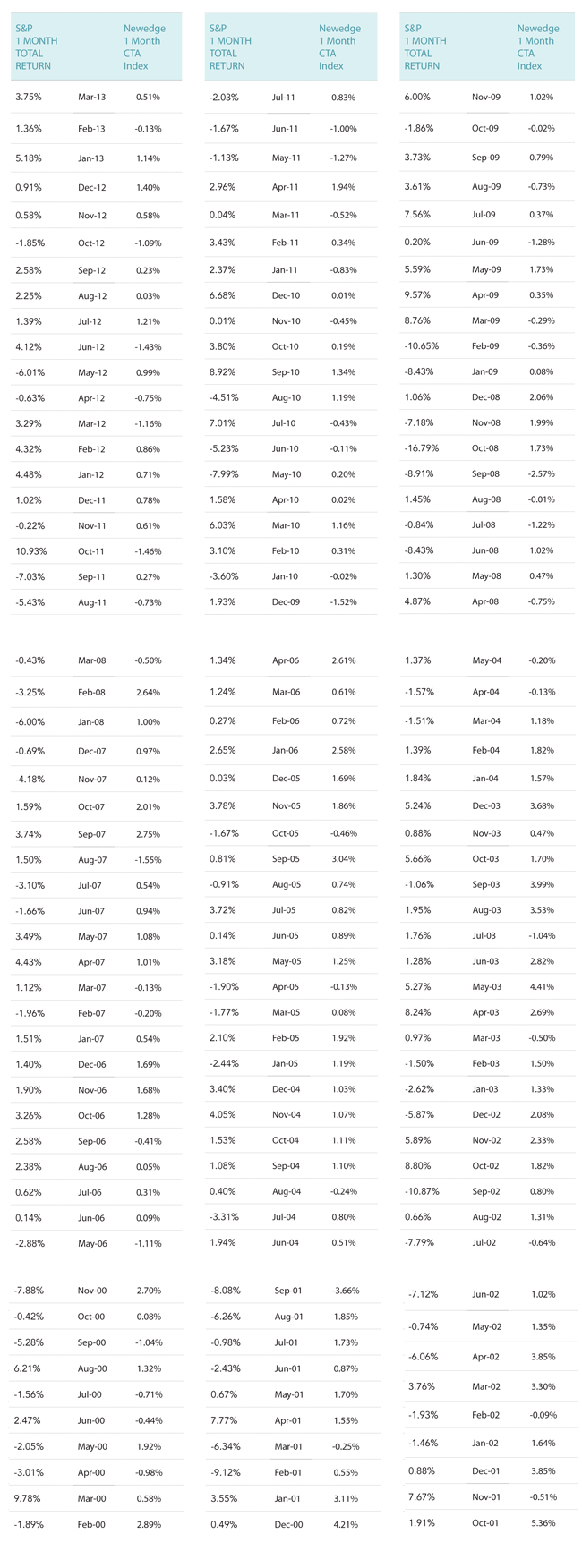

Chart Source CMEGroup: Managed Futures Portfolio Diversification Opportunities On a strategic level, Managed futures trend following programs are said to perform positively during times of market declines because the market trend lower typically involves a consistent movement in one direction. To prove this, look at a price chart of stock market activity during the circled time periods. Once a market decline progresses, it is said to do so in consistent fashion. Thus, if a trend following program was able to identify the trend lower (which is done based on price action) then the trade remains consistently in place. If the market trend lower were to reverse, for instance, in what is known as a stair step market price pattern, this could trigger the manager's risk limits. The lesson to recognize is that market environments that exhibit stair step, inconsistent price patterns are those in which the trend following program might not excel. Does this mean trend following (and managed futures in general) would be expected to perform negatively when the stock market rises? That's actually an interesting math to consider. Let's take a look at it from another, less considered angle. When managed futures has performed negatively, how has the stock market performed? Comparing the performance of the two indices side by side, one will note managed futures, as measured by the Newedge CTA index, has performed negatively 46 times over the 120 month study period. During the 46 months of negative managed futures performance, the stock market performed negatively 24 months - more negative months than positive months. In fact, when managed futures did perform negatively - 46 out of 120 months - the average stock market loss was -0.43%. This is just another way to arrive at the conclusion that examination of managed futures returns patterns will reveal that managed futures has a neutral, not negative, correlation to the stock market.

Risk Disclosure / Footnote / Performance sources: |

|

This article was published in Opalesque Futures Intelligence.

|

RSS

RSS