|

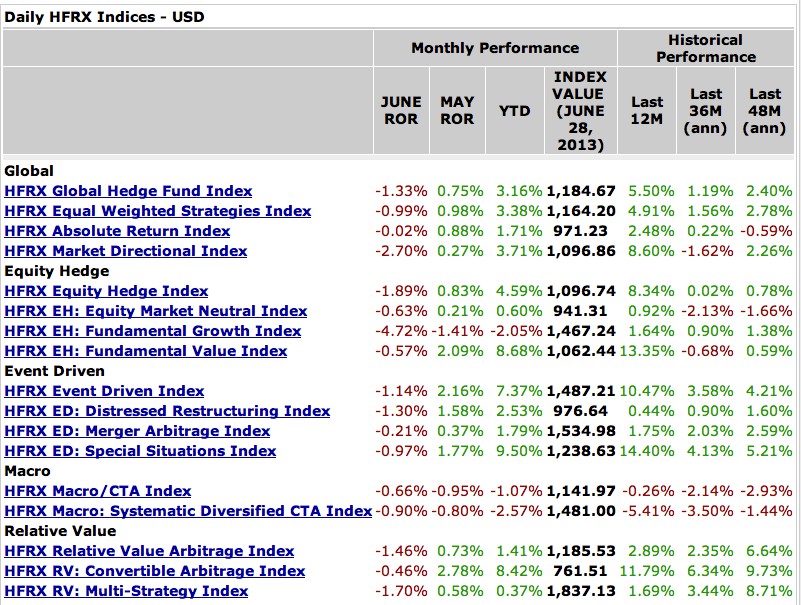

Opalesque Industry Update: Global financial market volatility persisted throughout June as investors positioned for a reduction of stimulus efforts and bond purchases by the US Federal Reserve. US Treasury bonds posted sharp declines as yields rose sharply for the 2nd consecutive month, with 10 year bond yields topping 2.5 percent, an increase of over 80 basis point in 2 months. Government bonds yields also rose across UK, France, Germany, Italy, Spain and Switzerland; high yield credit also posted declines, with yields rising approximately 200 basis points for the month of June. Gold and other Metals posted steep declines on expectations for reduced stimulus by the US Federal Reserve; Gold & Silver declined over -12 percent for the month. Global equities posted declines led by European, Asian and Emerging Markets exposures; China, Italy and Brazil posted the steepest declines, while Hong Kong, France, UK, Germany, Spain, Argentina, Turkey and the Netherlands all posted significant declines. US equities posted more moderate declines, with the S&P 500 falling -1.5 percent, with declines in Commodity sensitive and Technology partially offset by gains in Energy. Following May's sharp gains, the US dollar was mixed against global currencies, posting narrow declines against the Euro, Japanese Yen & British Pound Sterling while gaining against commodity currencies including Australian Dollar, Brazil Real and New Zealand Dollar. Hedge funds posted declines for the month, with the HFRX Global Hedge Funds Index falling -1.33%, the first decline in 8 months. The HFRX Absolute Return Index was narrowly changed for the month, posting a decline of -0.02%. HFRX Macro Index posted a decline of -0.66% in June, with contributions from quantitative Systematic CTA strategies, tactical Fixed Income and Currency strategies only partially offset by Multi-Strategy managers and Emerging Markets exposure. The HFRX Emerging Markets Index posted a decline of -0.82% with mixed contributions from Emerging Asian and Latin American exposures. The HFRX Macro: Systematic Diversified Index posted a decline of -0.90% from losses in Fixed Income and Commodities exposure partially offset by Currency strategies. HFRX Event Driven Index posted a decline of -1.14% in June, with contributions from Distressed, Special Situations & Activist strategies. The HFRX Merger Arbitrage Index declined by -0.21%, with contributions from transactions in GE/Lufkin, KKR/Gardner Denver, Thermo Fisher/Life Technologies, First M&F/Renasant. The HFRX Special Situations Index declined -0.97% from exposure to transactions in the Energy/Basic Materials, Cyclical and Financial sectors, as well as Dell, AIG, Yahoo, Berkshire & Smithfield Foods, Sprint Nextel, Vodafone while the HFRX Distressed Index posted a decline of -1.30%. The HFRX Relative Value Arbitrage Index posted a decline of -1.46% in June, with contributions from in US Convertible, Commodity, Multi-Strategy and Corporate Fixed Income strategies. The HFRX RV: Convertible Arbitrage Index declined -0.46% with gains concentrated in Japanese convertibles and volatility gains, offset by declines in US exposure. The HFRX Fixed Income Credit Index declined -0.74% as bond yields rose across the yield curve and credit spreads widened, with losses only partially offset by Japanese and Emerging Markets credit exposure. The HFRX RV: Multi-Strategy Index posted a decline of -1.70% with declines in Commodity and US & European credit strategies only partly offset by Energy exposure. HFRX Equity Hedge Index posted a decline of -1.89% in June, from losses concentrated in small cap and Emerging Markets equity. The HFRX Fundamental Value Index posted a decline of -0.57% with hedged European exposure offsetting fundamental US exposure. The HFRX Market Neutral Index posted a decline of -0.63% as short exposure in fundamental strategies failed to offset pairs widening. The HFRX Fundamental Growth Index declined -4.72%, with losses concentrated in Emerging Markets, US small cap.

Press Release BM

|

Industry Updates

HFR Indices down across the board for June (-1.33%), still positive year-to-date (+3.16% )

Tuesday, July 02, 2013

|

|

RSS

RSS